Tax Return: The last step in running your own business

Here's the 2021/22 edition of 'How to do your tax return' with SansDrama. New screenshots from my (Jo's) tax return (you're welcome) and old, recycled 'inbetween talk' explaining each bit. Why change a winning formula right?

Tea at the ready? What else do you need to complete your tax return?

- Government Gateway login (and password) that you received when you registered as self-employed

- P45s and P60s from any employed work you did this tax year

- Details of all self-employed work you've been paid for this tax year

- Details of all allowable expenses from this tax year

No need to stress, you don't have to know exactly what you're doing… we've practically already done it for you! (Particularly if you use the SansDrama Web App - first of many shameless plugs I'm afraid). Seriously though, why not make your tax stuff simple, organised and paperless for the price of a coffee a month? Try it for free here.

Good to know before you start... The actual self-assessment tax return form is used by ALL self-employed people in the UK (and lots of other people too). Therefore, a lot of it isn't relevant for us and we like to keep SansDrama specific to our creative community so don't be worried if we say 'this probably won't apply to you' because, well, it probably doesn't! We'll let you know, as best we can, if something differs and try to explain it so you can figure out if it does apply to you but if a question like 'Are you a practicing Barrister?' isn't pricking your ears up, you can probably move on feeling confident you're doing it right!

Sign in

As in our guide for registering as self-employed, we think the easiest way to fill in your tax return is to keep this article open in one tab and then open up another for your actual tax return so you can go through with the two side-by-side. When you're ready, click the link below to go to the HMRC tax return login page:

HMRC

login:

www.tax.service.gov.uk/gg/sign-in

What's my password again…?

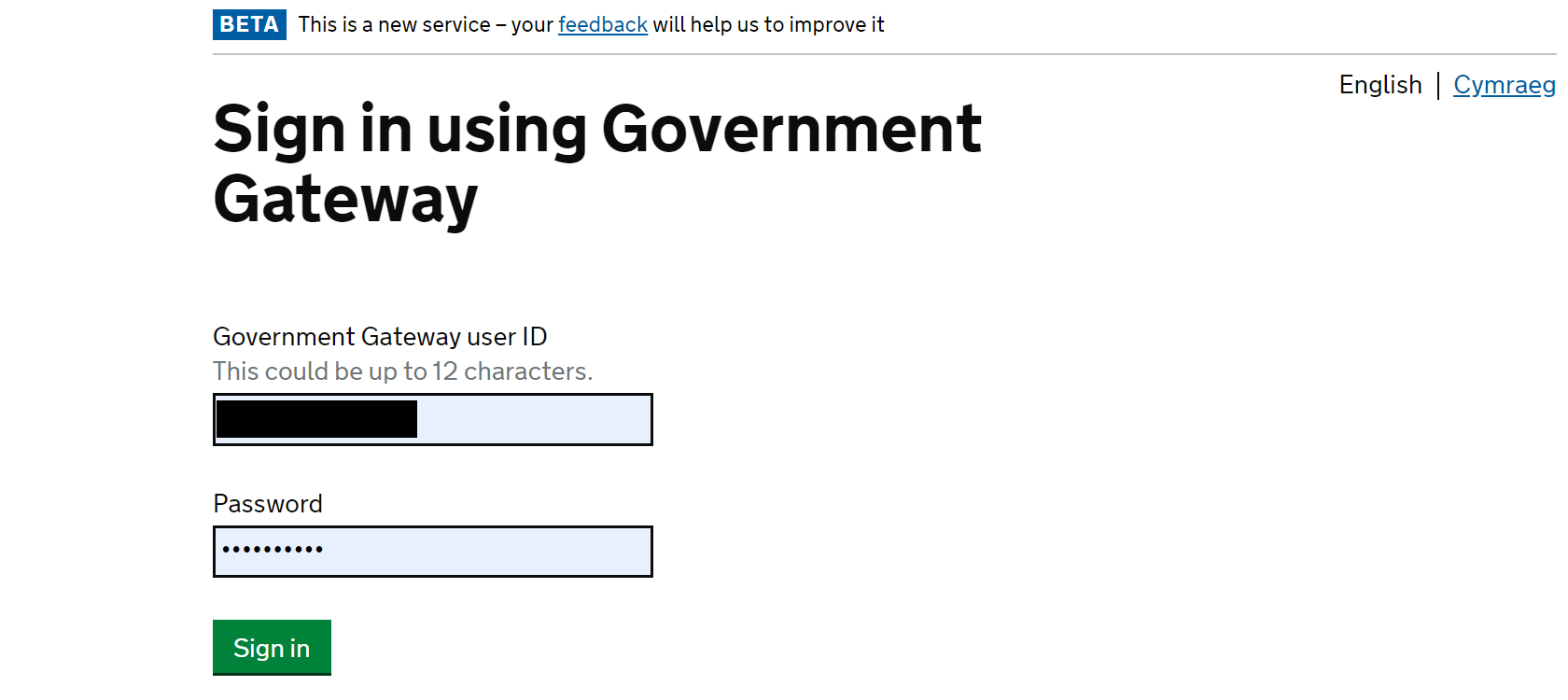

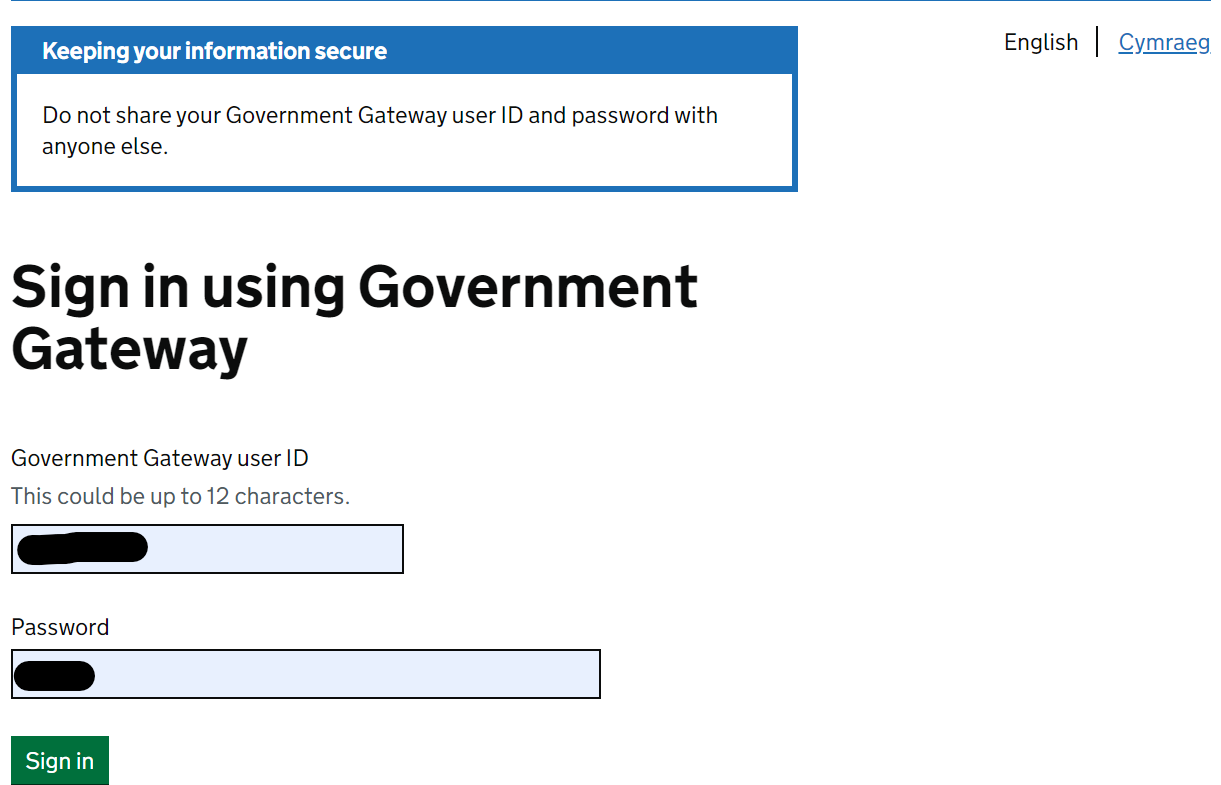

Link opened in new tab? Does it look the same as the screenshot below? Great! We're off to a good start! You'll see that it's time to log in. If you get directed through security checks at this point, don't worry - it is annoying, but isn't the end of the world (I found the 'secureidentity' App a good, quick option a couple of years ago) - I had all my details this year, so I just logged in. To save yourself the stress, pleeeease keep your Government Gateway user ID and password (you got this when you first registered as self-employed) safe (and in a place where you know where to find it! - my previous problem :-/ ).

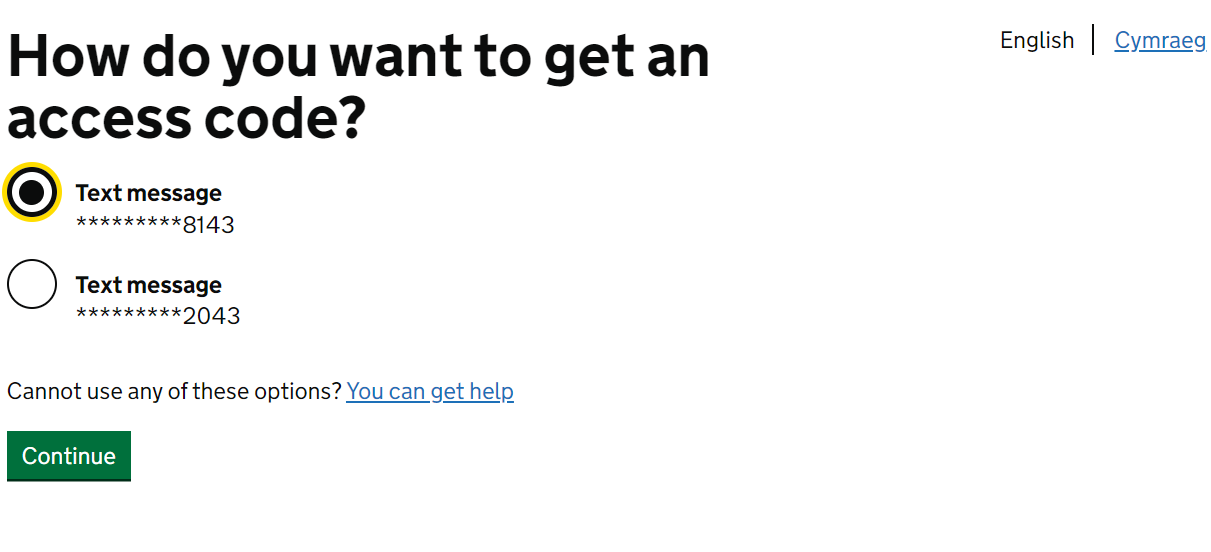

Setting up security

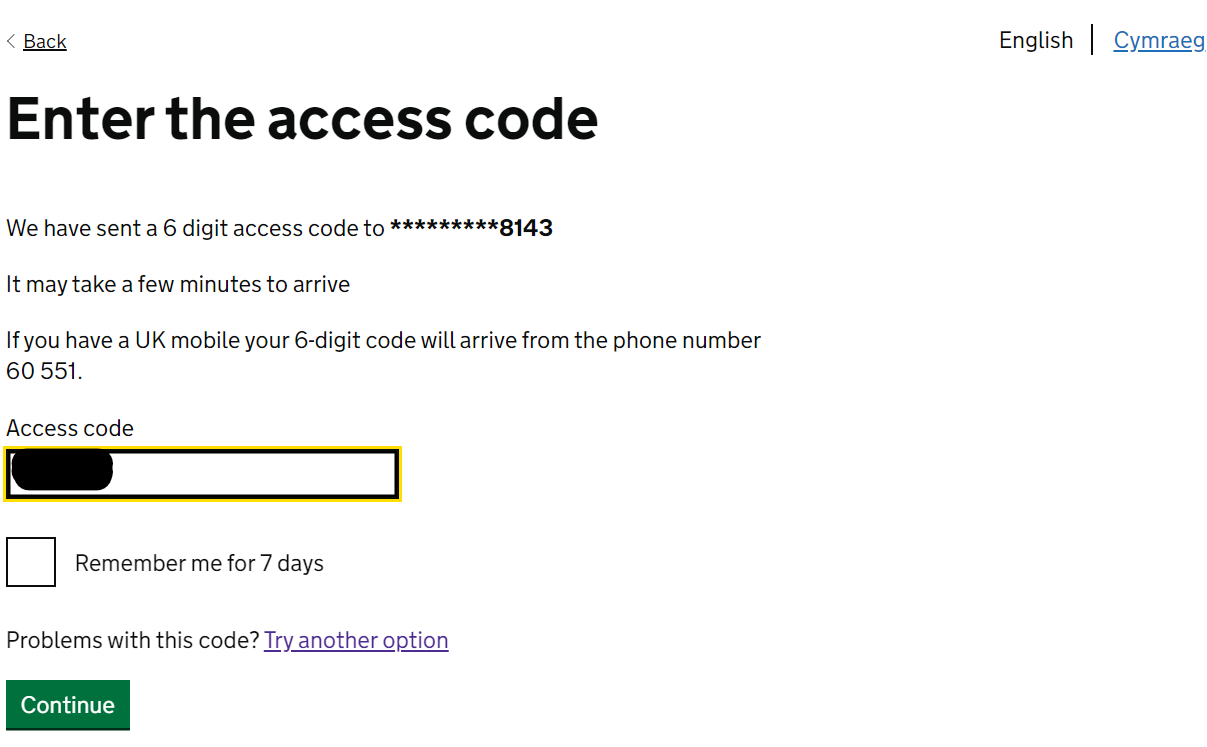

This is just HMRC protecting your account. You can get receive an access code via tect message or email, or you can go through a verification process via one of the HMRC security apps. They're all pretty straightforward but text message is what I use - see screenshots below. You'll notice I ticked 'remember this access code for 7 days' - handy if you want to log back into your account during the next week. Remember, you don't have to fill in your tax return form all in one go - you can log back in and do a bit more whenever you like.

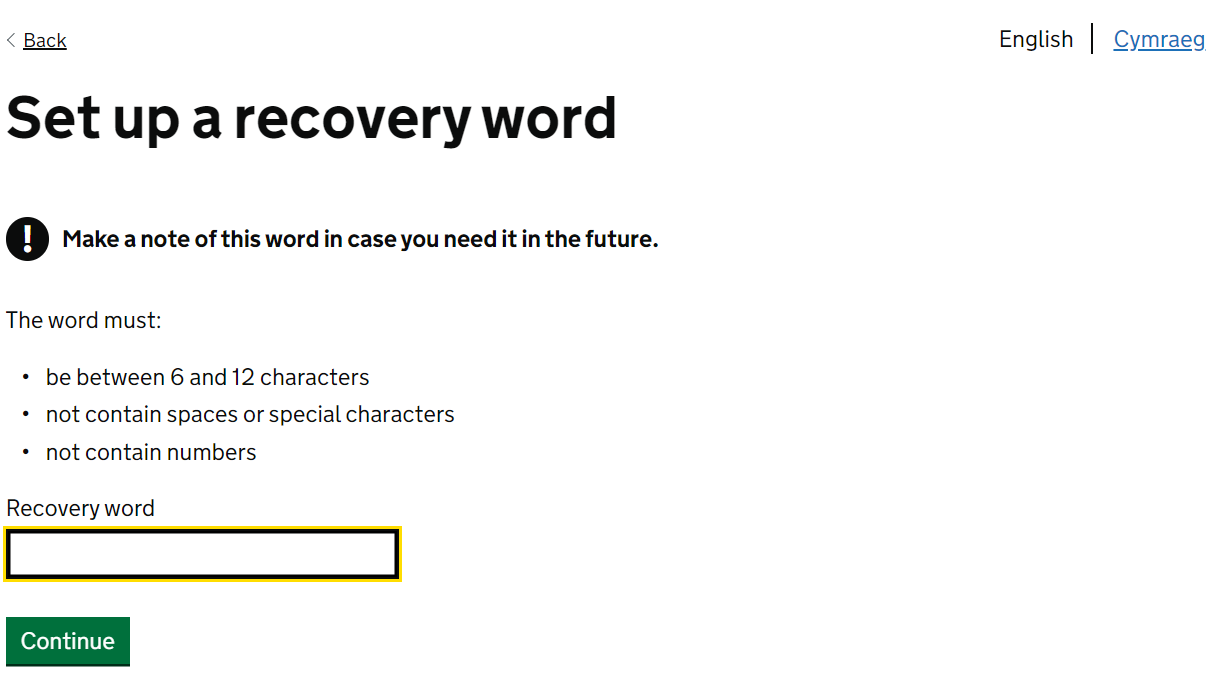

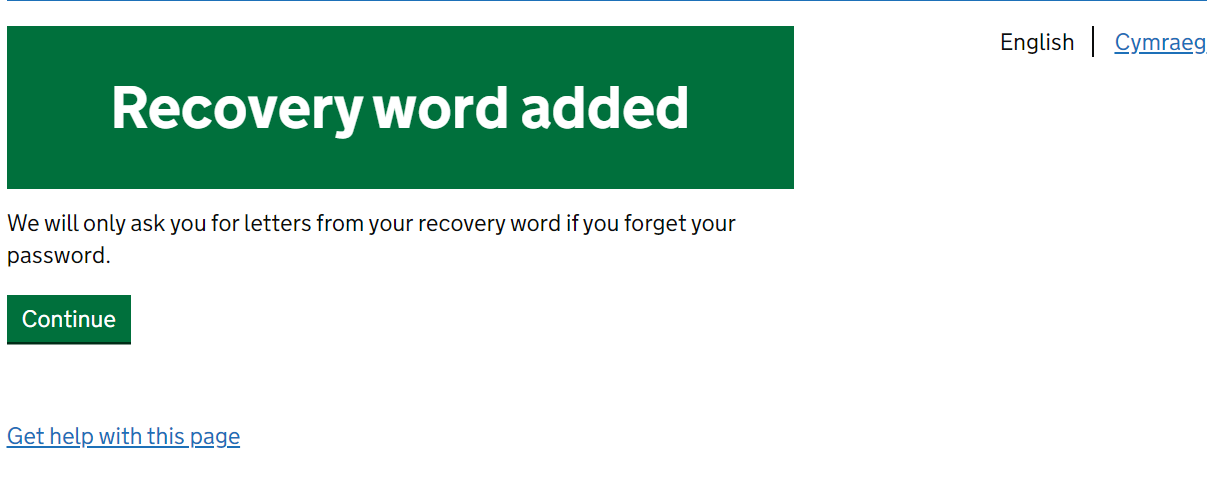

Once you enter your access code, you may be asked to set up a recovery word and then sign in again - see screenshots below:

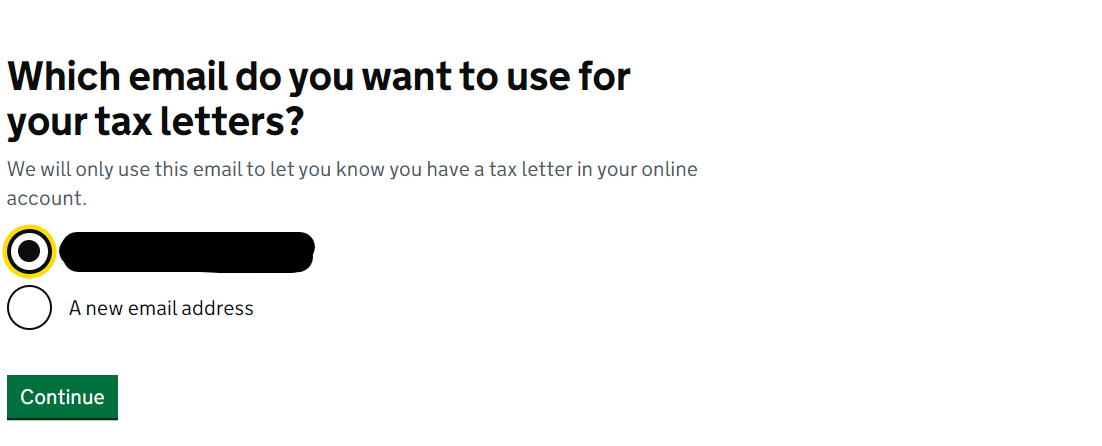

Digital tax letters?

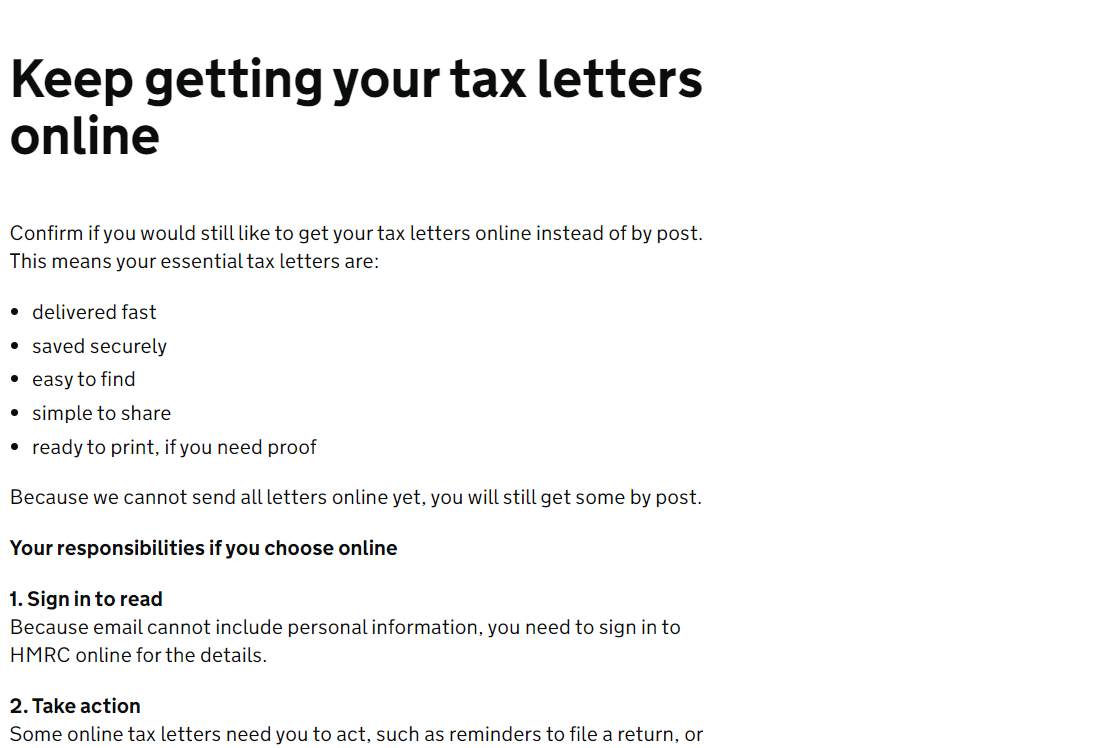

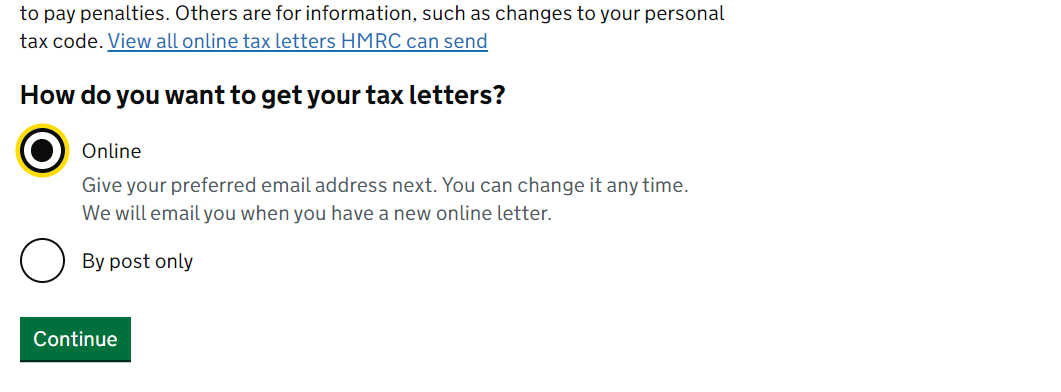

This year, HMRC has added in a question about how you receive your tax correspondence - I chose to get mine online and it asked me to confirm which email address I would like used for this. You may be asked the same.

