What are National Insurance Contributions (NICs)?

National Insurance Contributions (NICs) are paid by all over 16s in the UK if you are either:

National Insurance Contributions (NICs) are paid by all over 16s in the UK if you are either:

- an employee earning above £9,880 (2021/22: £9,568) in the tax year; or

- self-employed and making a profit (remember profit is income less expenses, because if you are self-employed, you are running a business) of £6,725 (2021/22: £6,515) or more a year.

The idea is that you make contributions to gain access to certain government benefits - state pension, job seeker's allowance (now part of universal credit), maternity allowance etc. Therefore, you don't expect to pay National Insurance for any foreign employed work that you have had. It's only relevant for UK income - so you're entitled to UK benefits.

The HMRC website is pretty good these days and talks you through NICs here: https://www.gov.uk/national-insurance. As always, we'll do our best to draw your attention to the bits most relevant for self-employed performers.

What are the different classes?

The class you pay depends on your employment status and how much you earn:

Employed (Class 1 NICs)

Paid by employees earning more than £190 (2021/22: £183) a week. This gets taken out automatically from your salary and will appear on your payslip. You pay:

| Your pay | Class 1 National Insurance rate |

|---|---|

| £9,880 (2021/22: £9,568) to £50,270 for the tax year | 13.25% (2021/22: £12%) |

| Over £50,270 in the tax year | 3.25% (2021/22: 2%) |

Self-employed (Class 2 and 4 NICs)

You usually pay 2 types of National Insurance if you’re self-employed:

- Class 2 if your profits are £6,725 (2021/22: £6,515) or more a year; and

- Class 4 if your profits are £9,880 (2021/22: £9,568) or more a year.

| Class | Rate for tax year 2022 to 2023 |

|---|---|

| Class 2 | £3.15 (2021/22: £3.05) a week |

| Class 4 | 10.25% (2021/22: 9%) on profits between £9,880 (2021/22: £9,568) and £50,270 3.25% (2021/22: 2%) on profits over £50,270 |

What if I do employed and self-employed work?

Unfortunately, you have to pay both if you do both. However, this is only true if you make the different earning thresholds - so it's a good thing really!

This all seems a bit complicated doesn't it?

We know! But the good thing is, you don't need to know any of this. It is all calculated automatically in your self-assessment tax return, which we walk you through in our Tax Return article. You pay your self-employed national insurance bill in exactly the same way as you pay your tax bill. It's all part of the self-assessment process. To pay just go to your 'Business Tax Summary' page and you'll see the amount you owe under 'your balance' in the self-assessment section. Then click 'Make a self-assessment payment' and choose your preferred payment option.