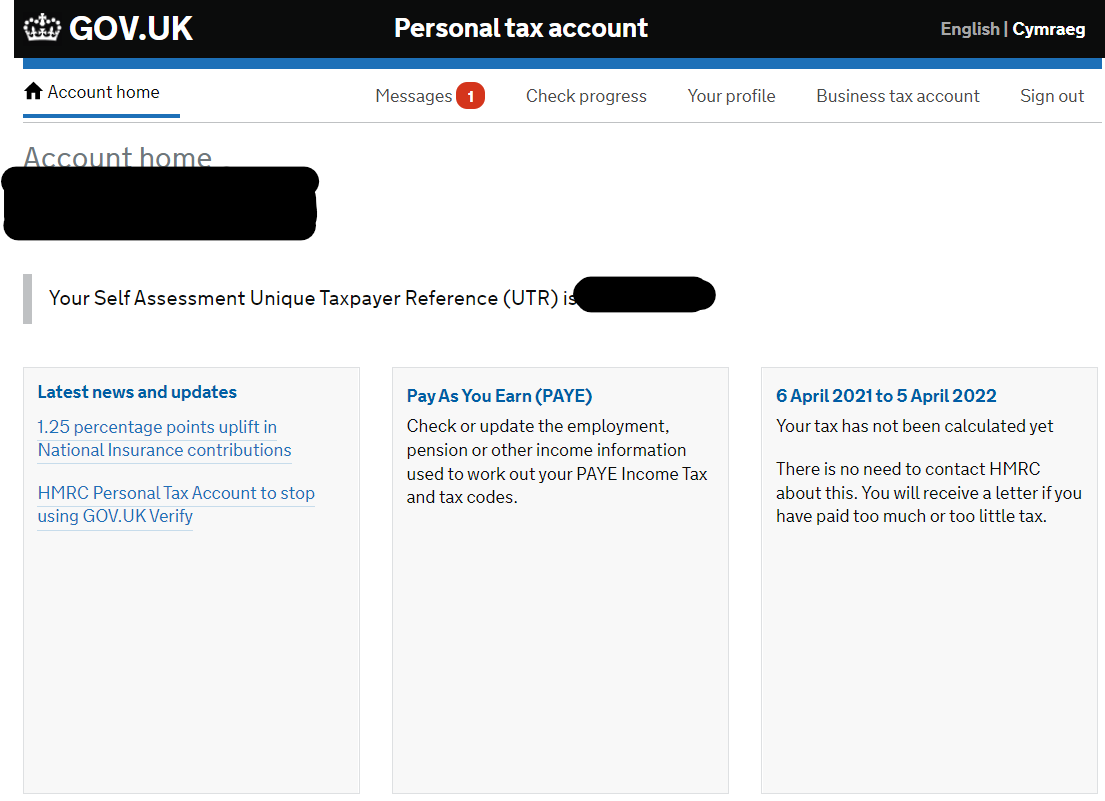

It's showtime

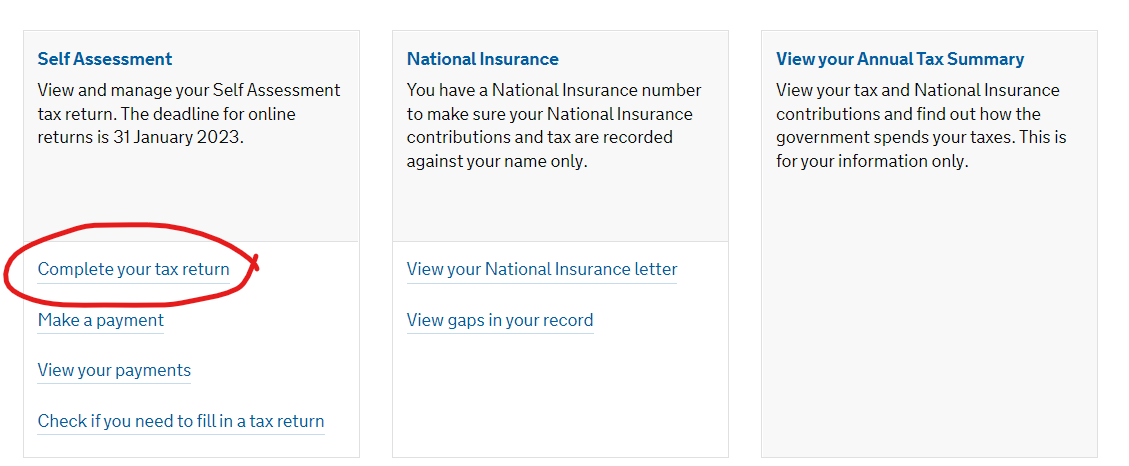

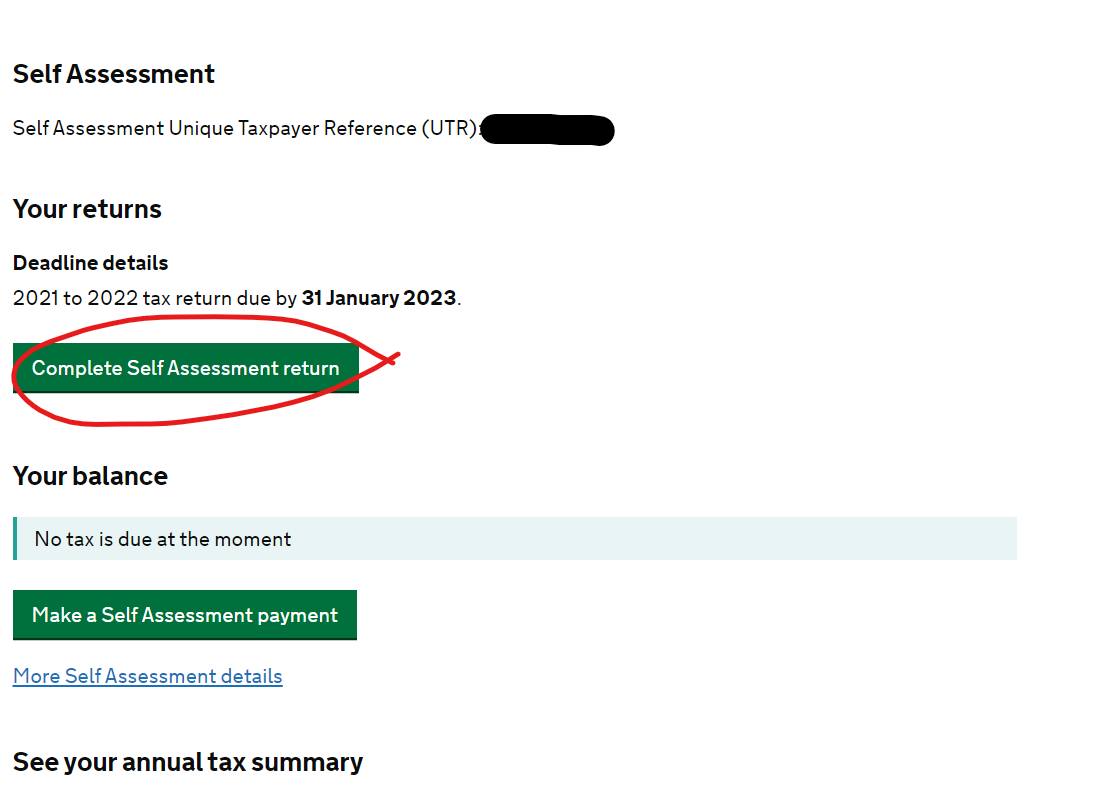

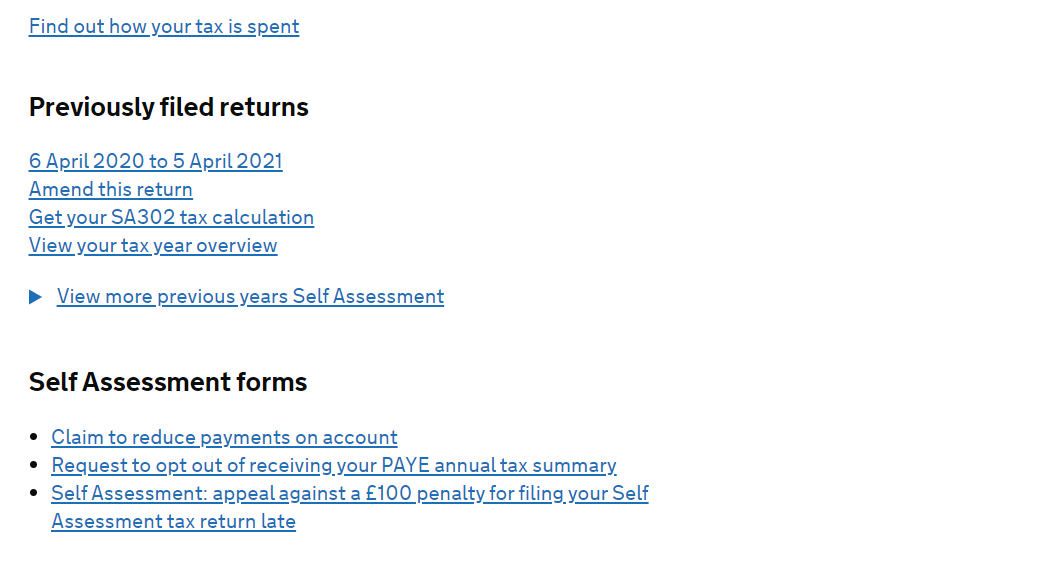

Once you've sorted out the security faff, you'll be taken to your 'tax homepage' - oh the joy! When you're ready, click Complete tax return from the Self Assessment section - curtains up, it's showtime!

Once you follow that link, you can click the 'Complete Self Assessment return' button to get started.

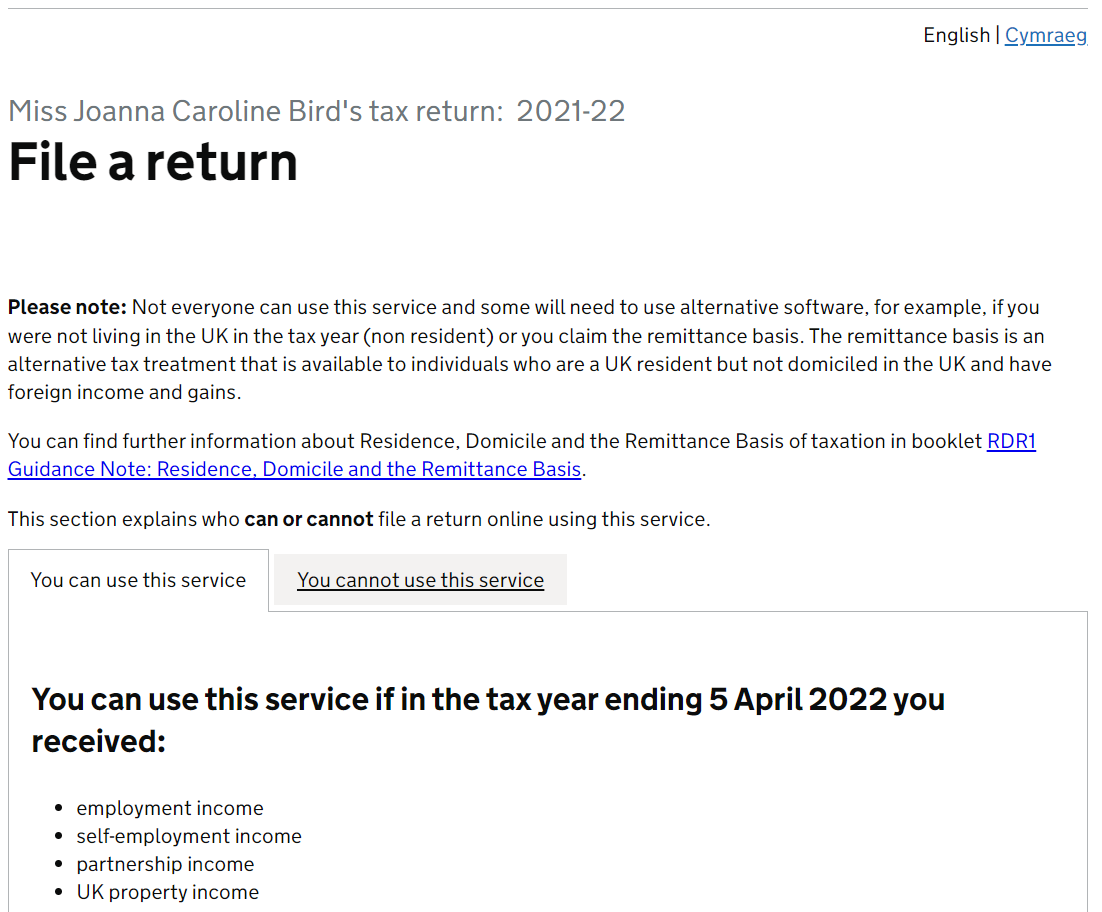

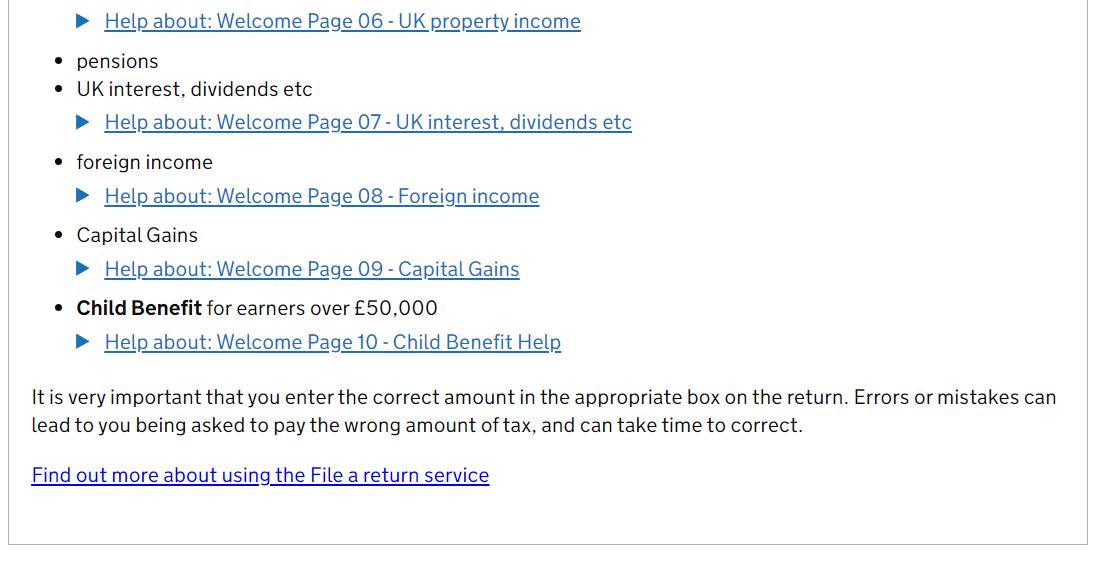

1. Welcome

This screen is just checking that you're here to do your self-assessment tax return. You can just scroll down and click Start Now >.

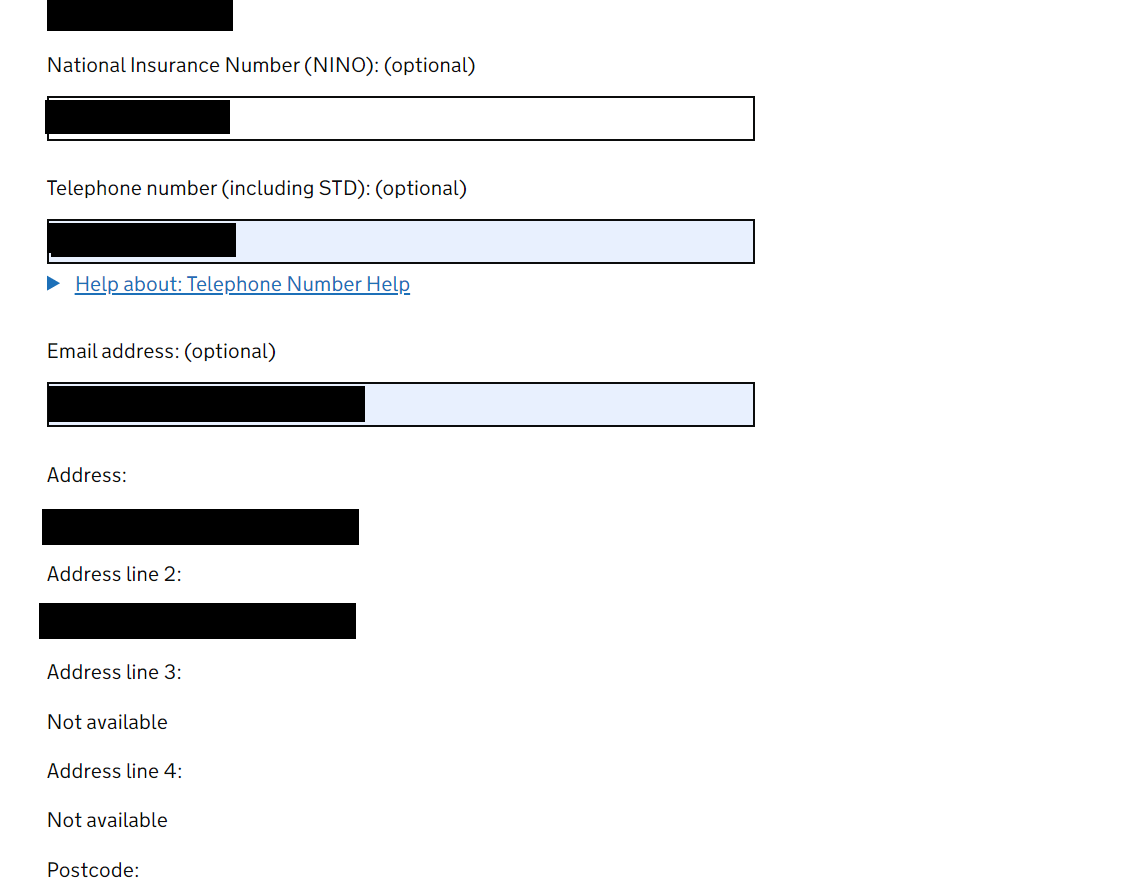

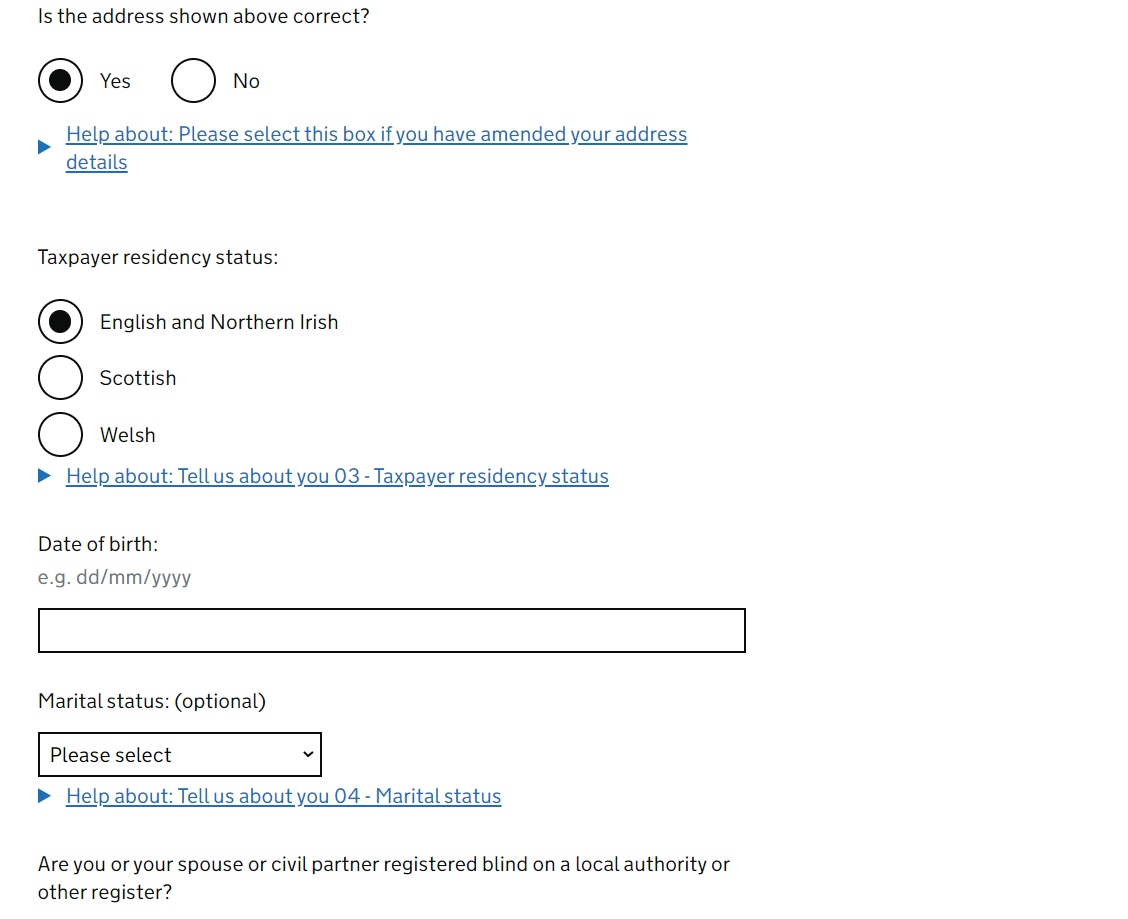

2. Tell us about you

Feel like you've got this info covered but if you've got any questions/problems, you can always use the question marks on the page for more info too. If you're unsure about your 'taxpayer status', it should be 'UK' unless you are resident in Scotland.

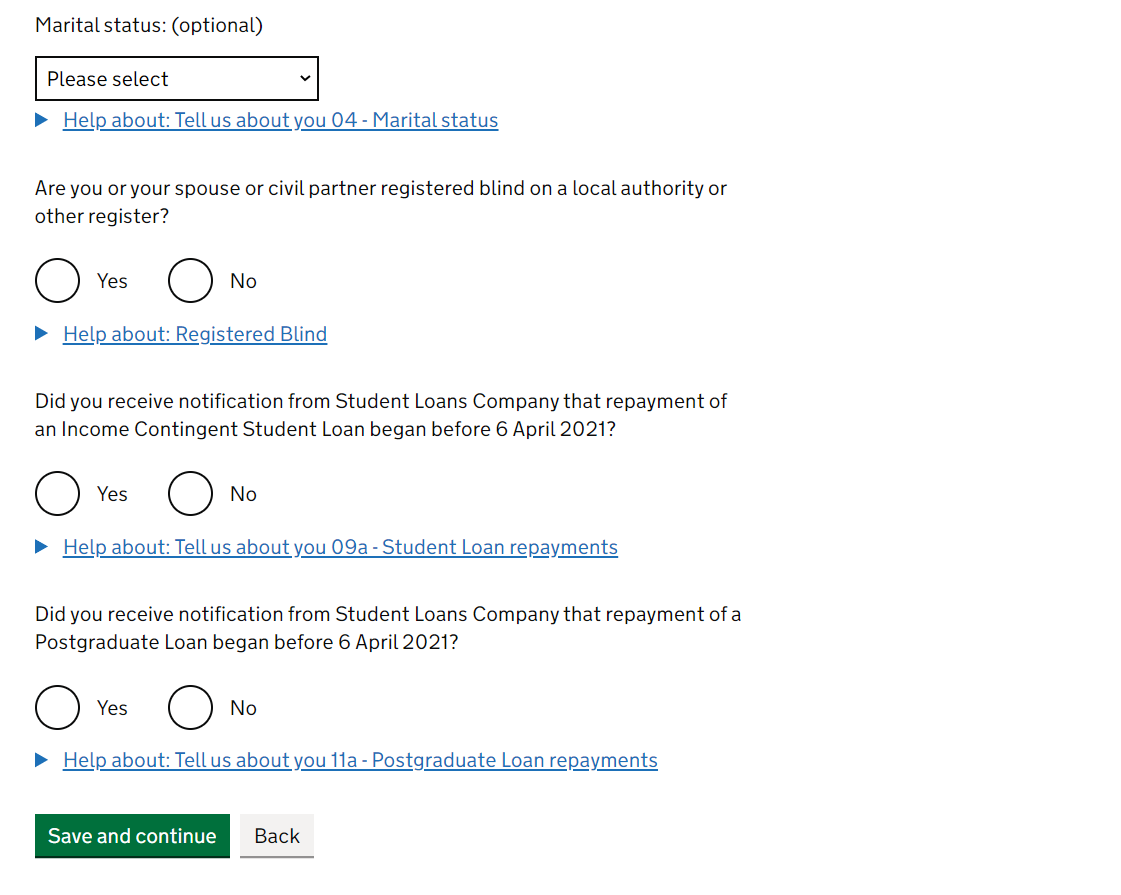

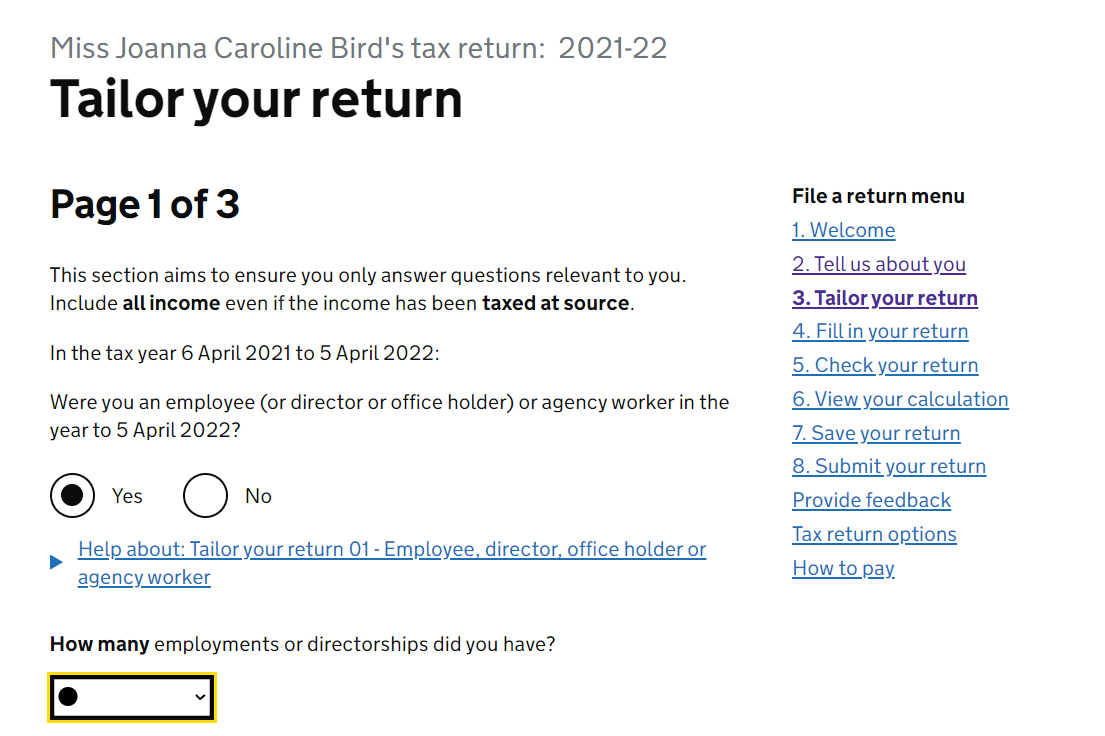

3. Tailor your return

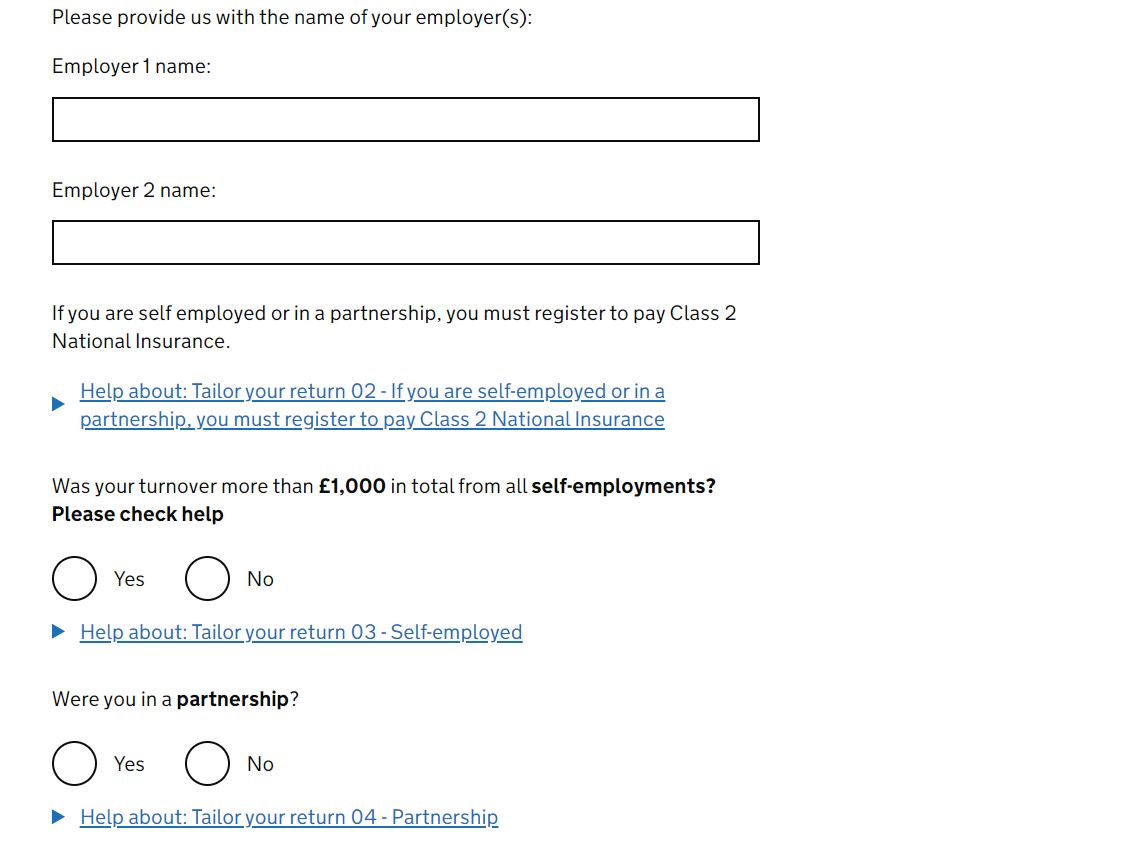

Here you tell HMRC what kind of income you've had throughout the tax year - based on this, HMRC will tailor your return to give you the relevant sections. Let's start with Page 1 of 3. If you have done employed work (the type where you get payslips and a P45/P60), then you need to answer 'Yes' to the first question. Then how many employers you've had - it may have a list of these employers already below. If they don't show, then you just put them in yourself. Remember this is for EMPLOYED work only. If you've only done self-employed work, select 'no' and move on.

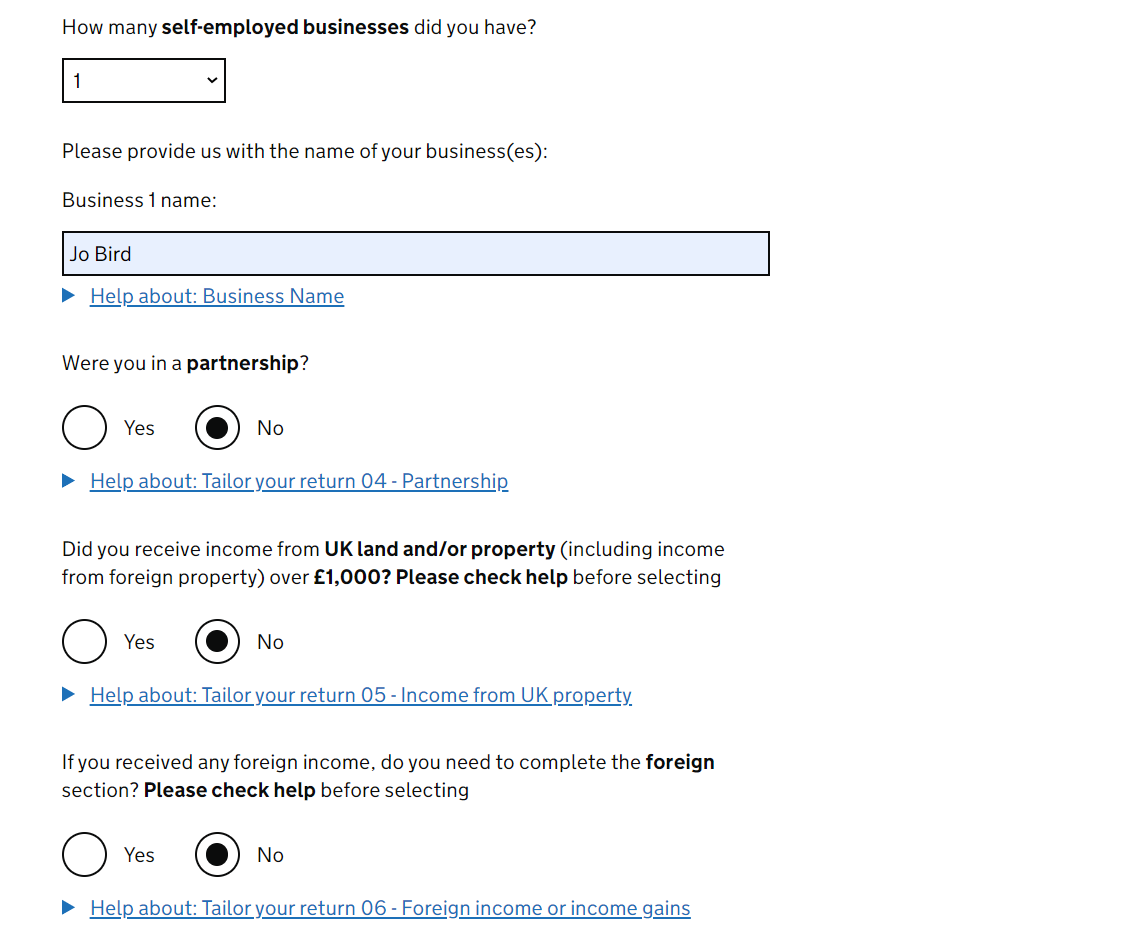

The rest of the questions on this page are for SELF-EMPLOYED work only. Check out your records to see if your self-employed income is collectively greater than £1,000 for the tax year (the SansDrama Online App tells you this on the tax return summary page - thank us anytime!). Assuming you guys have been busy bees and selected Yes you are now asked how many 'self-employed businesses' you have and what those businesses are called. Now, unless you know otherwise, you'll be the same as me and just have 1 and it'll be called whatever you named it when you first registered as self-employed. Most people use their stage name ie. 'Jo Bird' - if you followed our registration tutorial, you'll probs be the same.

The other questions don't really relate to us (except if you've paid tax on any foreign income from working abroad). FYI - we have a post on foreign income, but the foreign section in your tax return is only required if you've paid some sort of tax on your foreign income, otherwise the self-employed and employed sections are enough for you to report everything. Save and continue.

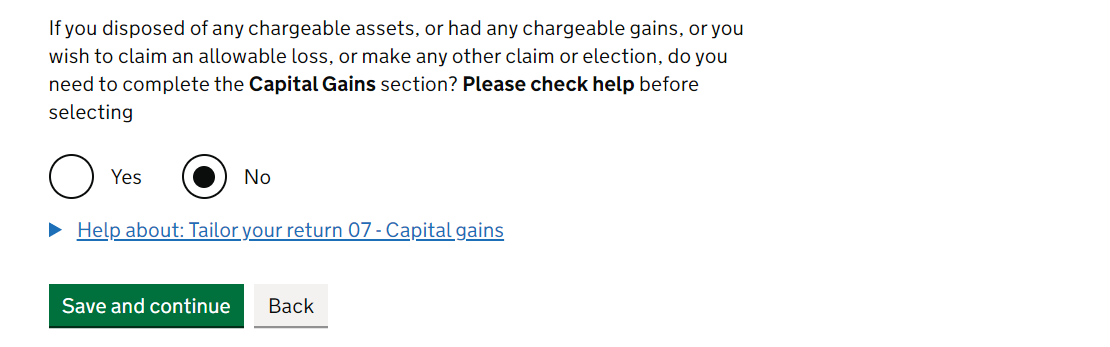

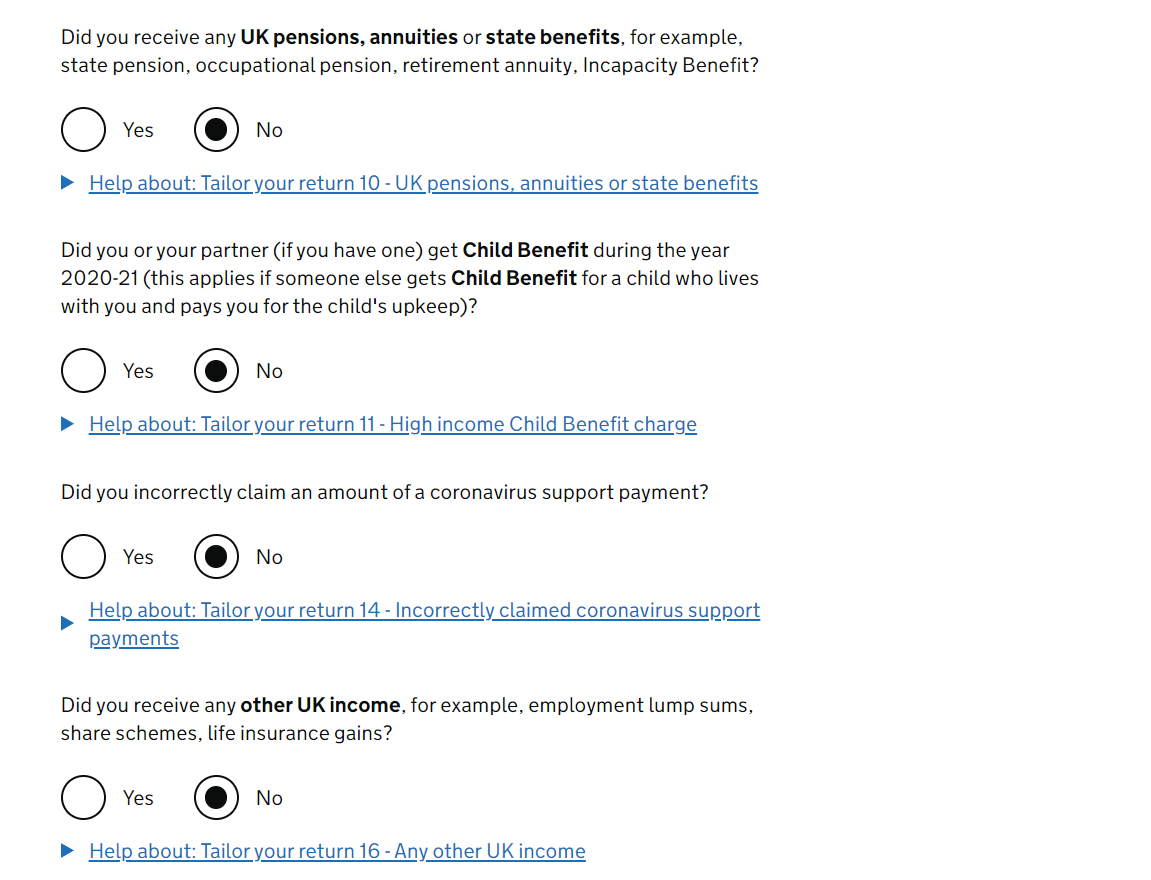

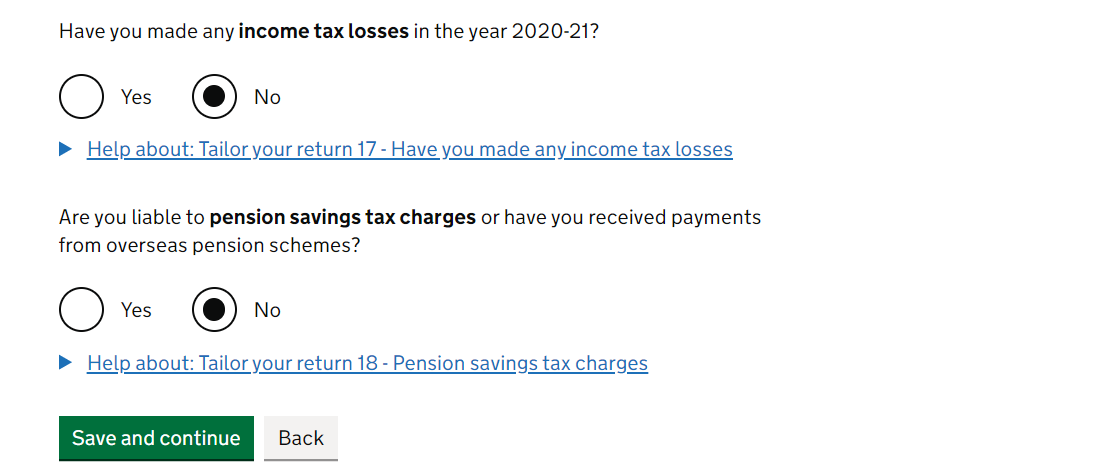

In Page 2 of 3 you're asked about whether or not you have any other types of income - Select 'Yes' if it applies to you and 'No' if not. However, like me you'll probably be 'Yes' for the first question regarding interest (if you have a bank account which you earn interest on, even if it's a tiny amount) and 'No' for everything else. If you've got your own business that is 'limited by shares' ie. it has 'Limited' or 'Ltd' at the end of the name, then you may be paying yourself money out of the business by dividends. But if you are, you probably have an accountant? Newcomer to the self assessment this year is a question asking if you incorrectly claimed an amount of a coronavirus support payment - incorrectly being the key word here team.

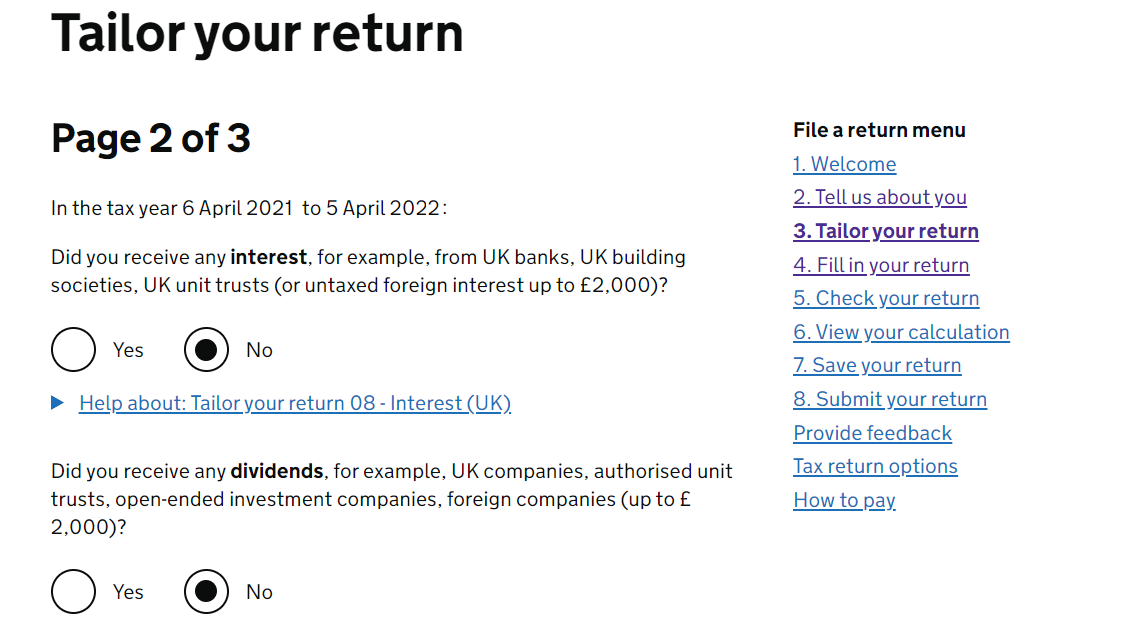

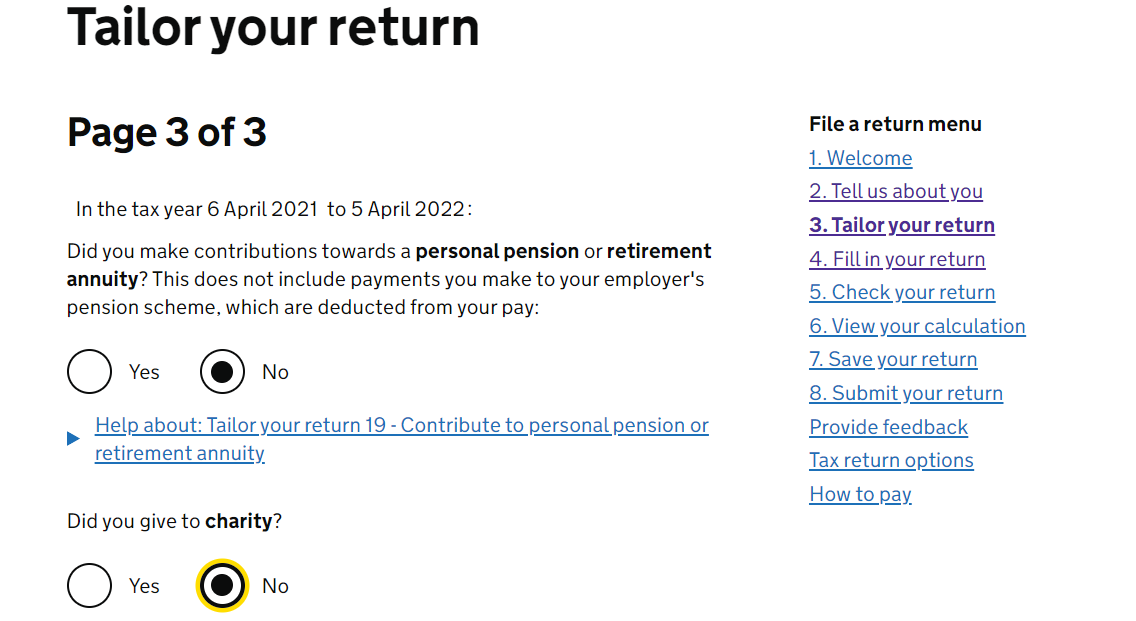

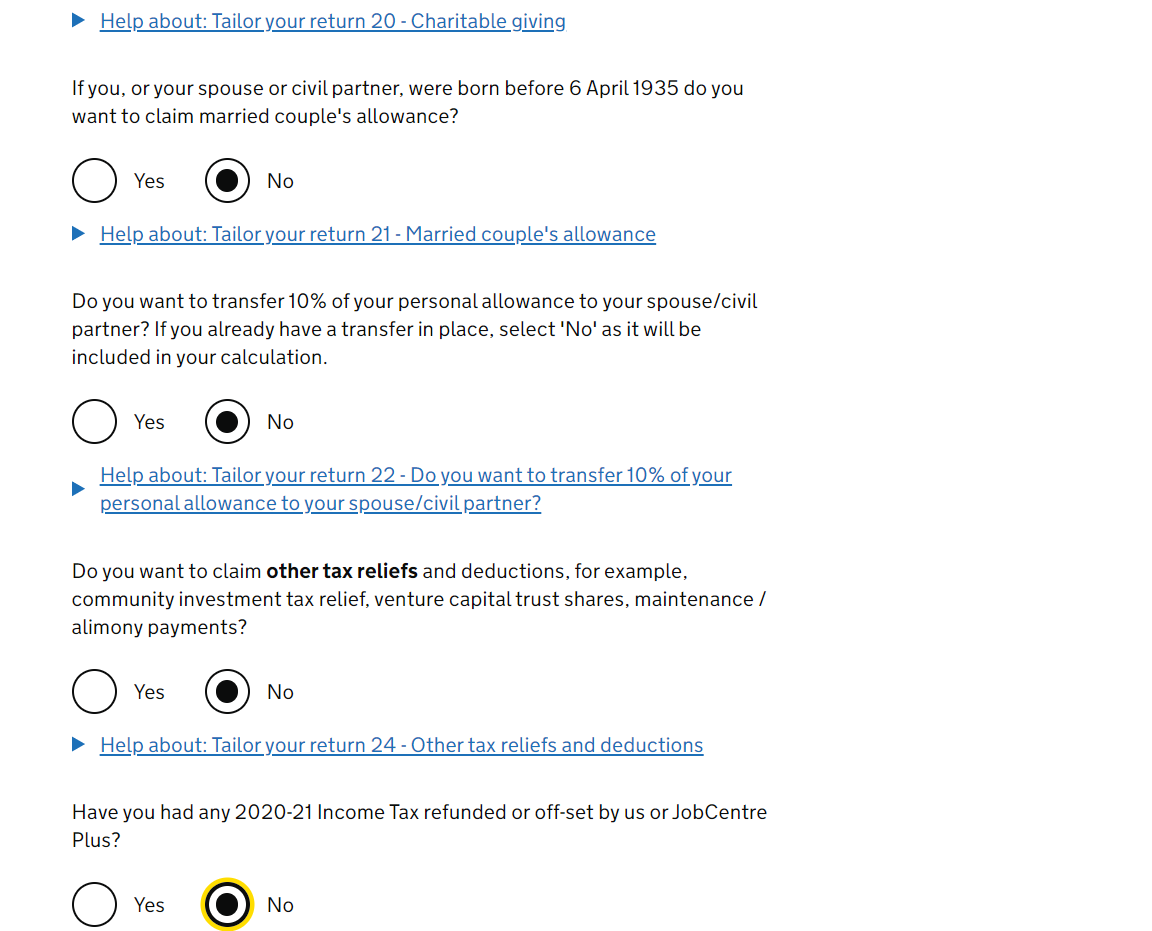

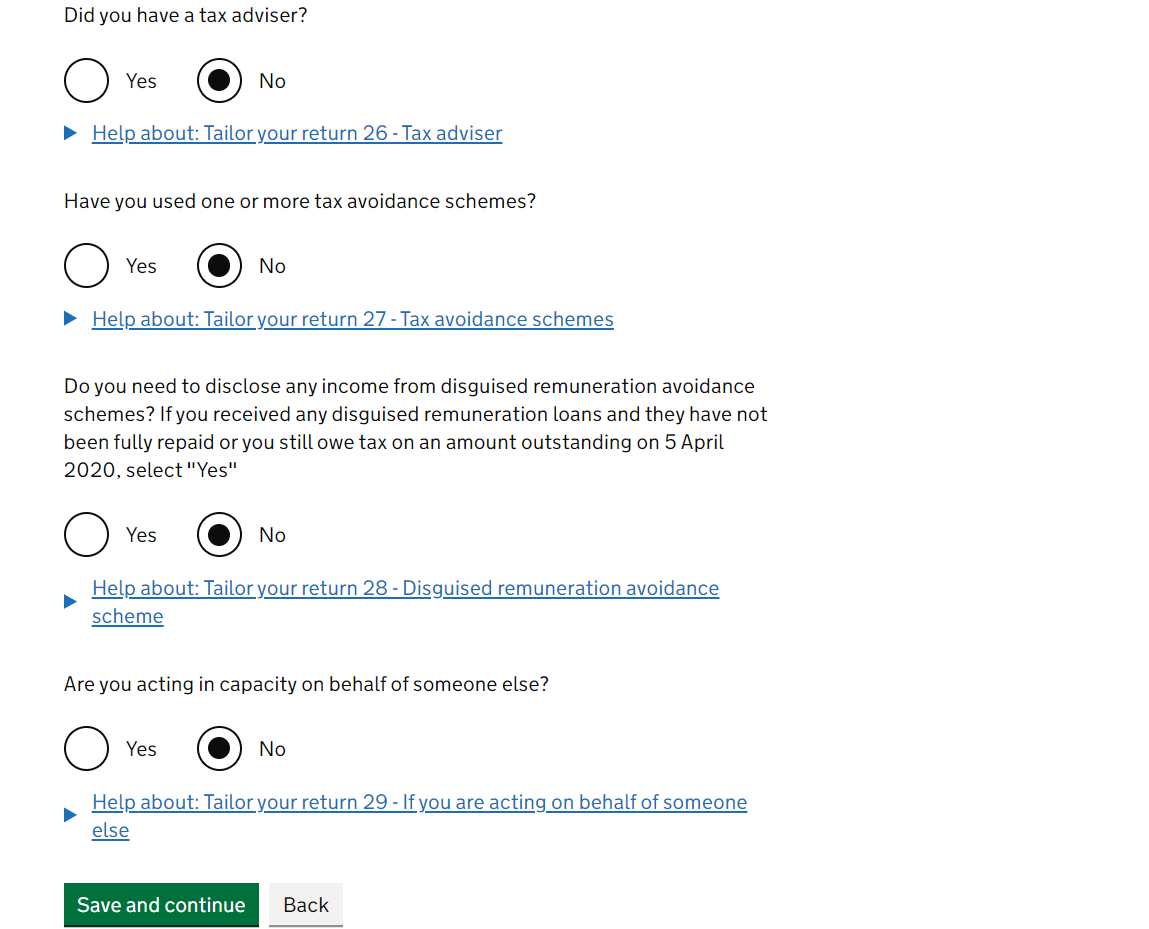

For Page 3 of 3 it's the same thing again, answering 'Yes' or 'No'. Again, you'll probably be 'No' for these like me, but here's a little dropdown for the most likely things that you might be a 'Yes' for. Save and continue.