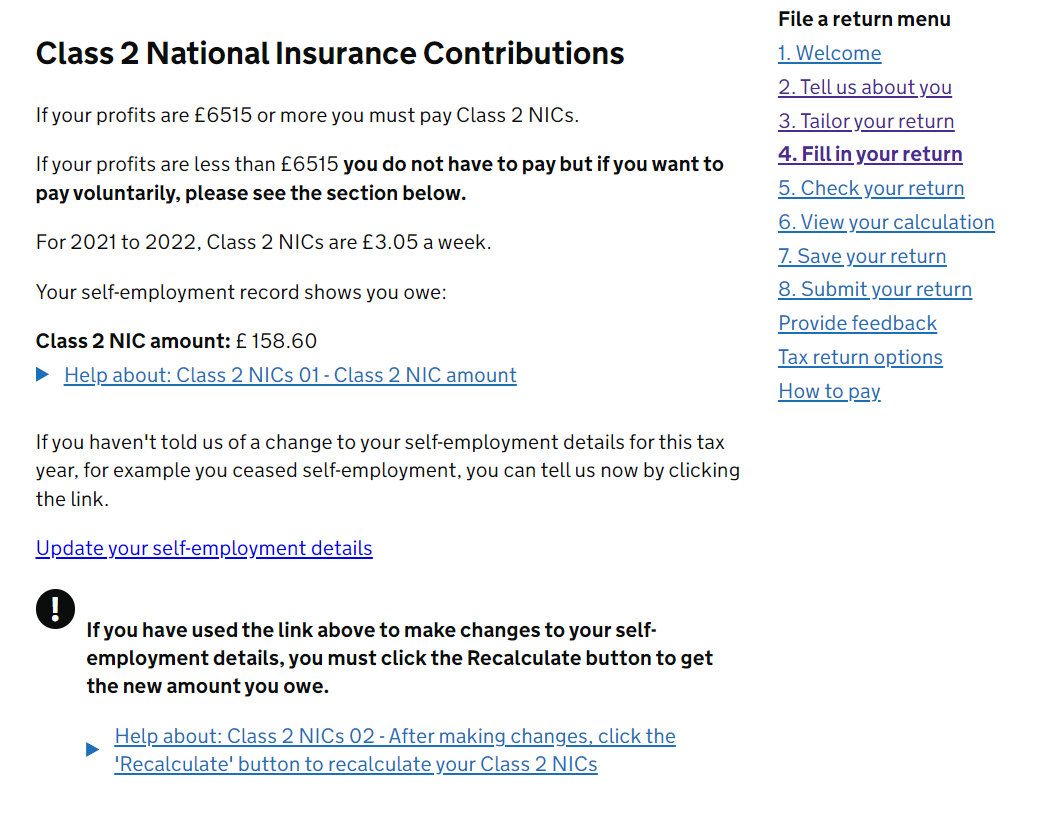

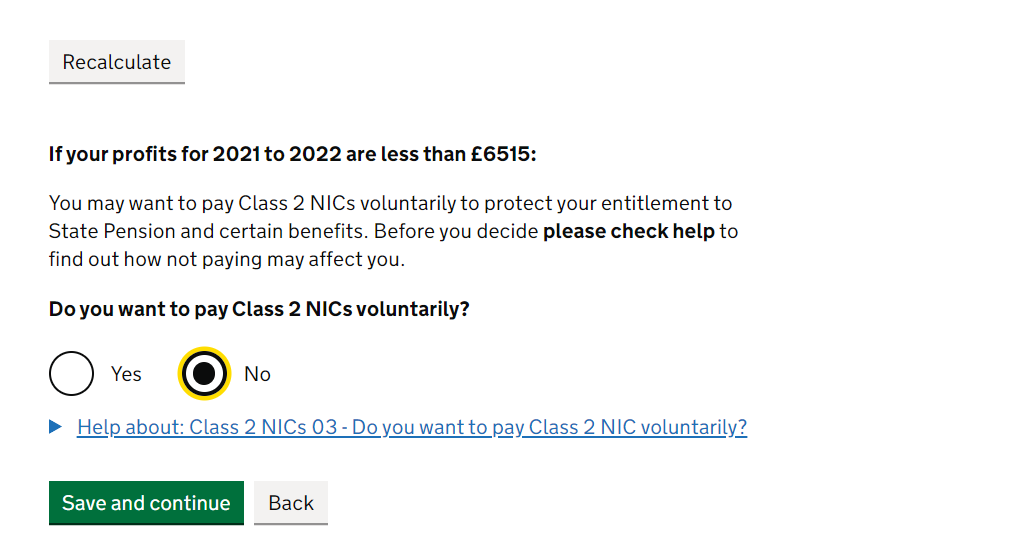

We have had a couple of people ask us why they are paying NICs when they haven't earned enough money in a year, so we want to show you the bit of the tax return that catches some people out. On the below screen, HMRC calculates a Class 2 NICs value regardless of whether you have made enough money. Then at the bottom of the screen, it asks you if you want to pay voluntarily. You can select 'No' and you won't be charged.

How do I pay?

You pay your national insurance bill in exactly the same way as you do for your self-employed tax bill - in fact you can add it together and do it at the same time. There are a few options including bank transfer or direct debit (one-off payment), which is what I do. The deadline is the same as your self-assessment tax bill deadline (midnight 31st January), but make sure you allow 5 working days for this and don't wait until January to address this if you can avoid it. Like doing your tax return, you can pay your tax and national insurance bill at any time throughout the tax year once the tax year in question has finished (post 5th April) so that's 10 months.

Knowing what your tax and national insurance bills are looking like throughout the year is going to help you a) avoid a bill shock (always welcome), and b) help you plan ahead so if you need to put a bit of money away each month then you know what you need to do to always be one step ahead. The SansDrama Web App includes this amongst other performer friendly features and is how we fund this glorious fact-filled website, so please check it out!

Anything else?

We’ve skipped Class 3? Yes, because it’s a voluntary contribution. We think it is worth doing if you can afford it as it qualifies you for a full state pension if you pay for a certain amount of years but won’t go into it for now. If you want to know more about it though, just get in touch as per!

SansDrama is here to help YOU and everyone else in our amazing creative community. If you've found the site helpful then you can help us to keep this site free to use forever by using the SD Web App.

Love Jo and James x