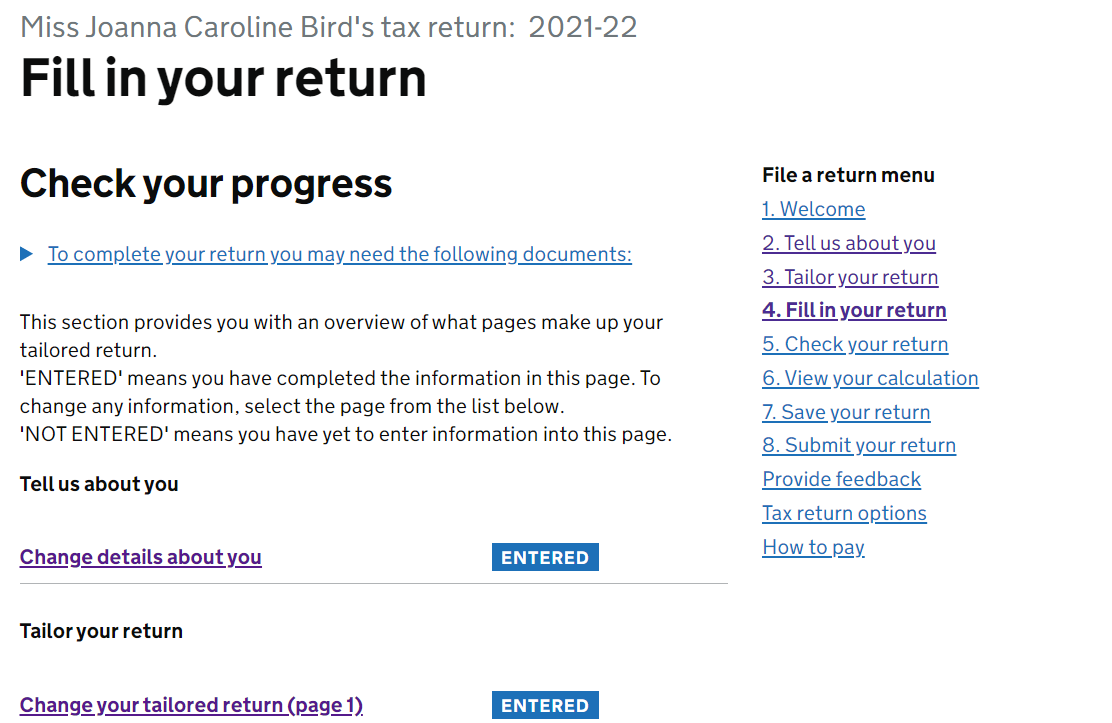

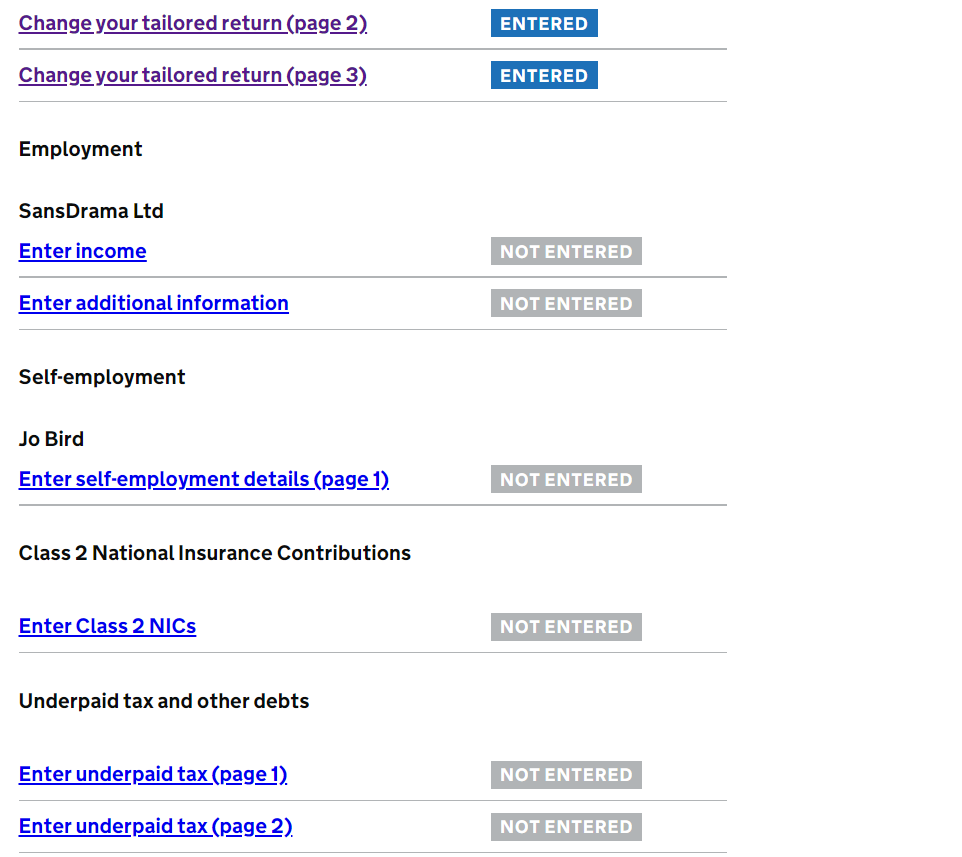

After this, it takes you to the summary 'Check your progress' page where you can select which section you want to complete next.

4. Fill in your return

Nailed it - so this next section (your actual 'tax return') has now been 'tailored' to YOU and only has the different sections that need completing for you.

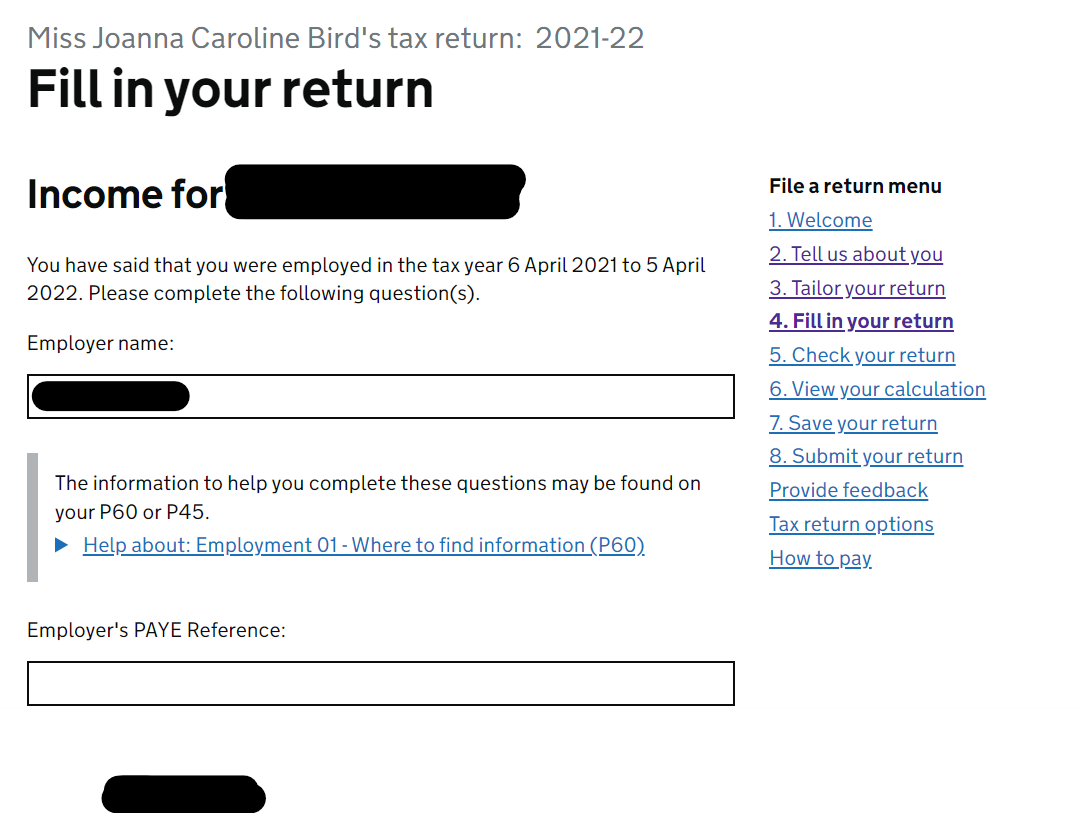

EMPLOYED INCOME first. (If you've only done self-employed work in the tax year this bit won't be relevant for you). For each employer you've had this year, there will be 2 pages: 'Enter income'; and 'Enter additional information'. See below:

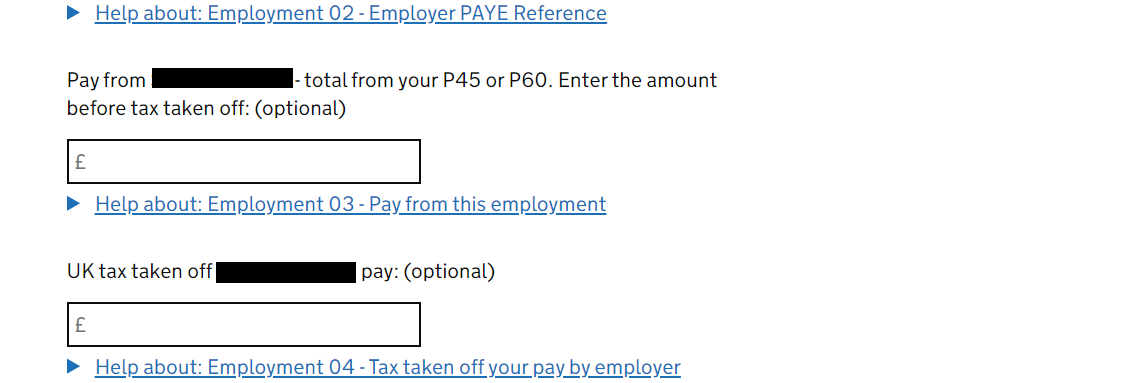

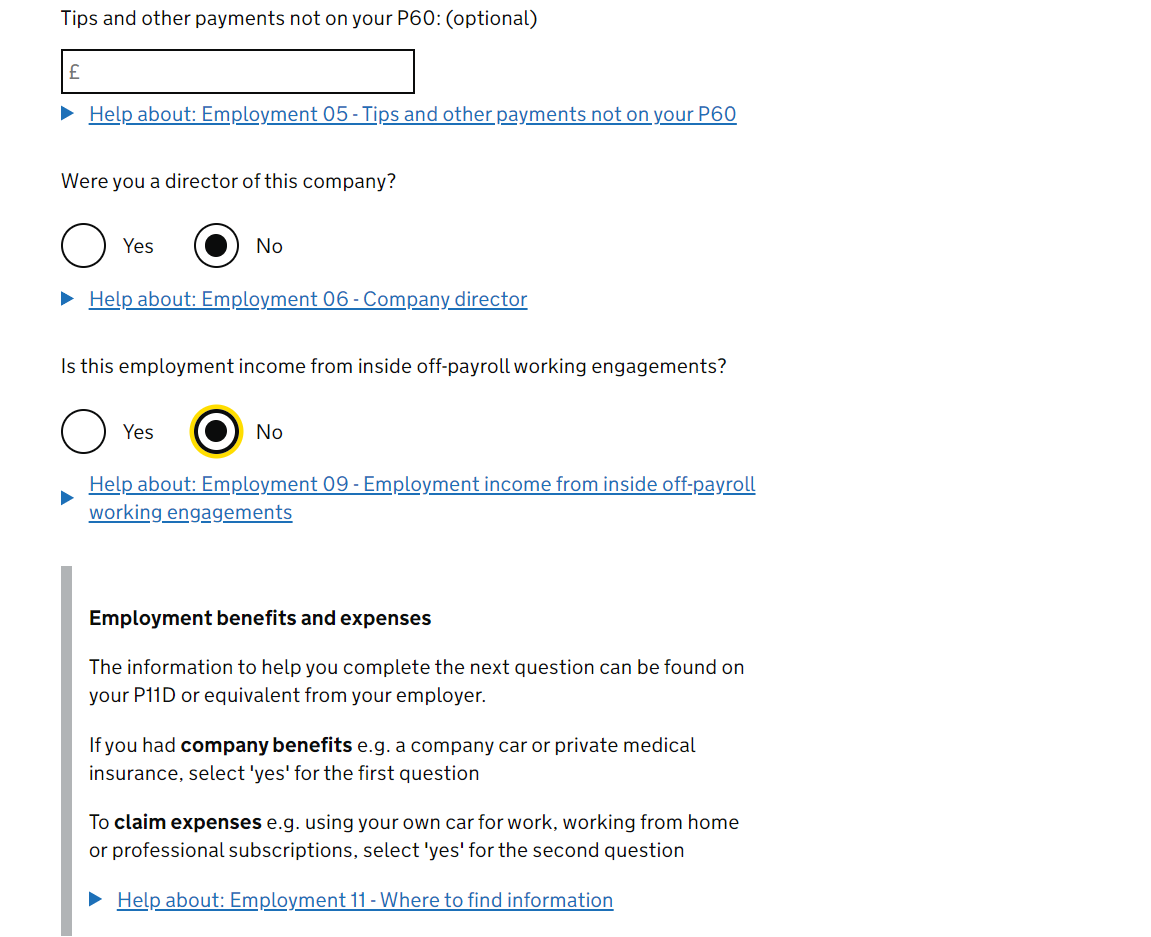

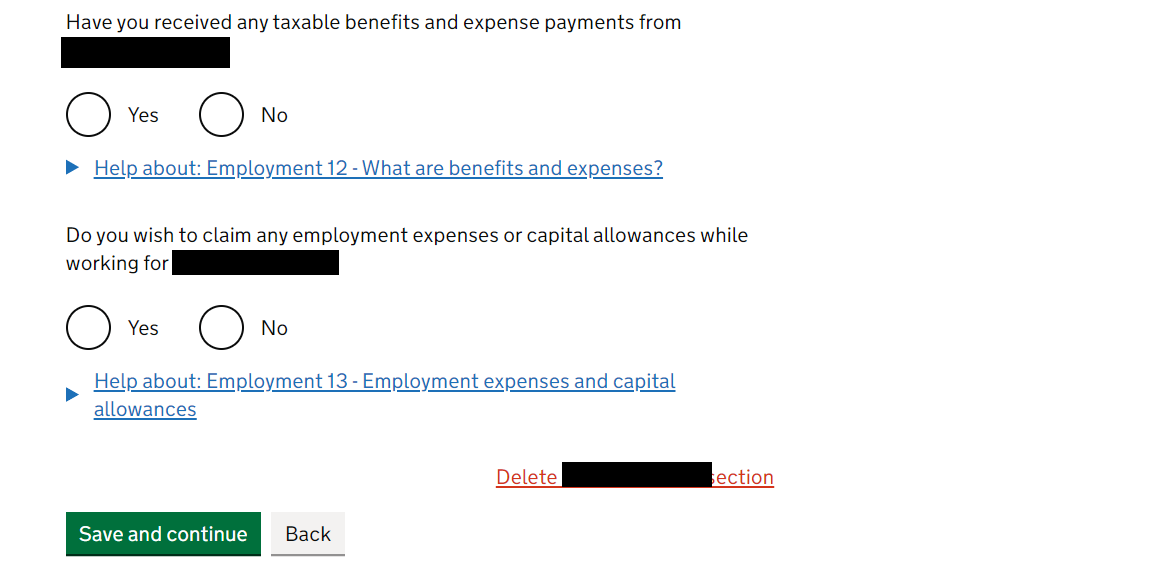

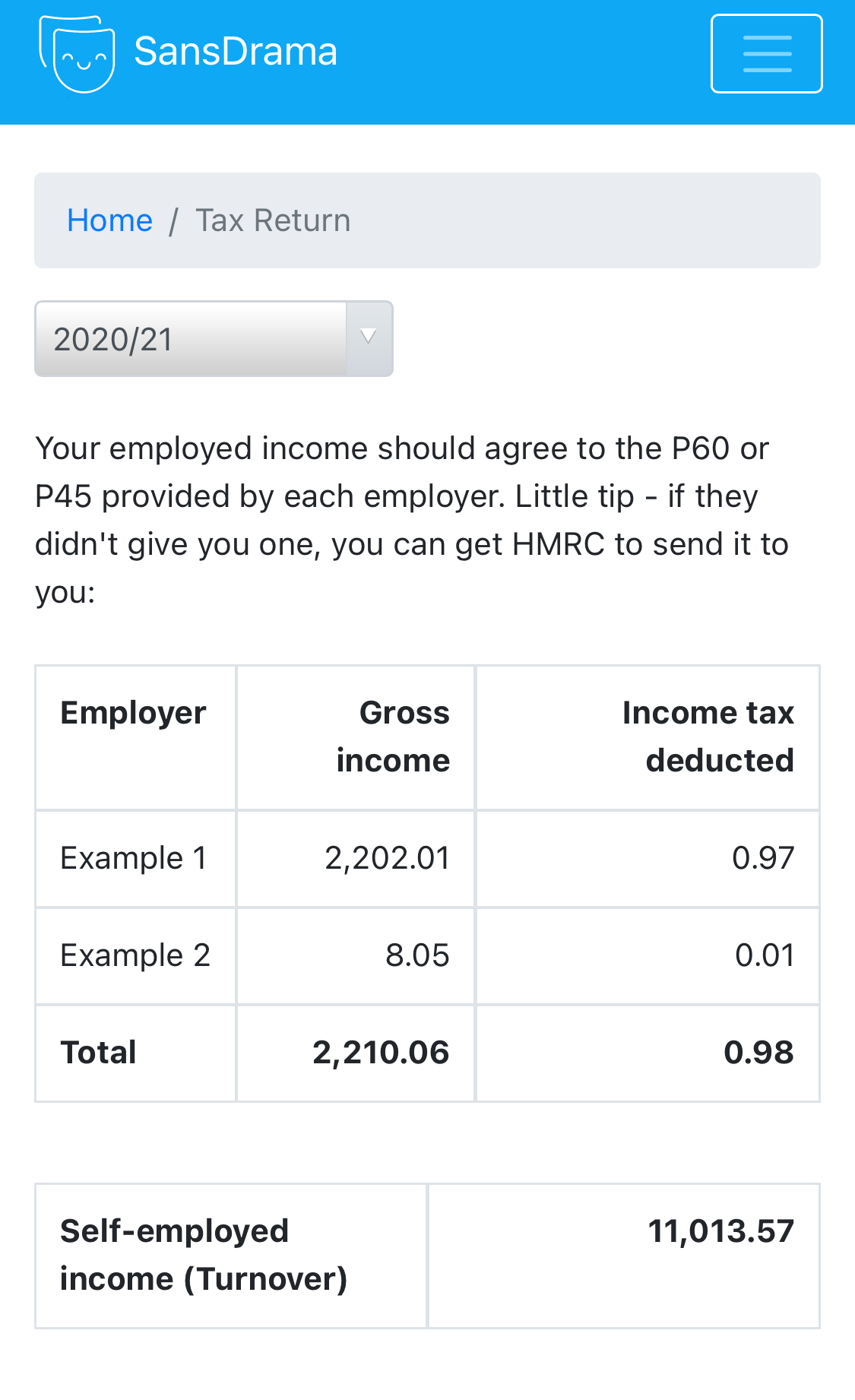

The page title will still be 4. Fill in your return and it may be pre-filled with the Employer name, Employer's PAYE Reference, and the amount that HMRC thinks you have been paid and taxed by them. You should agree this back to your records for that employer (the SansDrama Web App sets this out in your tax return summary). *Tip* Remember that all employers should have provided you with either a P45 or P60 that you can use to match it up with. Don't panic if this isn't pre-filled in, you can enter the info straight from you P45 or P60.Focusing on the asterisk questions (that HAVE to be filled out) you need to confirm if you were a director of this company (probably a 'no') and whether you have received any taxable benefits from the employer (probably a 'no' too - private medical or a car are the usual examples). The final question you have to answer is whether you wish to claim any employment expenses or capital allowances while working for this employer (again, probably a 'no'). Don't forget you can also use the question marks for more detail!

We've not mentioned that you should technically disclose any tips you make at work on this page, too. Similarly, we won't talk about the Repayment of Teachers' Loan Scheme bit as it probably doesn't apply, so leave it blank. Save and continue!

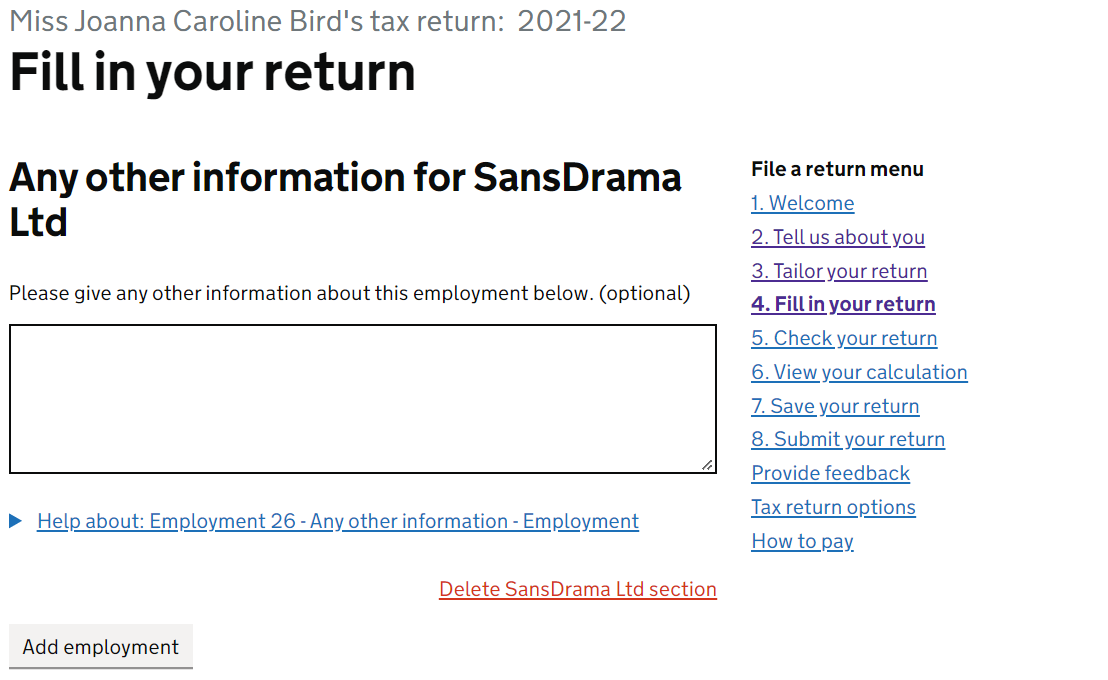

We've never found it useful to add anything in here on the 'Enter additional income' page so we've just left it blank, but we're keen to hear if you have. Let us know as it could be helpful for others! Have a dunk of your biscuit, eat, dunk again, finish biscuit and click Save and continue, repeat the above until all employers have been filled out.

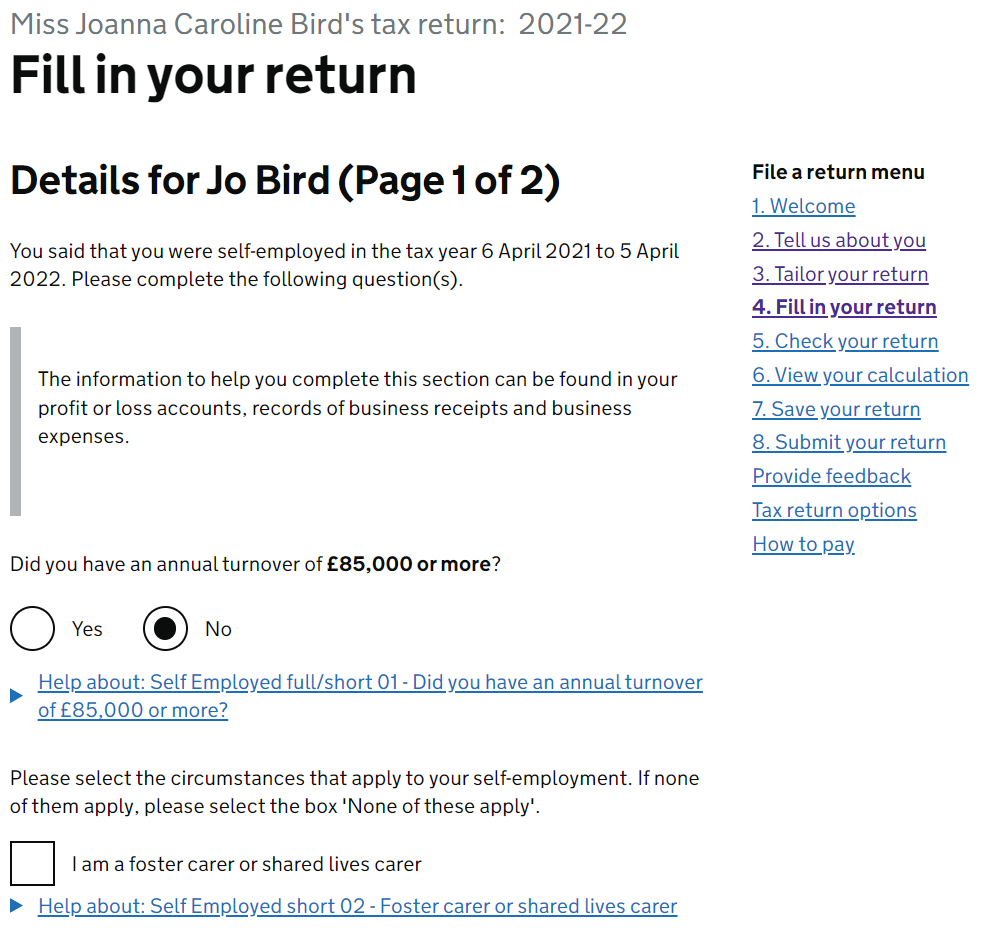

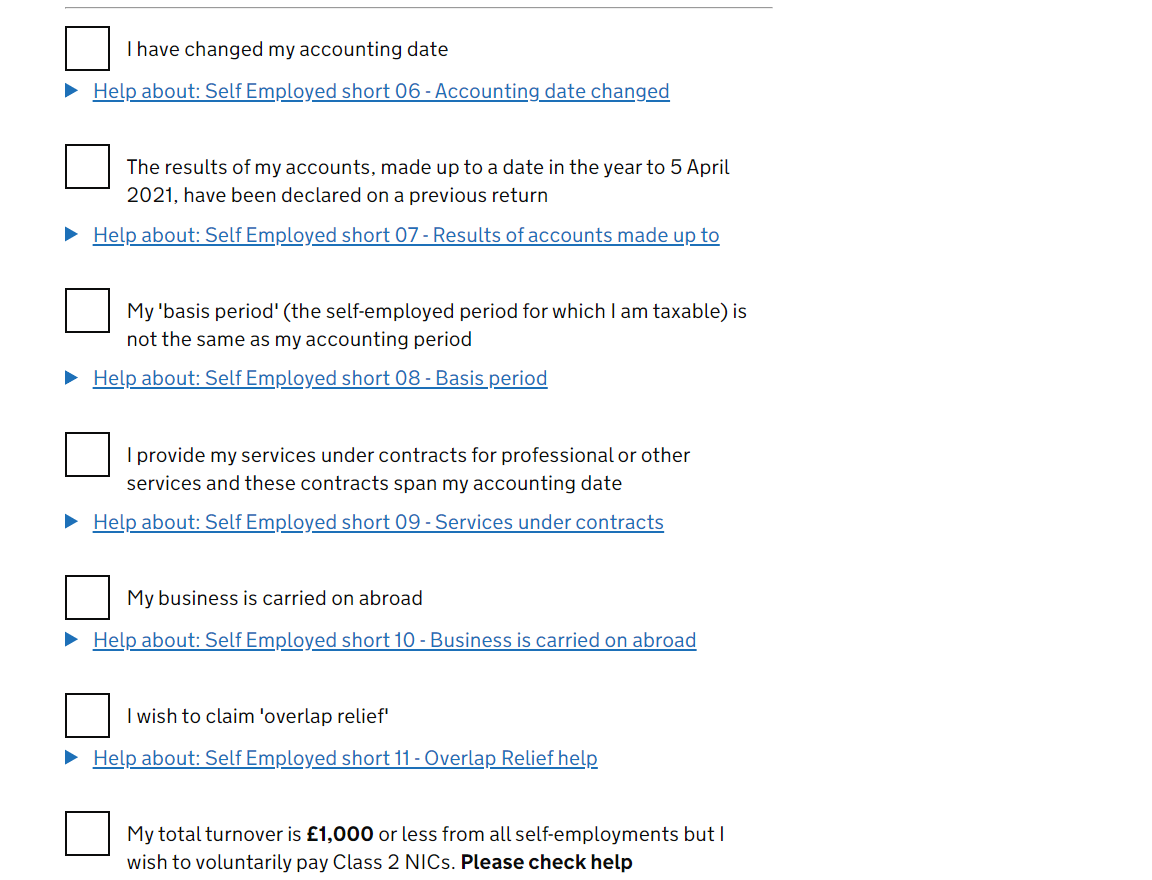

Nice. Employed income has been dealt with. Go you!! Let's move on to SELF-EMPLOYED income! The next page asks whether your self-employed business had income of over £85,000 this year (I mean... we can all dream!). If you did, congrats! You may want to contact an accountant at this point because you should be VAT registered. For the rest of us mere mortals, select 'No'.

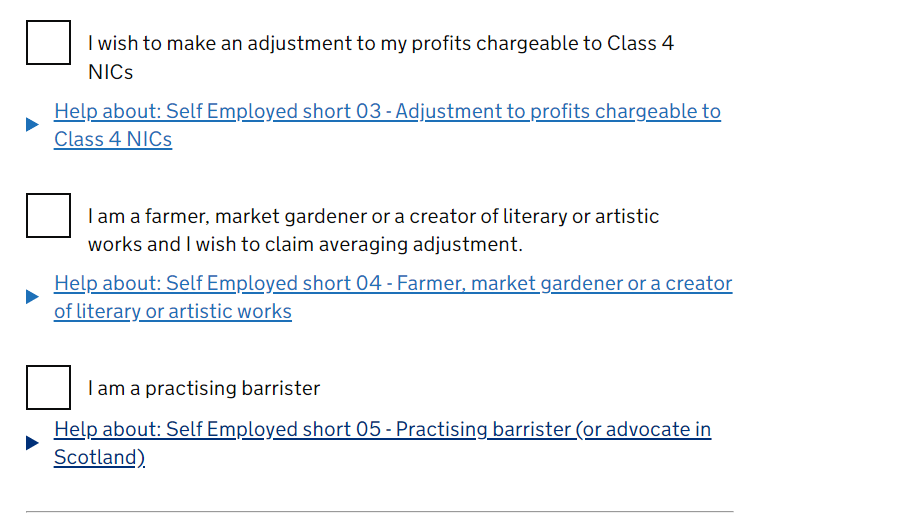

This gives you a load of 'special circumstances' that a self-employed person may be operating under. We've had a look at these and can't see any that would obviously apply to us performers. You should review them too for anything that might apply to you, but if they don't, click in the box None of these apply at the very bottom and then click Save and continue.

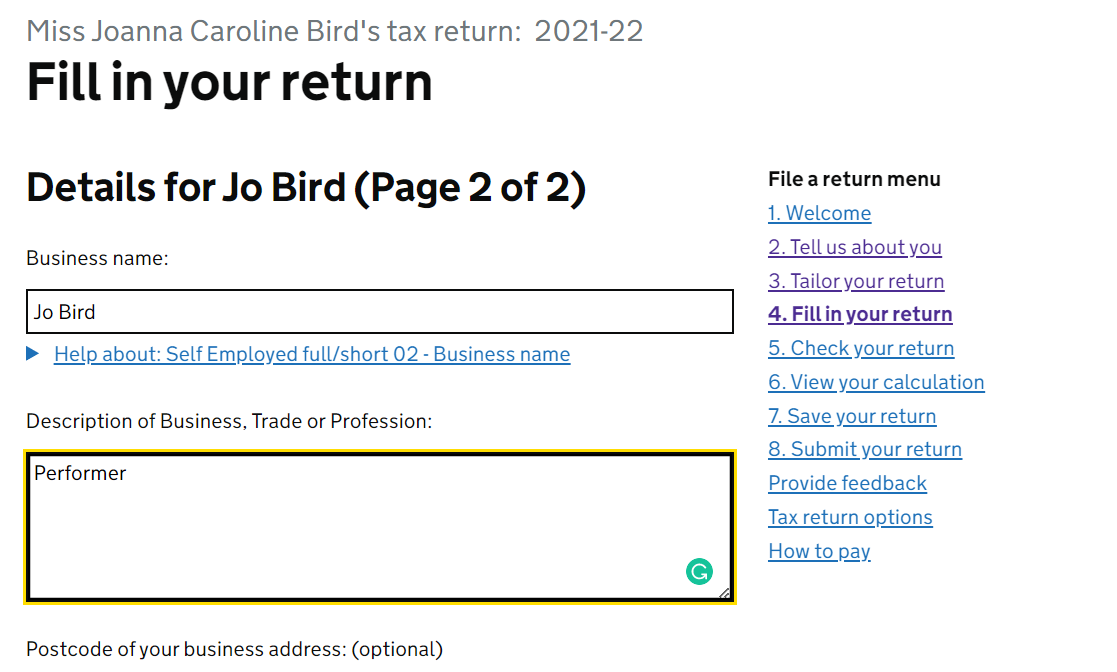

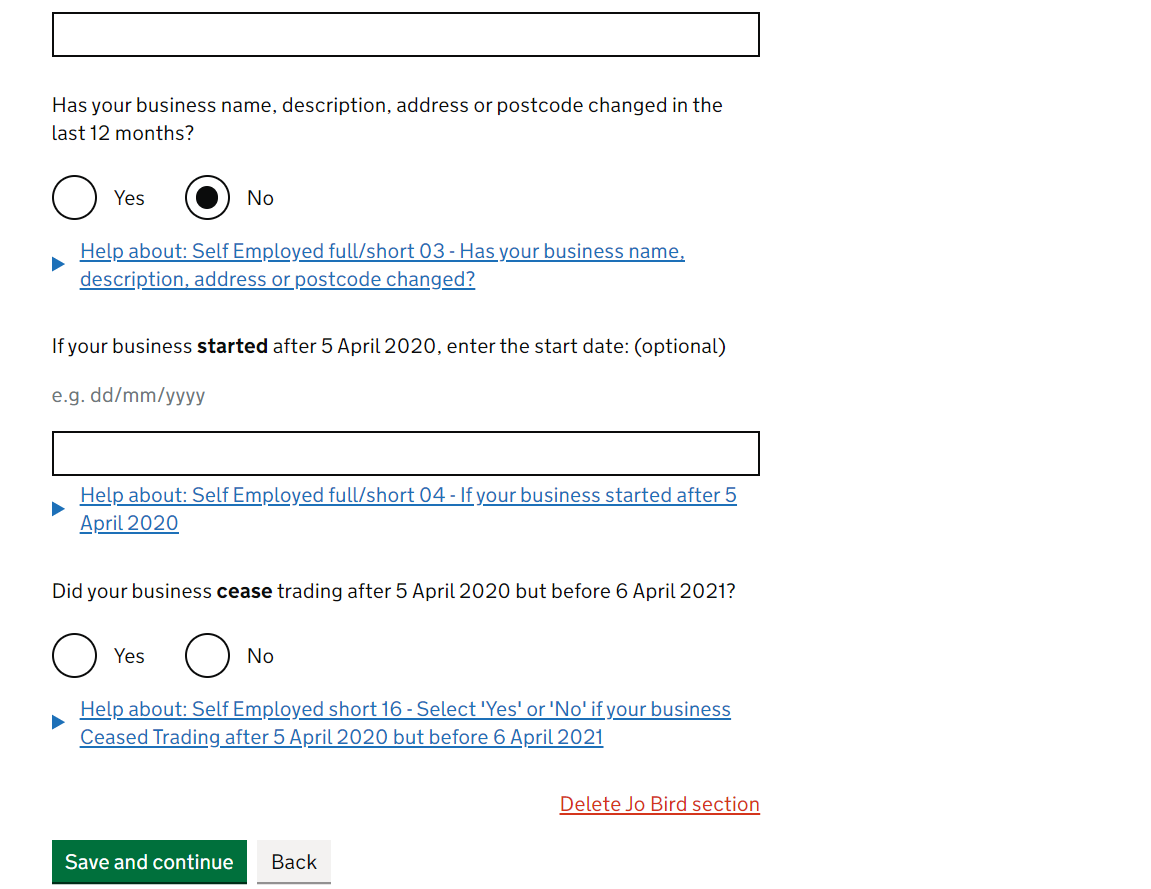

The second page gets you to confirm the name of your business (again, I use Jo Bird) and the description of the work you do ('Performer' for example). The next 4 questions are not required, but you can answer if relevant for you. Save and continue.

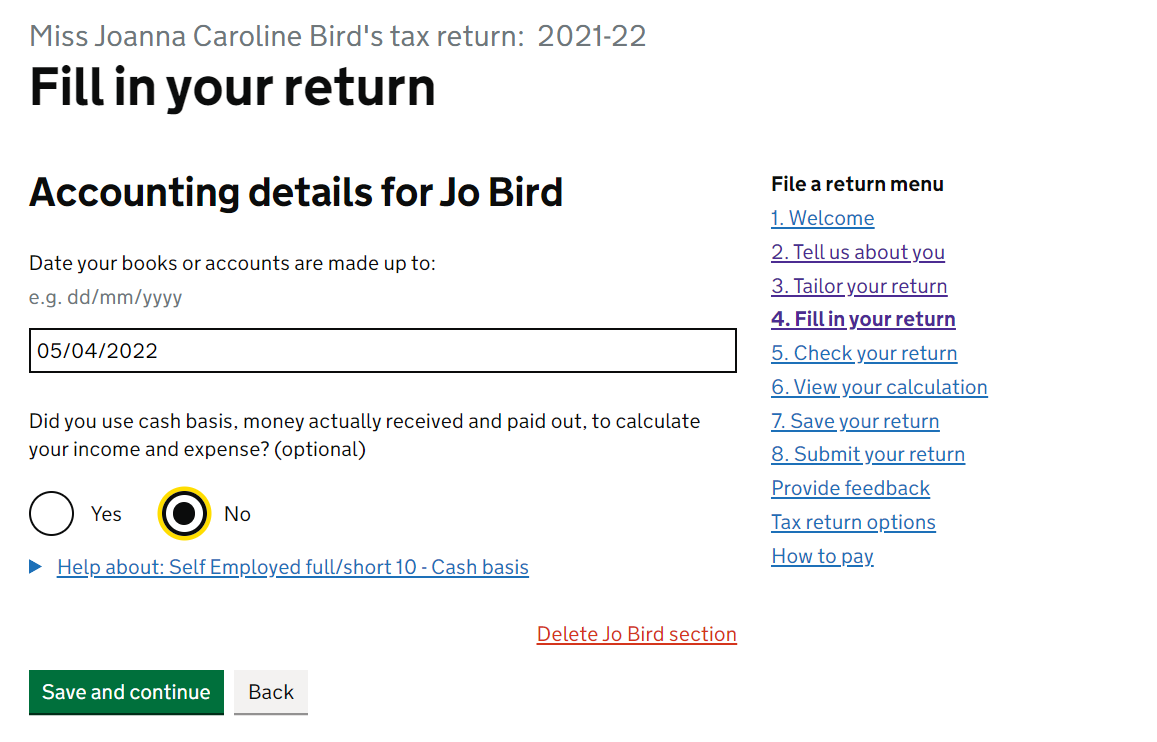

One last page before the fun starts - just fill in as per the screenshot below (unless you know otherwise).

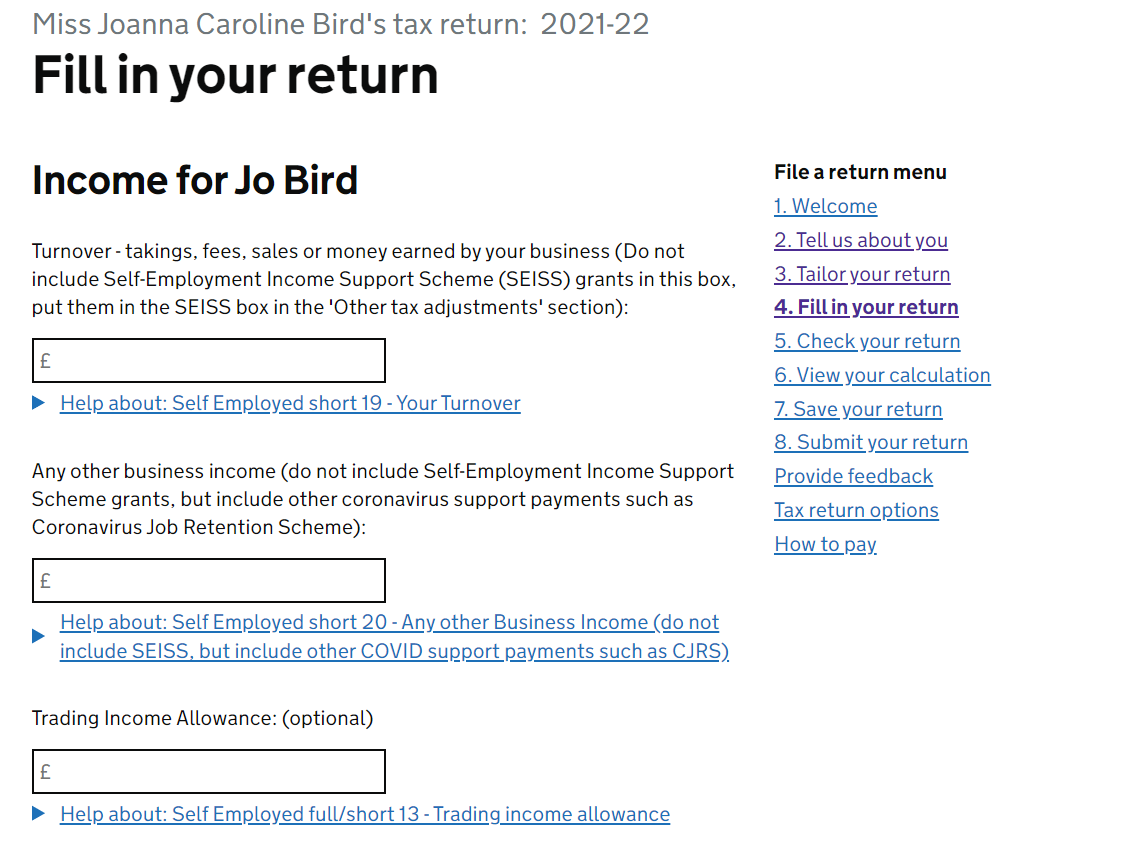

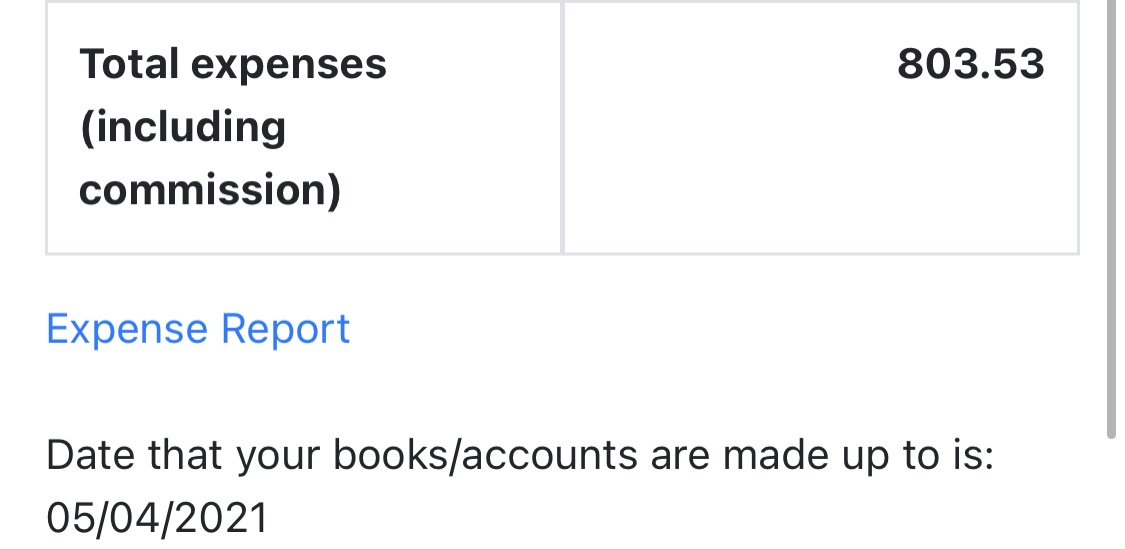

Okay, the next page is where your efforts recording your income and expenses in the SansDrama Web App pay off - from the main menu in the app, just click '4. Reports' > 'Details for my tax return' and all the info you need will be ready for you. Enter the total figure of your self-employed income in the top box, you can probably leave the next two boxes blank (HMRC likes you to leave boxes blank rather than putting in zero).

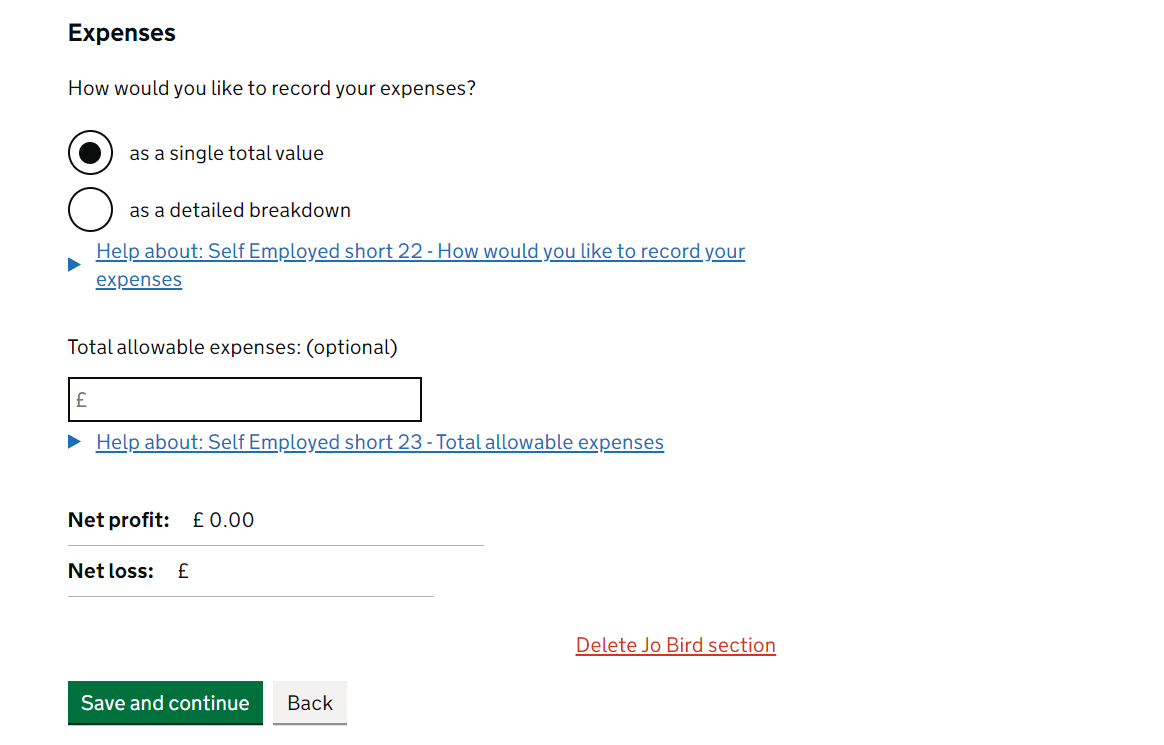

For expenses, select 'as a single total value' (as shown in screenshot below) and enter your 'Total allowable expenses' into the next box. If you want to double check what counts as an 'allowable expense' we've got you covered on our expenses article! Note that although there is a section for coronavirus payments received here, this does not include Self-Employment Income Support Scheme payments.

We've included a little screenshot of the 'Details for my tax return' page on the SansDrama Web App so you can see how easy it is to transfer your information from app to tax return form. When we say we've got you covered - we mean it!

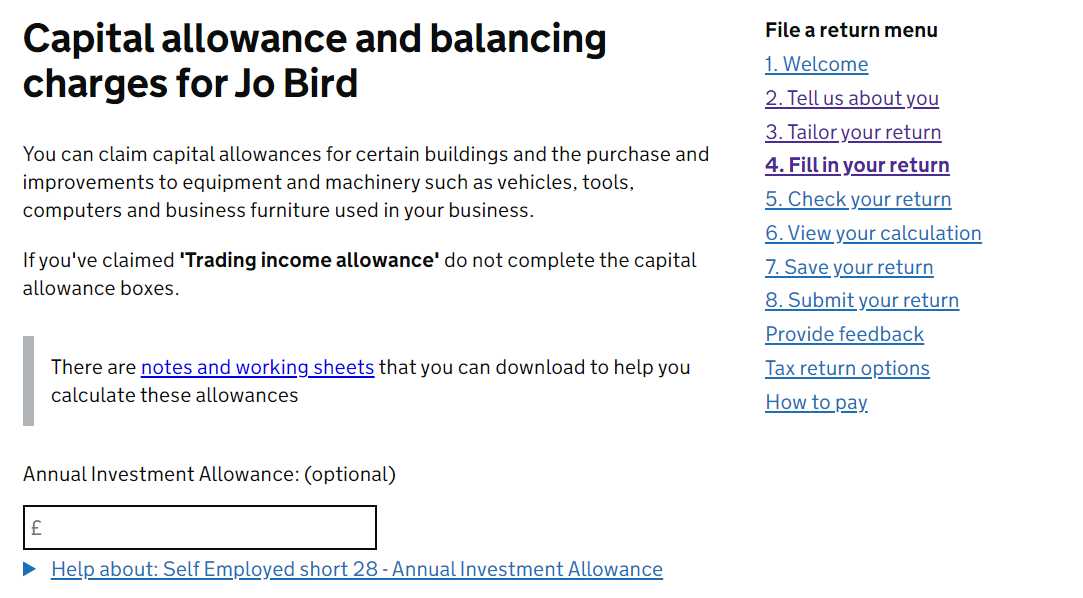

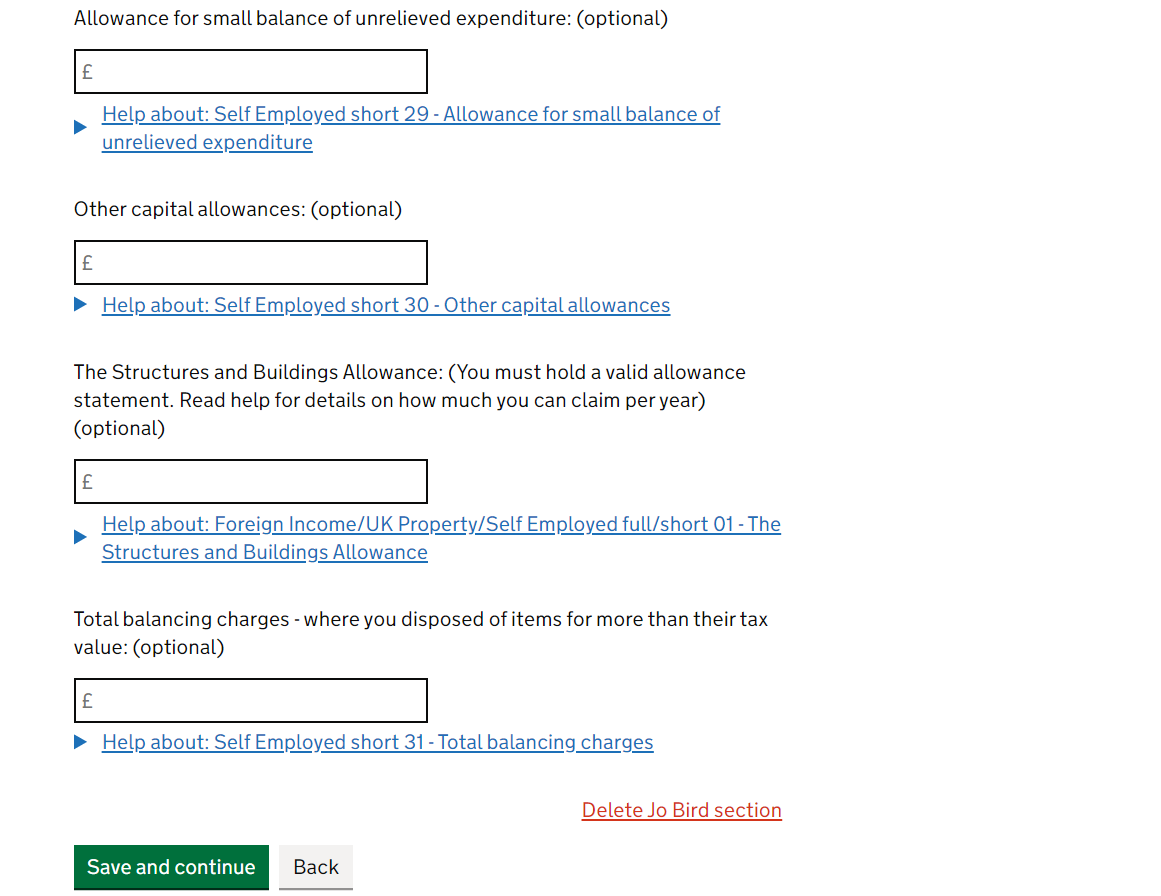

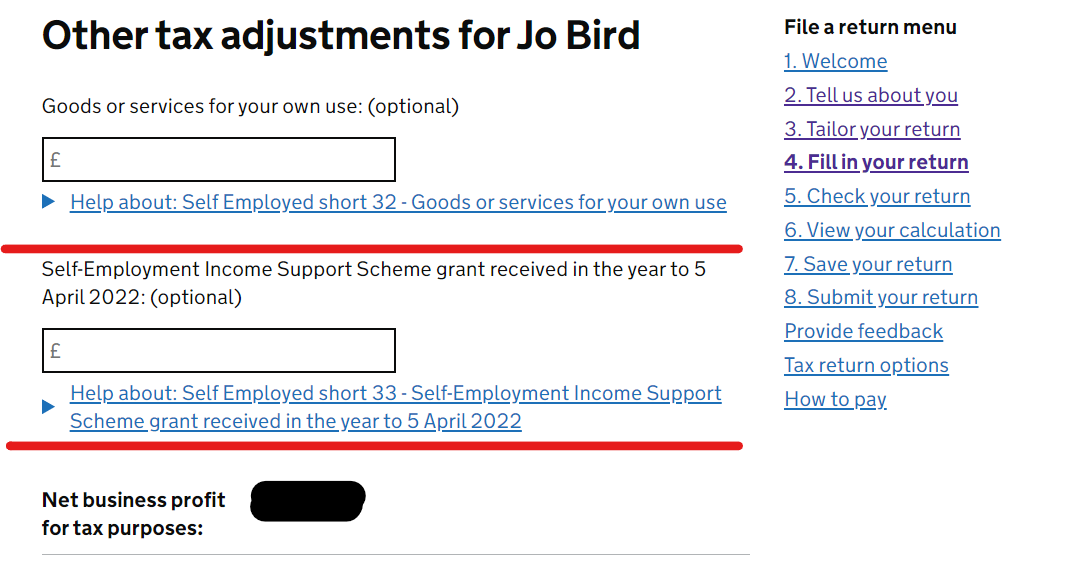

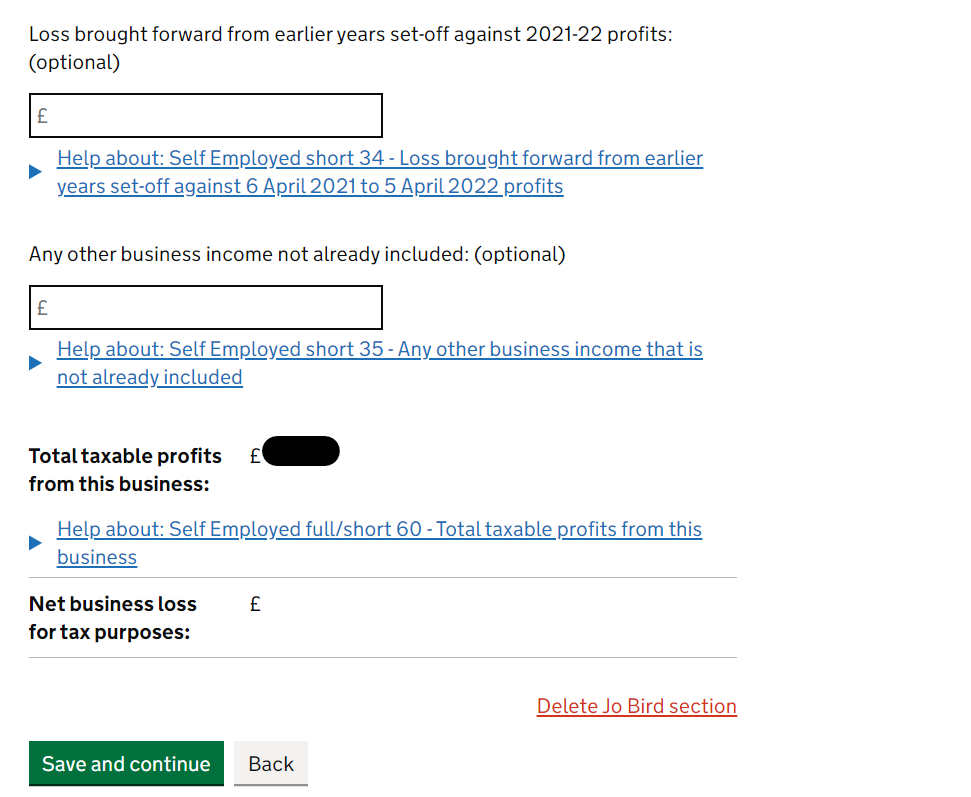

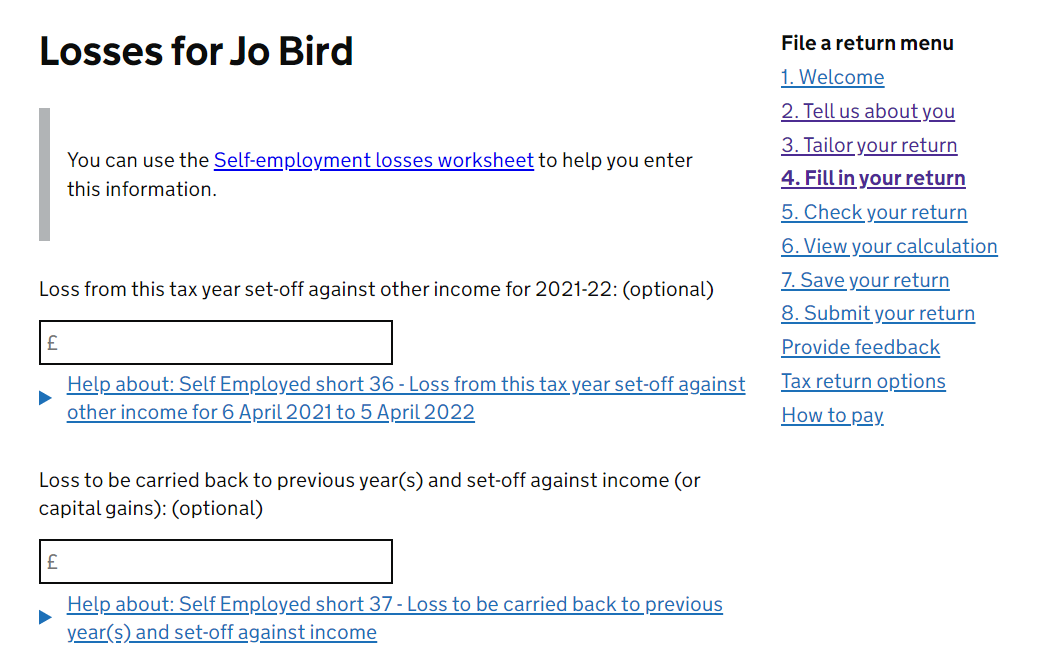

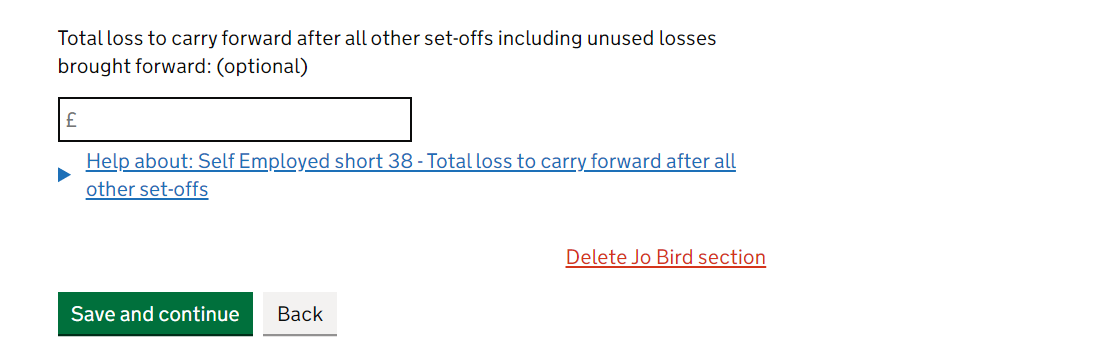

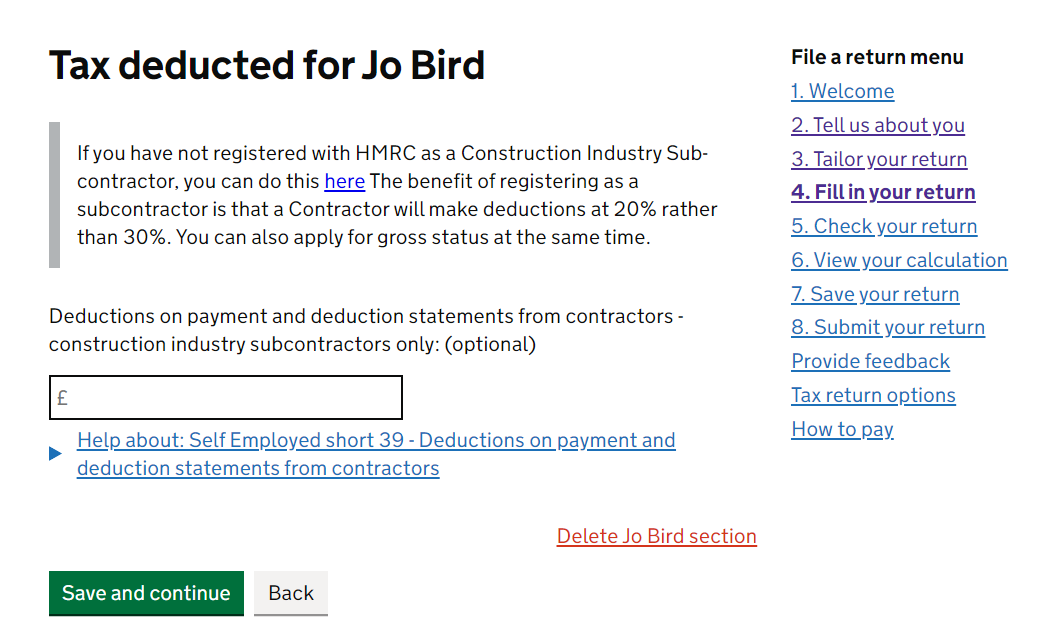

Still relating to SELF-EMPLOYED work only - the next 4 pages (see screenshots below) don't really apply to us unless you've received the Self-Employment Income Support Grant (see big red box). If you're only source of SELF-EMPLOYED income is performance and other self-employed side jobs you'll be the same as me and can leave the boxes blank and click the Save and continue button. However, it's always worth reading them yourself to be sure.

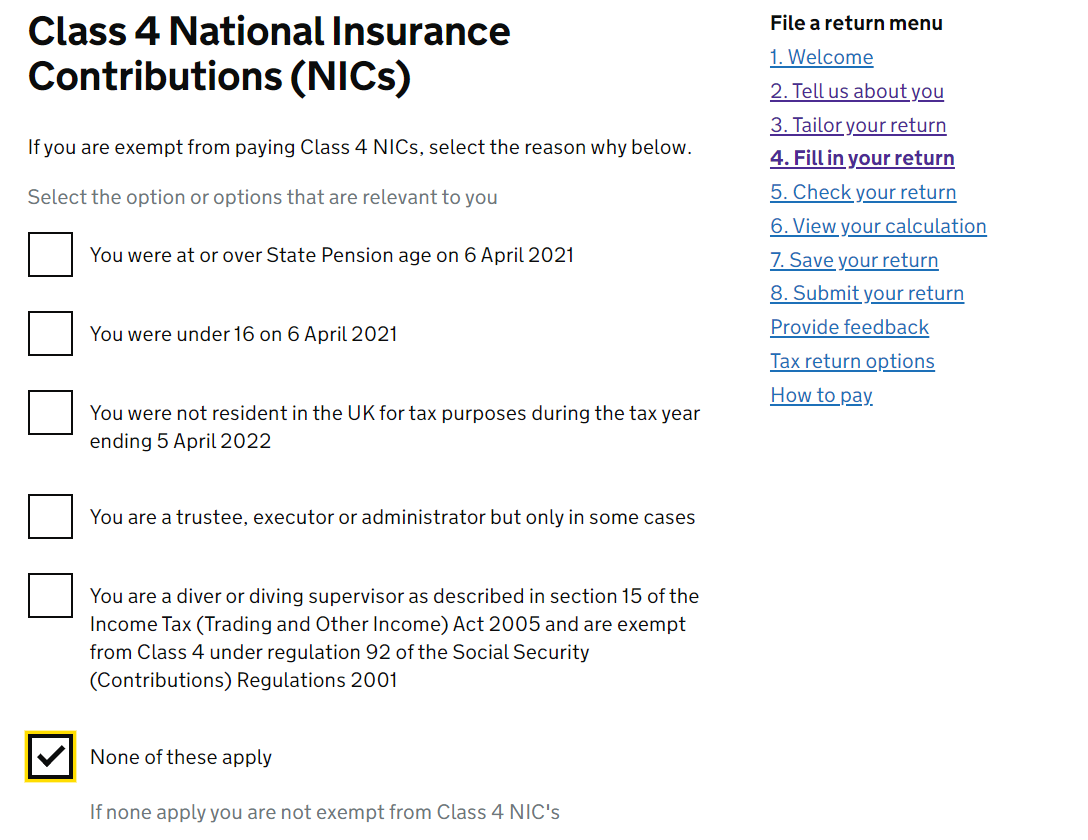

That's the end of inputting income!! The next page is about Class 4 NICs (ie. National Insurance Contributions) - a tax paid as a percentage of your profits for the year. You only have to pay Class 4 NIC if your profits (income minus expenses) are over a certain amount - currently £9,568. Moving on, it's probably a No to the question 'Are you exempt from paying Class 4 NICs?' The page gives you the 5 reasons why you may be exempt. Give these a read and see if they apply - probably not! The only one which may apply to us performers is if you've been working abroad and are NOT considered a resident of the UK for tax purposes for that tax year.

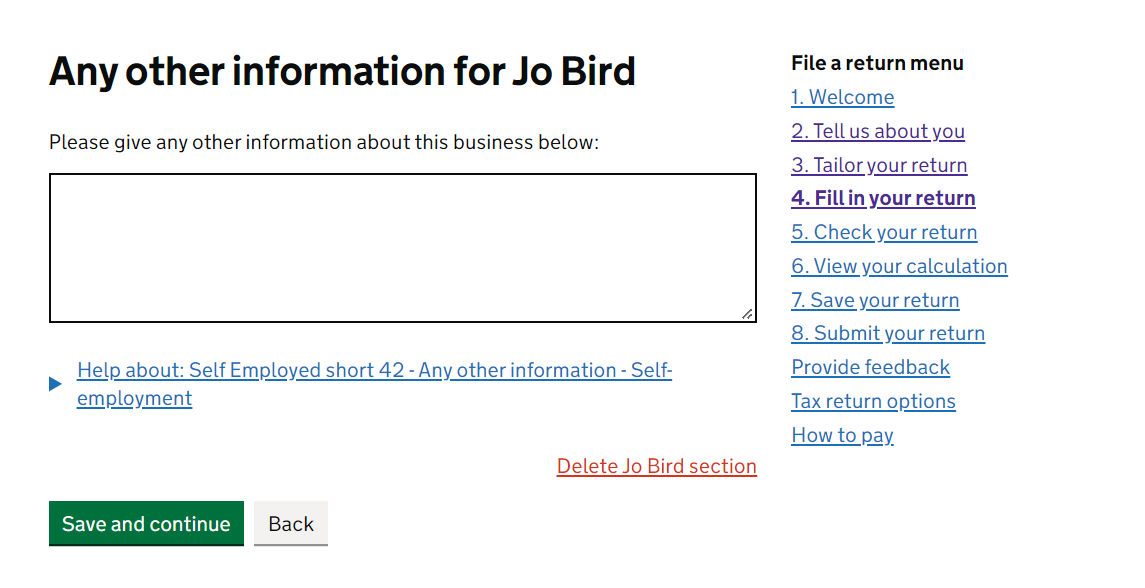

Okay team, we're so close to completion now. We've nearly finished stage 4 and stages 5-8 are just for clicking through! Next page is more 'additional information' - again, we never put anything in here so unless you're bursting to tell HMRC something, leave blank….and Save and continue.

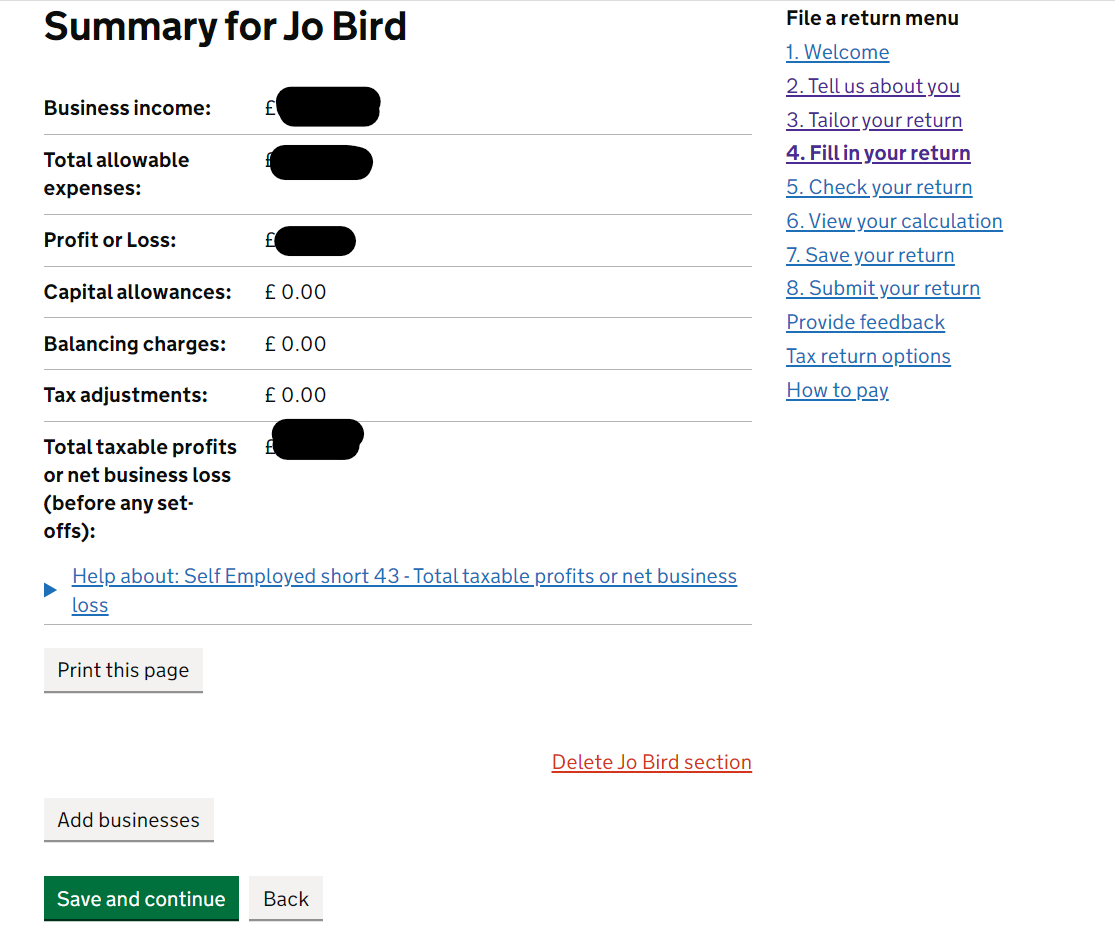

If you have more than one self-employed business, you need to go through the self-employed pages again for the other(s). Click here and go back to to the instructions for this. If not, enjoy this little summary page where you literally don't have to do anything! Winning! Just click Save and continue. Maybe you can check out your profits first….

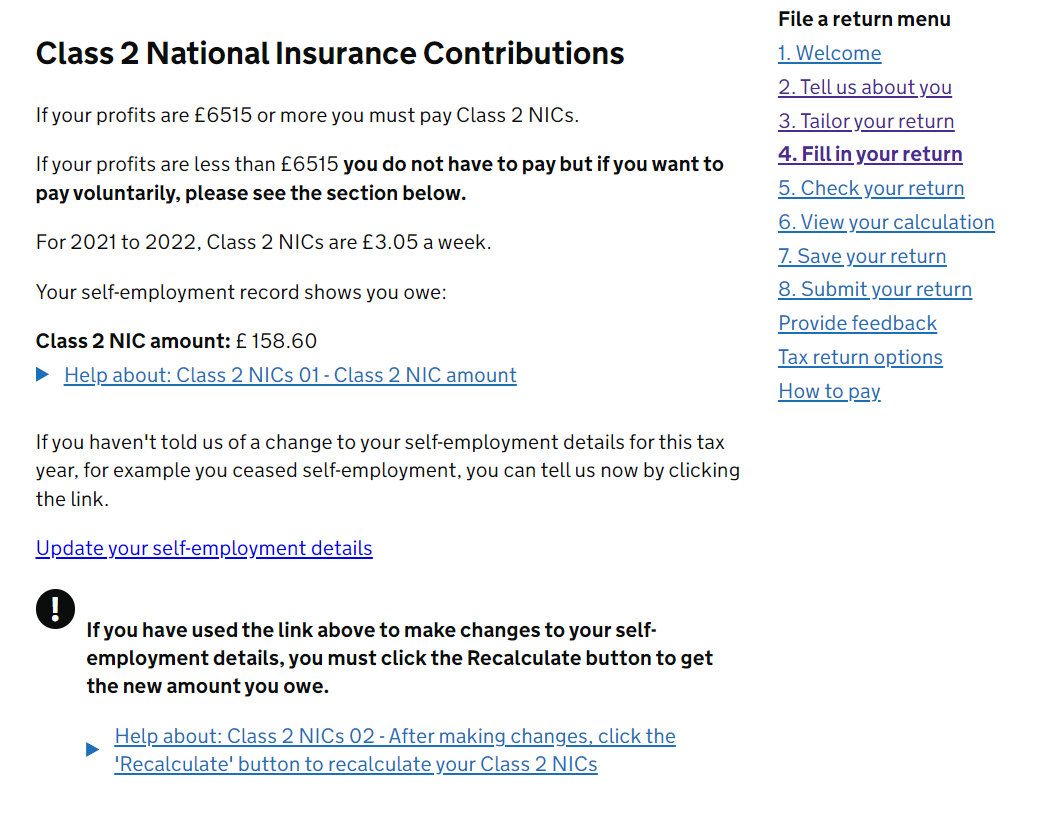

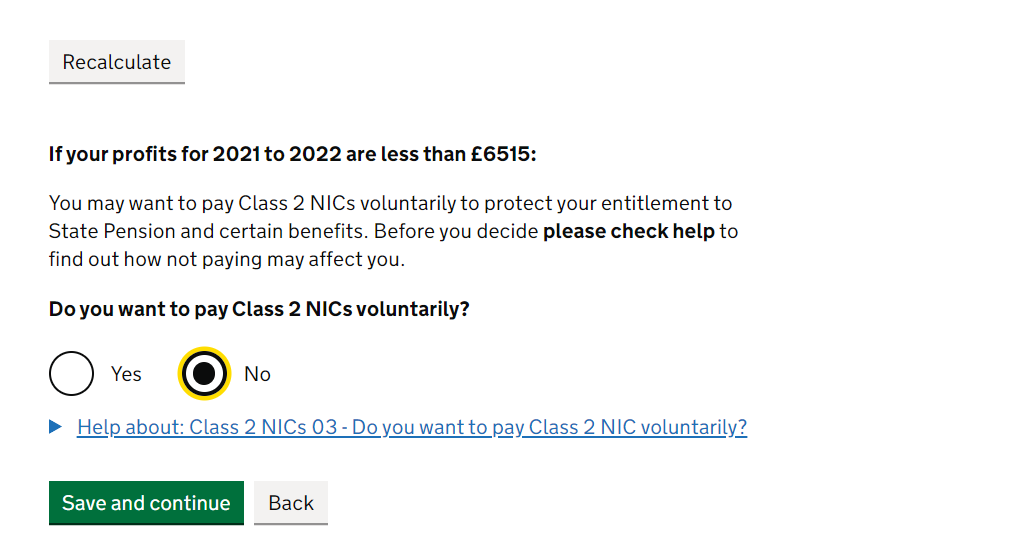

We've covered Class 4 NICs. Up next is Class 2 NICs which is similar, but instead of paying a percentage of your profit, you pay £3.05 for each week that you are self-employed. Like Class 4 NICs, if you earn under a certain amount (£6,515 for 2021/22), you don't have to pay this but on this page (see screenshot), you're given the option to pay NICs voluntarily even if your profit is below the threshold. 'What?! Why would I do that?!!?' I hear you ask… well, paying this impacts your eligibility to receive certain benefits including your statutory pension (the one from the government). Frankly, it would be a bit of a bore to explain this in detail right now, but this site gives a pretty good summary for why you may want to contibute voluntarily: Low Incomes Tax Reform Group: What National Insurance do I pay if I am self-employed?

Our view is, if you can afford it, then do it. But, obviously don't go hungry - prioritise food (biscuits) over this contribution! If you have earned over the threshold, HMRC will work out the amount you owe (like in screenshot below) and display it here. No choice for you I'm afraid!

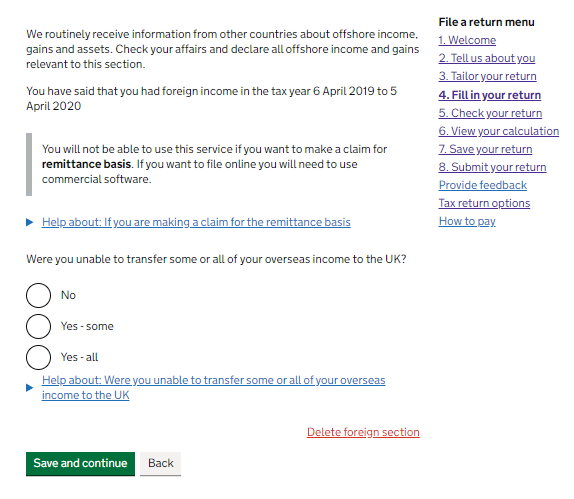

If you paid tax on foreign income, include this income within employed/self-employed as relevent and then you should have selected 'Yes' for 'If you received foreign income, do you need to complete the foreign section?'. If you did then you will see the below page. This is just letting HMRC know how much of your foreign income you managed to bring back into the UK.

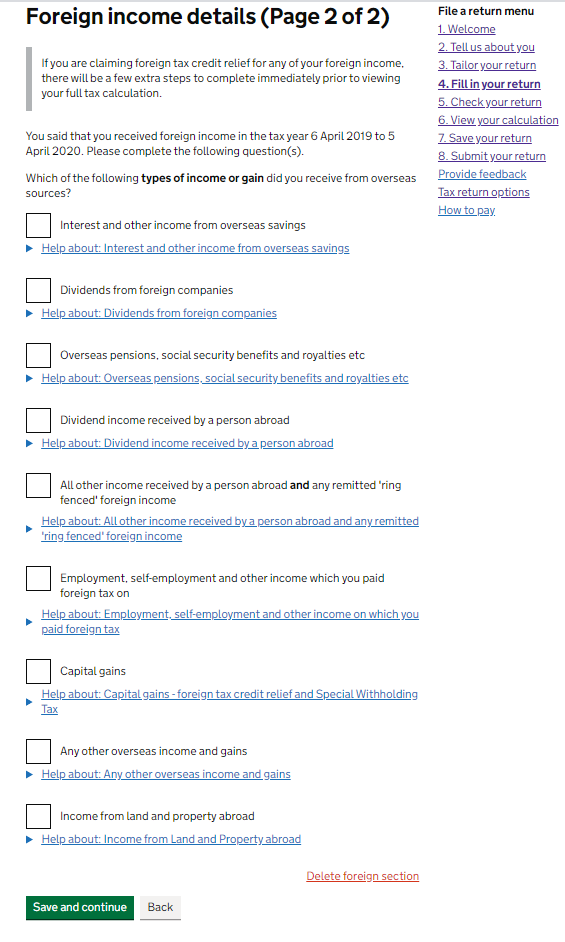

On the next page, tick in the box for 'Employment, self-employment and other income which you paid foreign tax on'. This is to claim the Foreign Tax Credit Relief (FTCR).

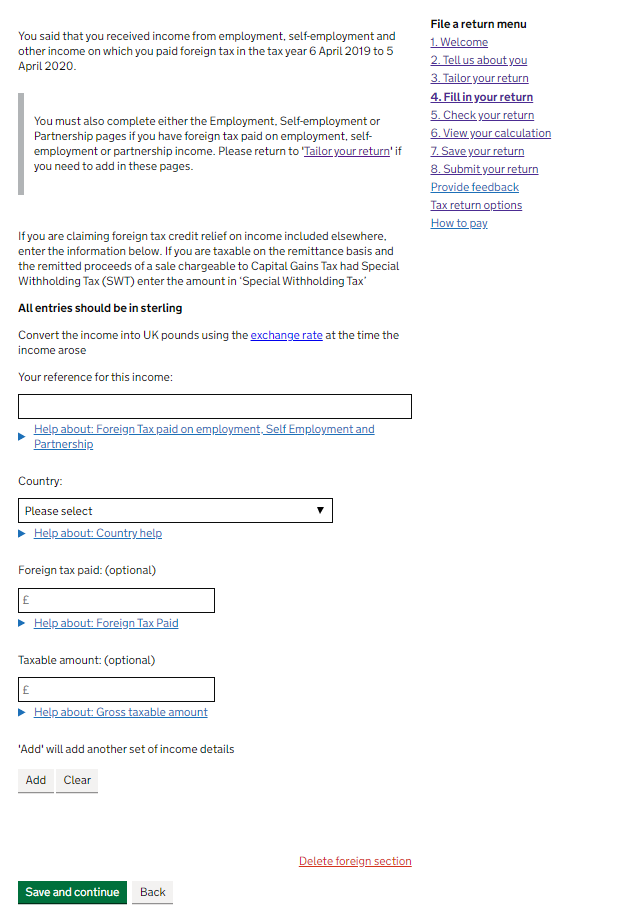

Final page, fill out the boxes. First one is just a name to help you identify what it relates to (e.g. Germany tour), then select the country you paid tax in, the amount you paid in tax while there and the amount you were paid (that you included in employed/self-employed income). Not that you need to convert both of these numbers into GBP (£) before entering into here. This should be the amount you remitted (which just means what it was in GBP when it went into your bank account) or you should convert it on the day you got paid. We have made a tool within our Foreign Income post to help you convert these amounts. You can get foreign tax credit relief for the lower of the tax you paid or the equivalent UK tax on that income.

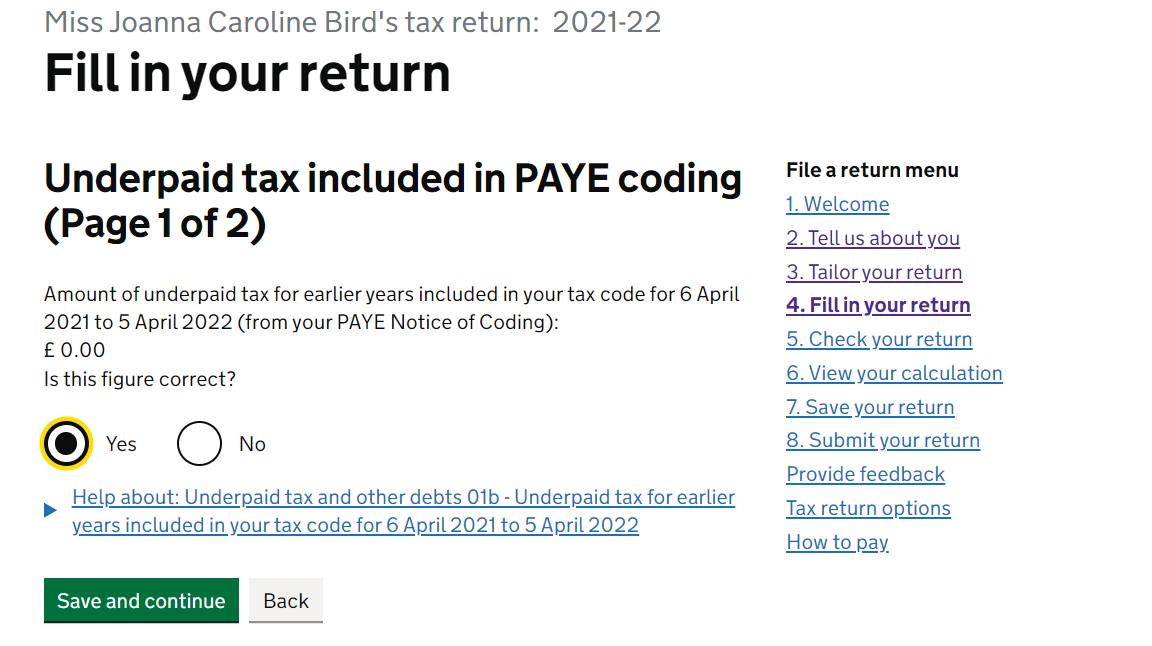

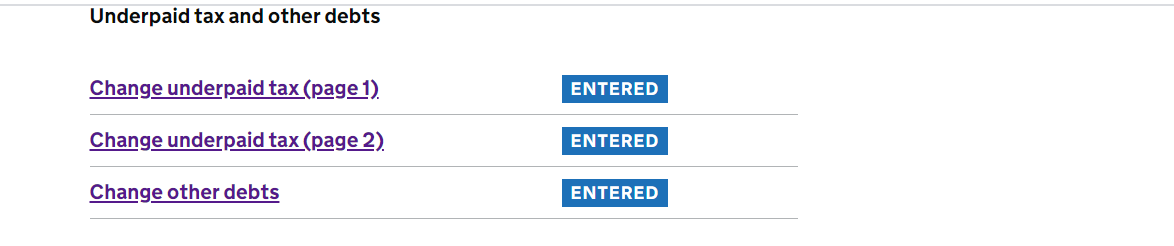

The next page tells you if HMRC thinks you have underpaid tax in

previous tax years, that you still owe them for. This happens when you

try to use your tax code to pay tax you owed in previous tax years,

but haven't earned enough through employed work to cover the balance.

HMRC probably has this right, so you can say 'Yes' unless you are sure

they have it wrong. Note: if you have only ever done self-employed

work or have always paid any tax you owed, you'd expect to see £0.00

here. Sip your tea and click Save and continue.

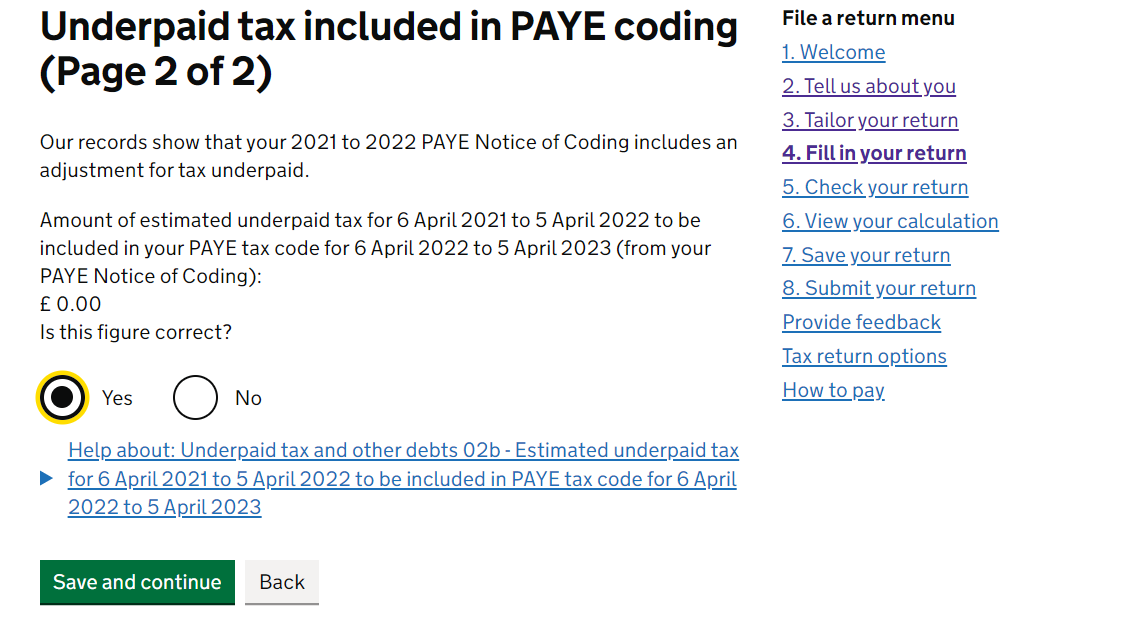

Literally the same but for the tax year you are currently completing. Again, HMRC is pretty good at getting this right, so click 'Yes', gulp your tea and then click Save and continue.

Unless you know otherwise, it's probably the same again… pop a zero in the box and finish the bloomin' tea. Click Save and continue.

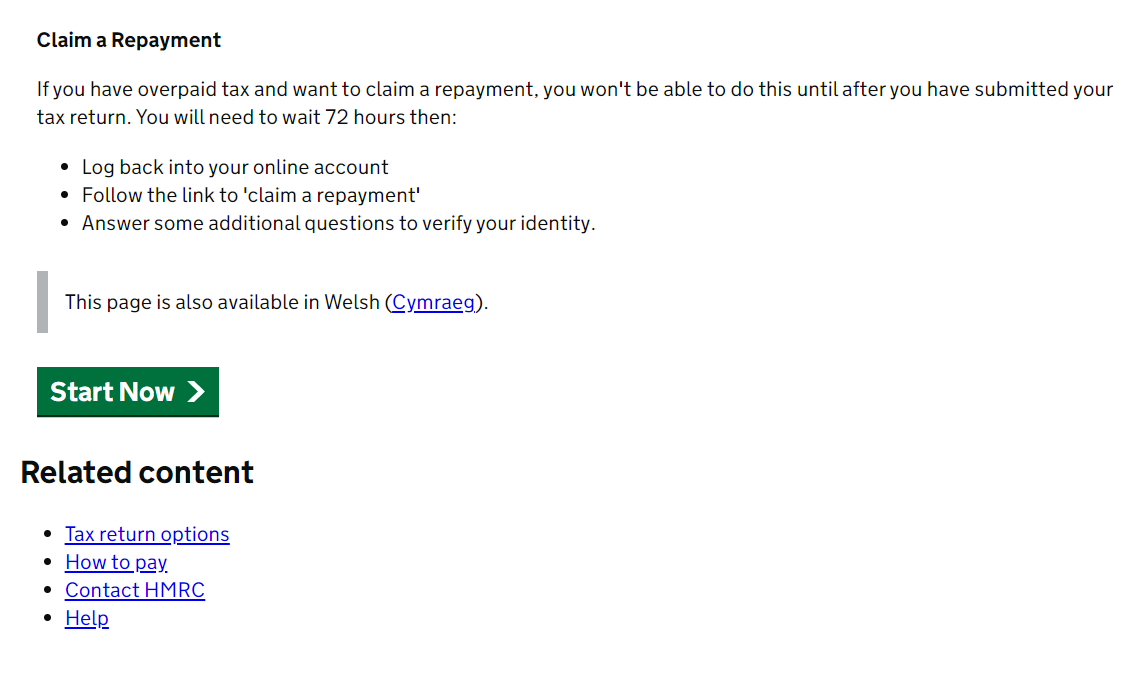

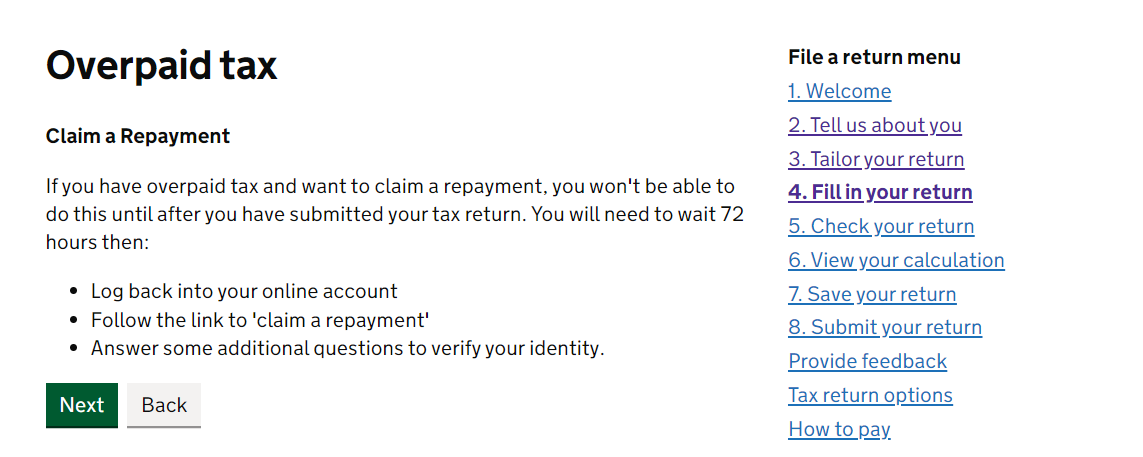

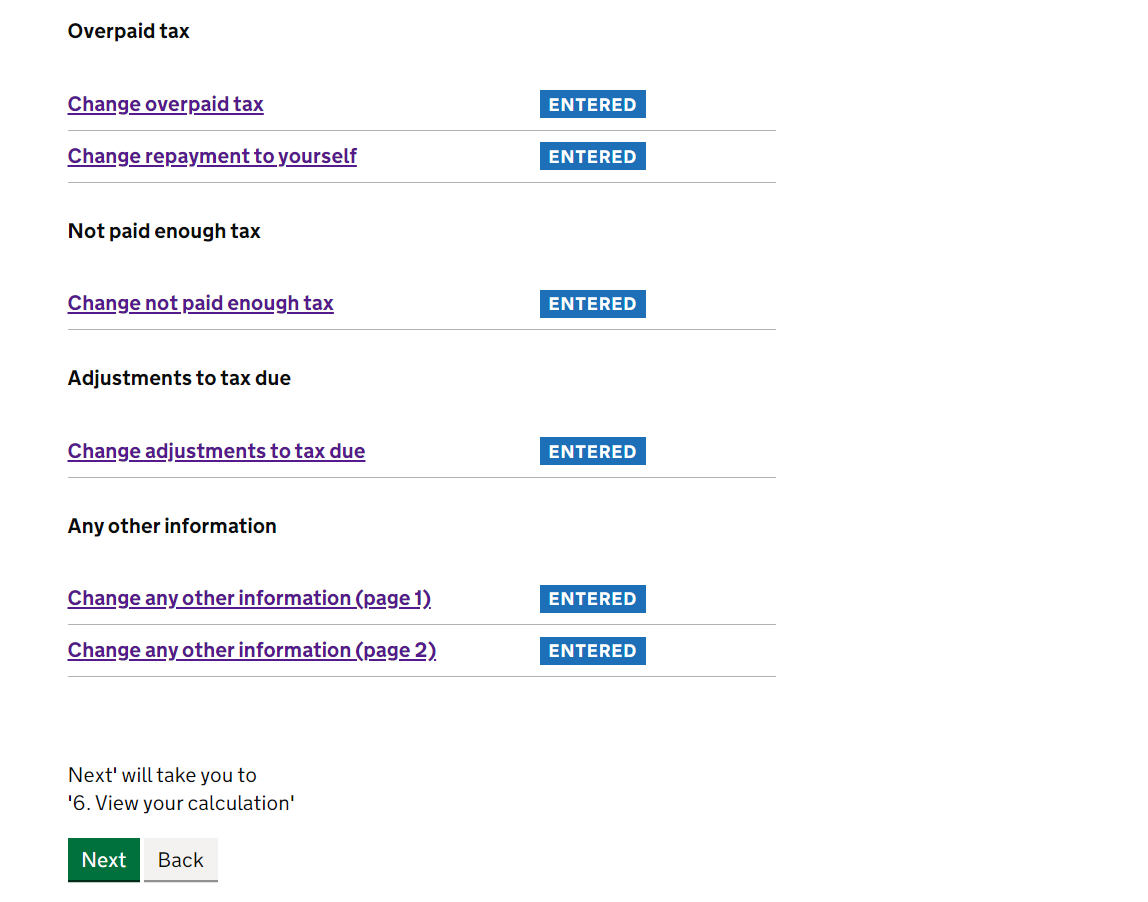

You've heard of a 'tax rebate' right!? You'll get your full calculation later on but if you've overpaid on tax throughout the year, here's your opportunity to make sure you'll be getting it back! Just make sure you select Yourself on this page (see below)... unless you want to give it to someone else? Donations are always welcome towards our biscuit tin… just saying...

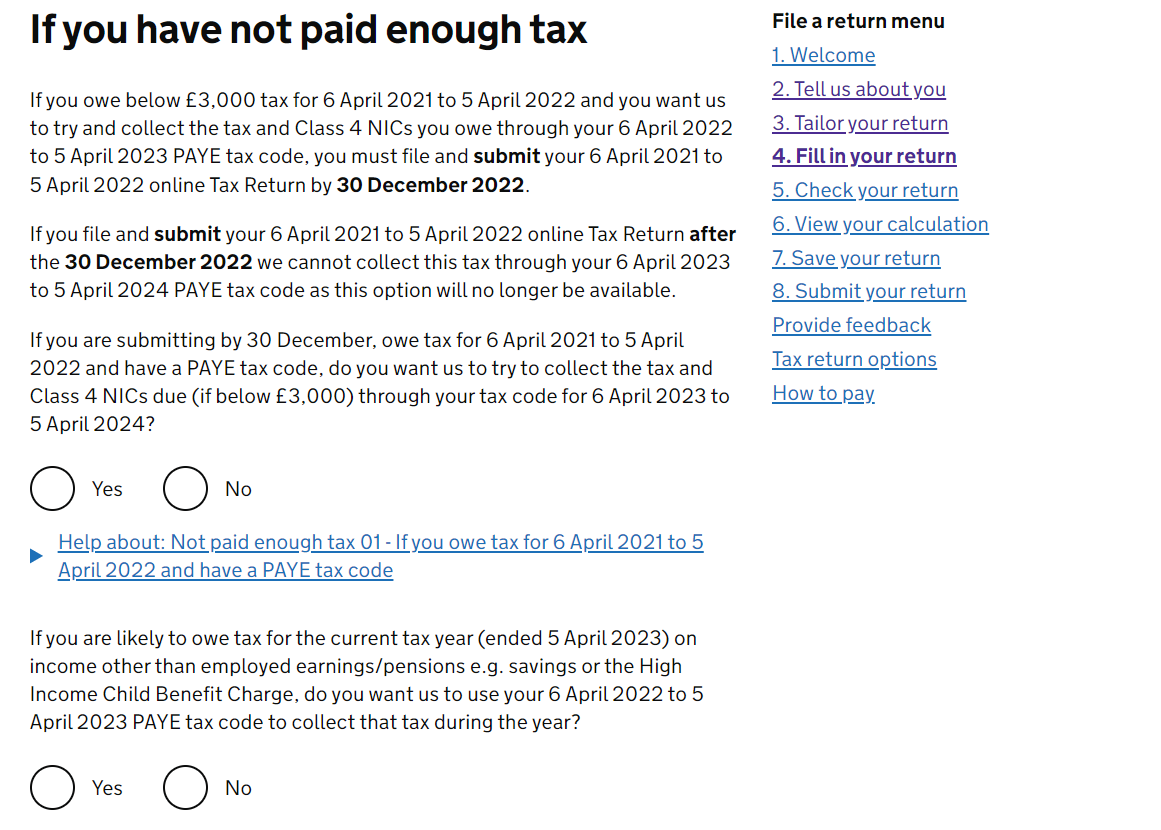

The next page deals with underpayment of tax. To the first question, HMRC are asking if you want to pay any tax you may now or if you would prefer to have it taken out throughout the next tax year via your employed job - they'll do this by changing your 'tax code'. If you are going to be employed this next tax year, it makes sense to select 'Yes' here. If you're NOT going to be doing employed work for the next tax year, select 'No'. The second question relates to additional income you are expecting in the next year that you want to build into your tax code - it's a bit niche, so if you are unsure, just select 'No' for this. Save and continue.

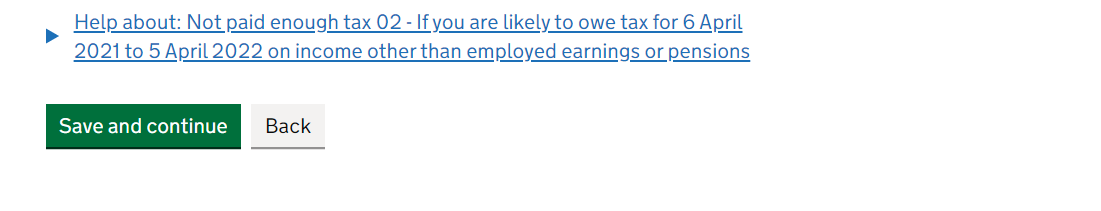

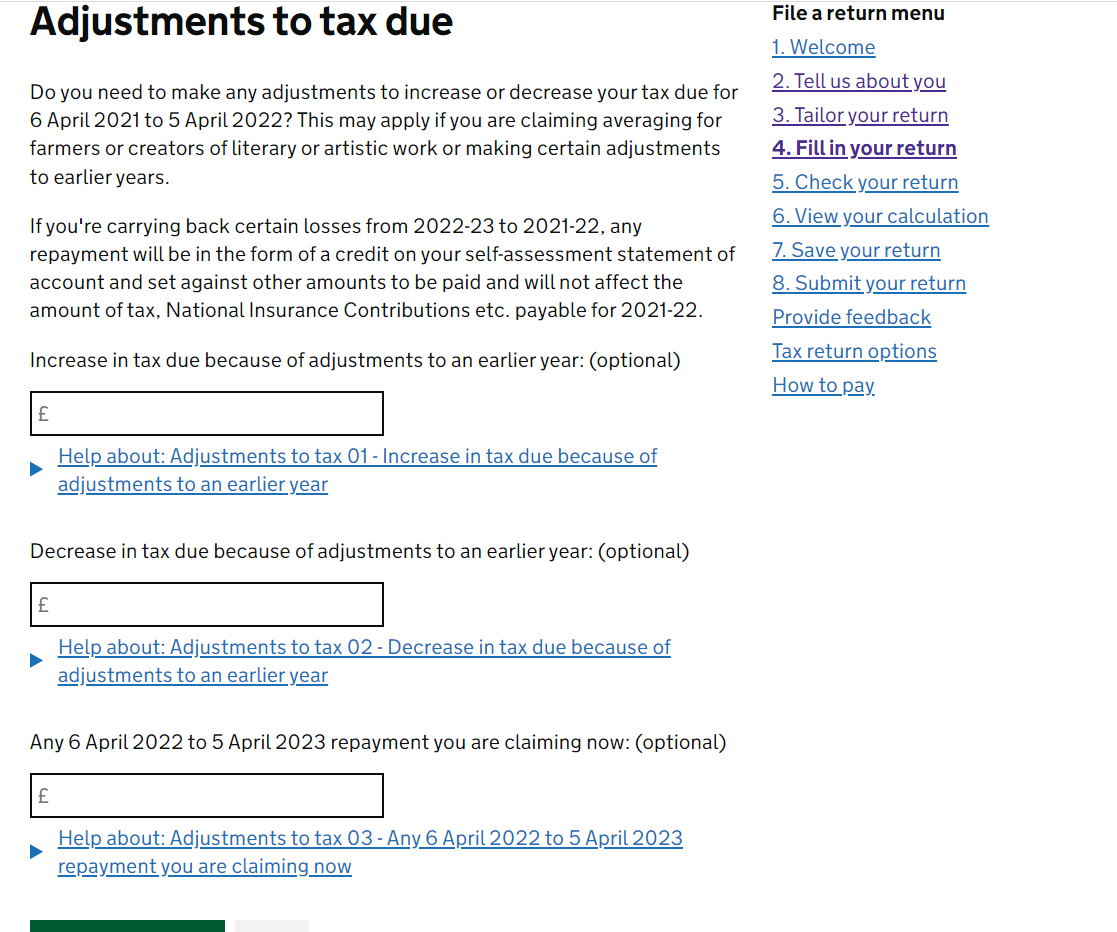

This is another page you can probably leave blank (unless you know of a specific reason why not) and just click Save and continue.

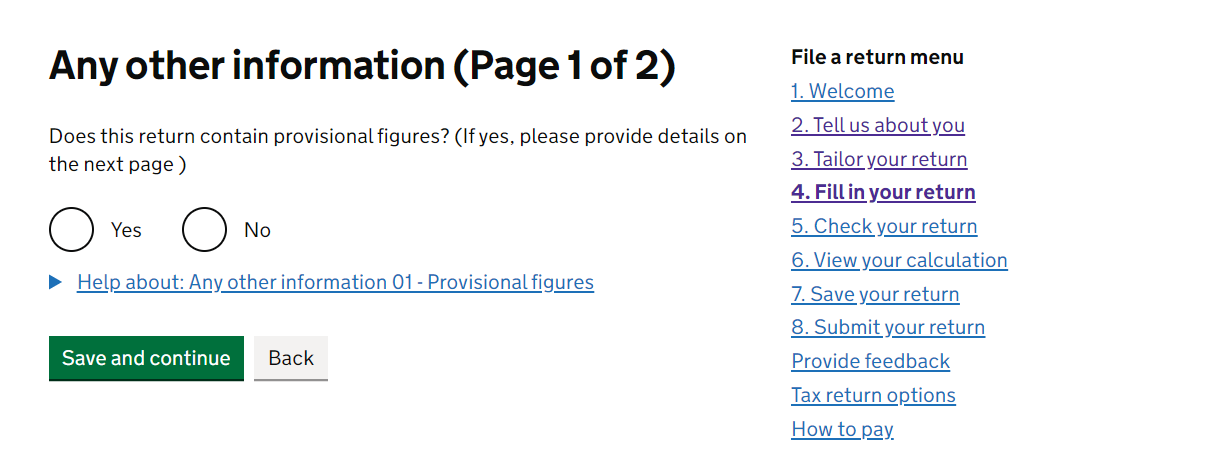

This Any other information (Page 1 of 2) page asks whether any of your numbers are provisional or estimated. Since we work on a 'cash basis', provisional seems unlikely. Technically, you may have estimated your interest received, but likely you can just say 'No' here and click Save and continue.

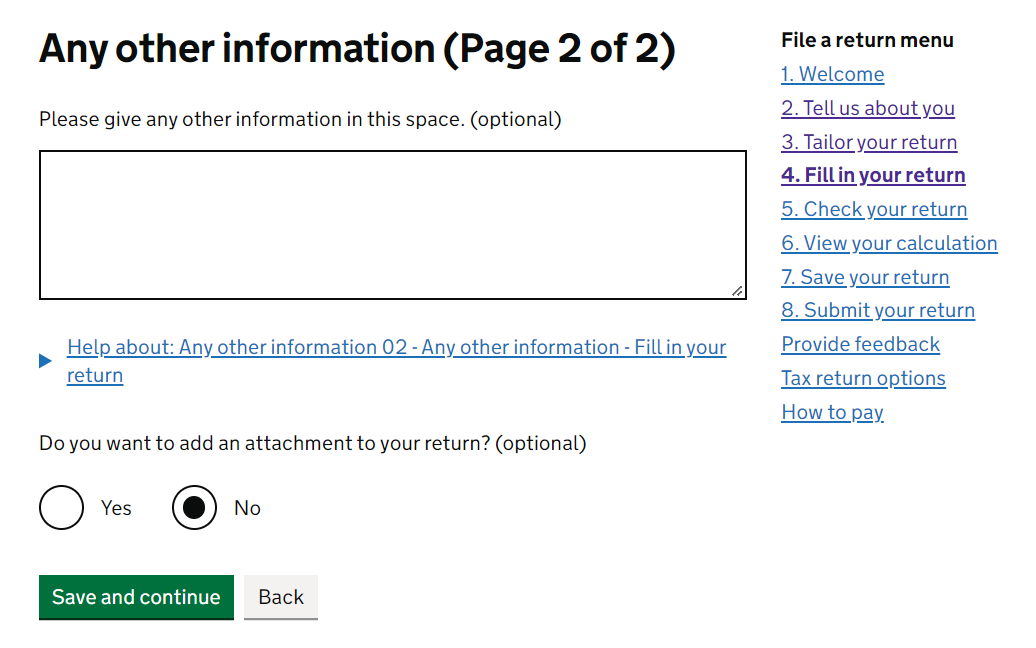

Another 'any other info' type page to finish this section - we expect you'll want to leave the box blank and select 'No' in the drop down. Save and continue.

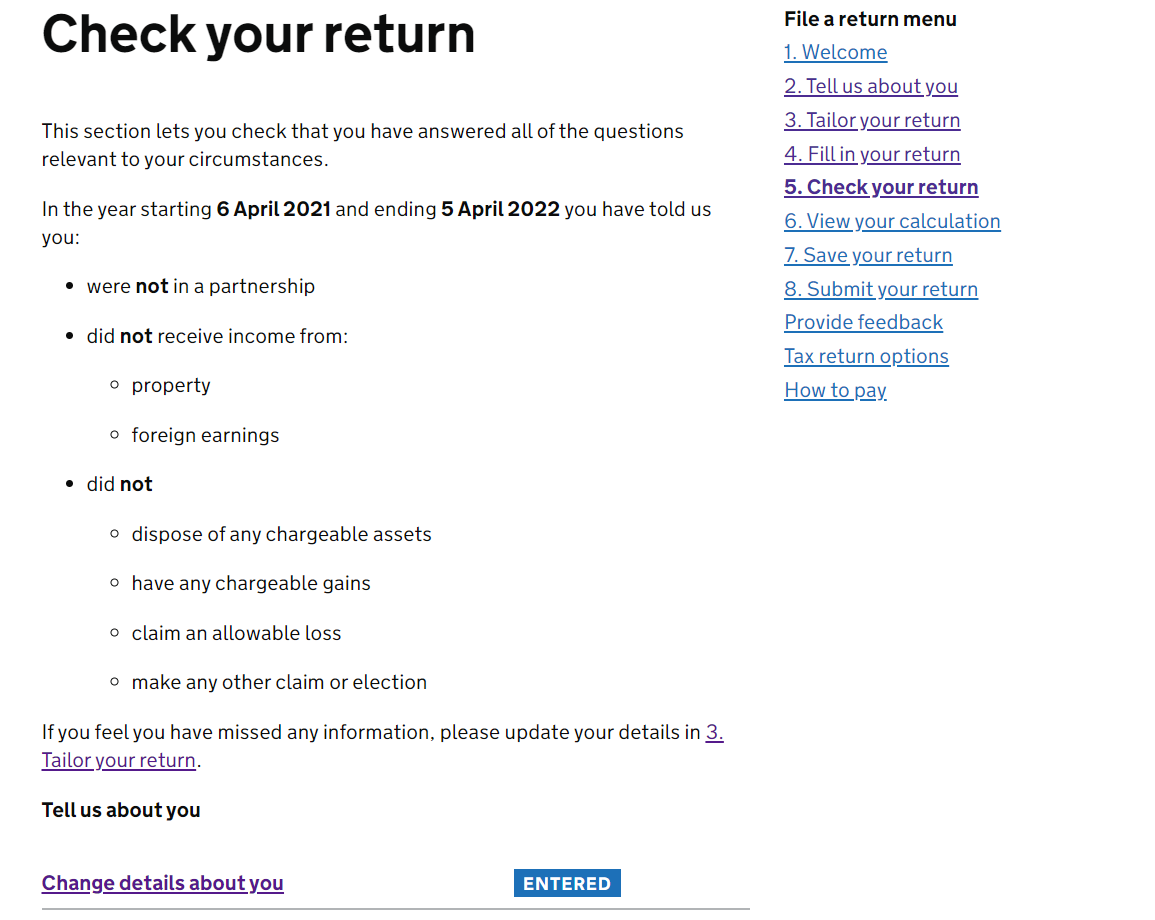

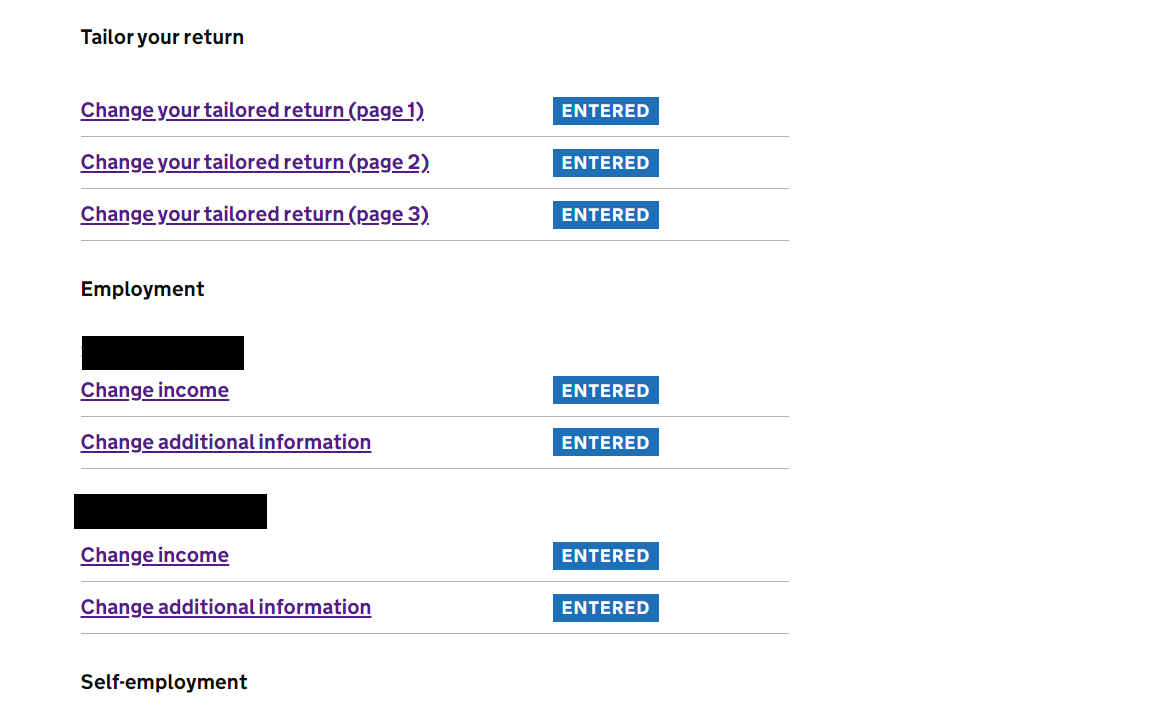

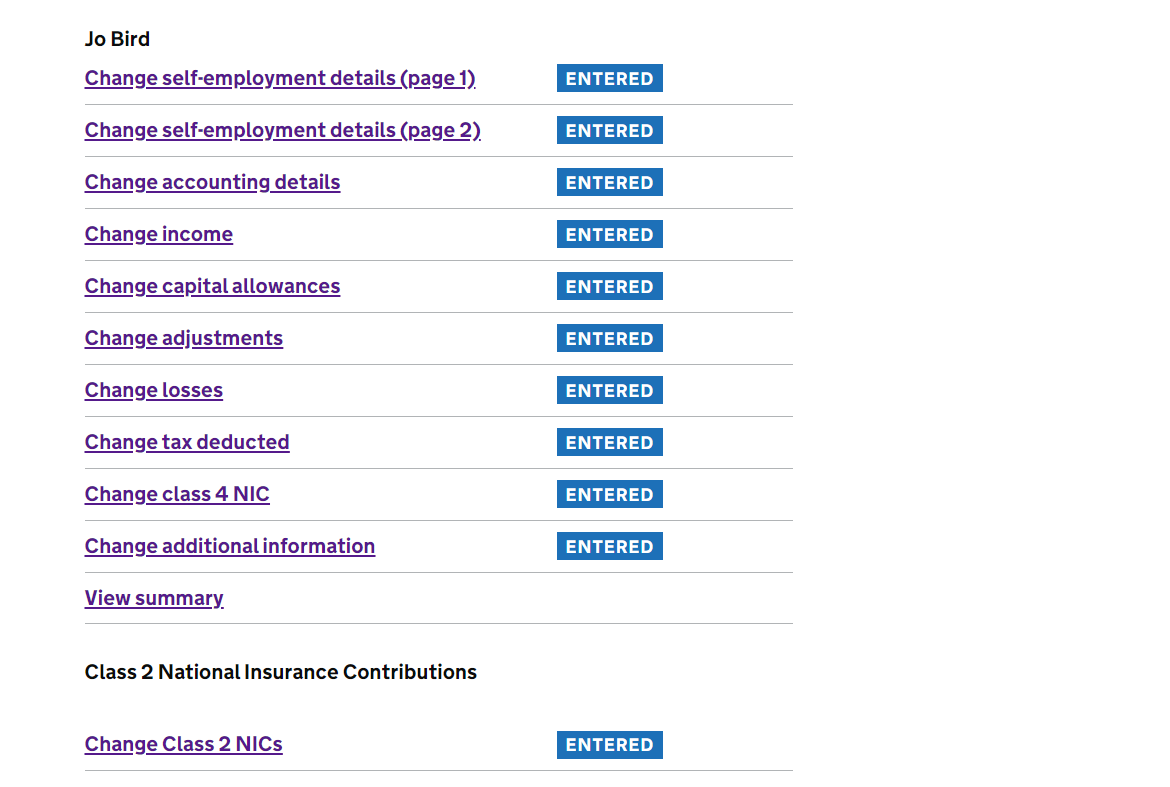

5. Check your return

Success! Recognise this summary page? Run down it and make sure you've got a lovely line blue 'ENTERED' boxes, then click on. Most importantly!! Check that the statements at the top are correct - if that's wrong then you won't have been given the right boxes to fill out in your return.

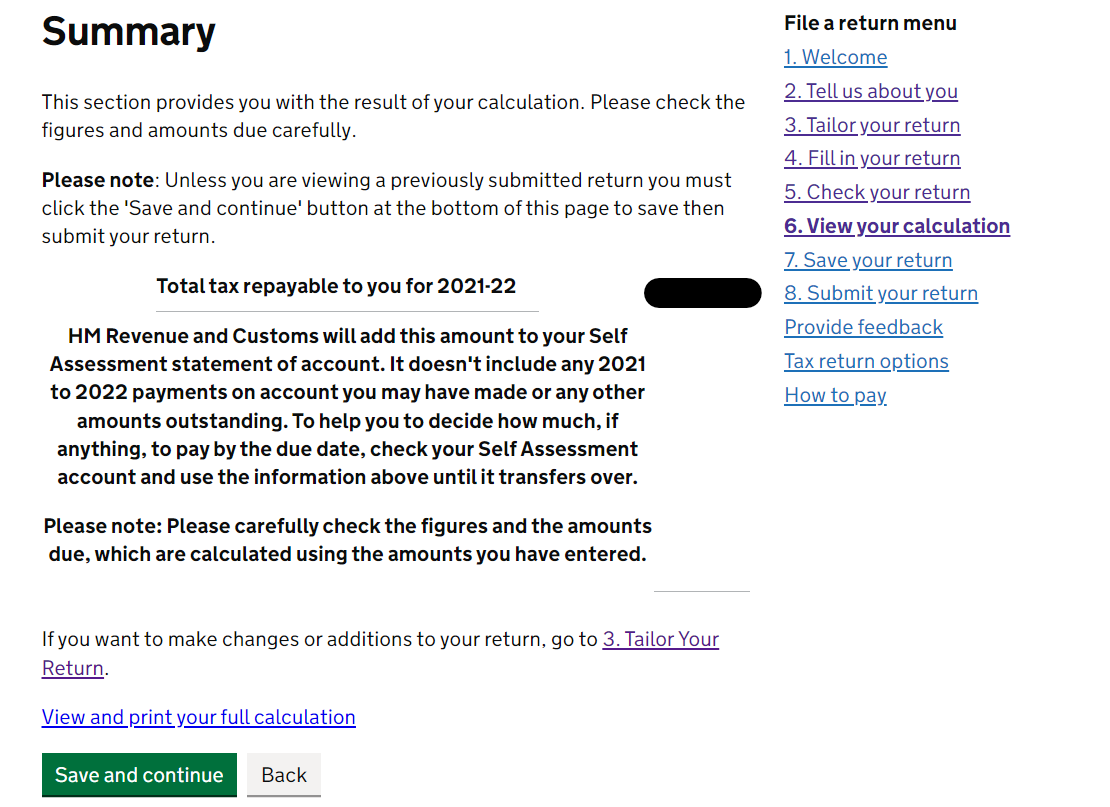

6. View your calculation

If you owe tax, the next screen will ask whether you want to claim a reduction in 'payments on account'. Basically, if you owe tax, HMRC wants you to pay throughout the year next year. If you expect to have a similar year next year, probably not a bad thing to do this as it stops you getting 1 BIG tax bill at the end of the year.

Time to find out whether you are owed a tax rebate OR if you owe tax to HMRC. Fingers crossed for a rebate! You can download your full return using the 'View and print your full calculation' link (you should do this anyway to keep a copy for your records), then click Save and continue...

...and see a full breakdown summary of the calculation of your tax situation. Now, If any of these numbers look odd, you may need to go back to the relevant bit of your tax return and update. Again, there is a 'Print your full calculation' button at the bottom before you click on.

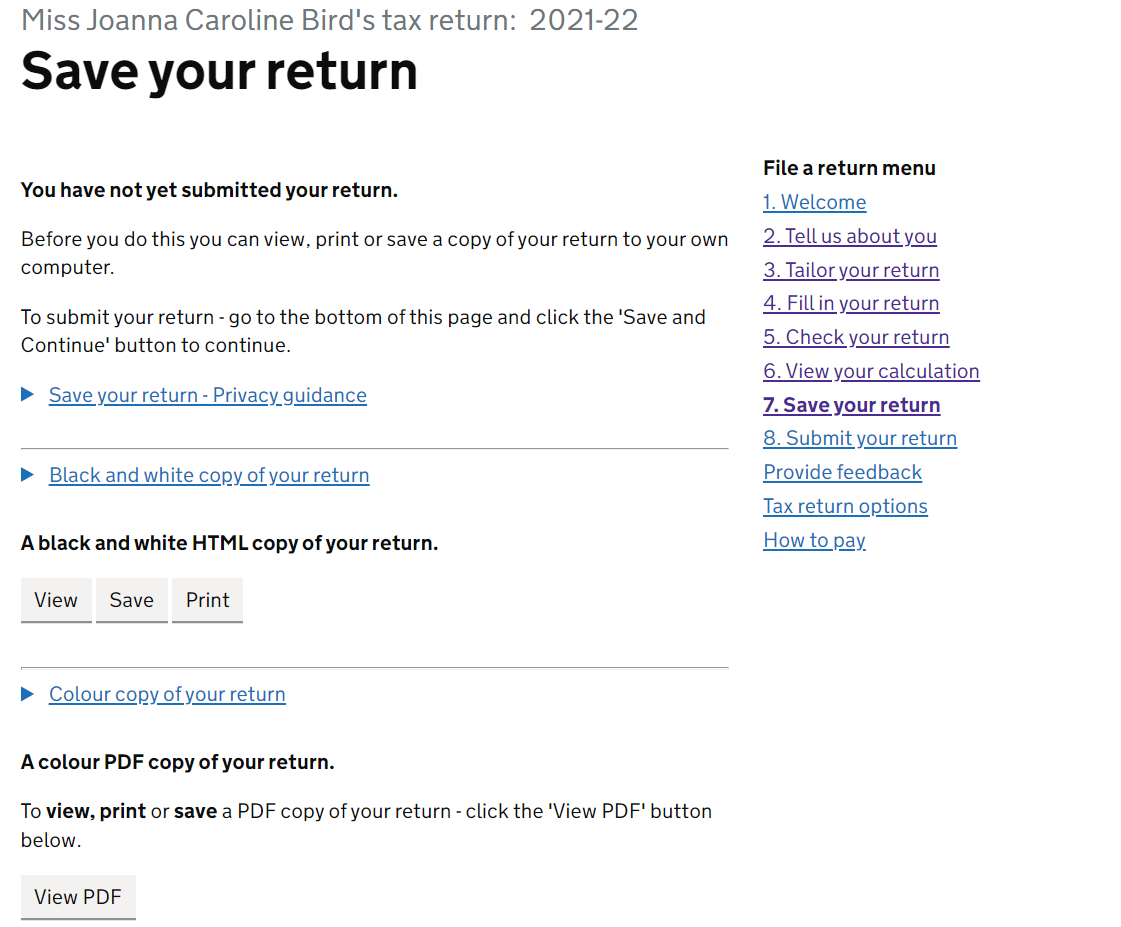

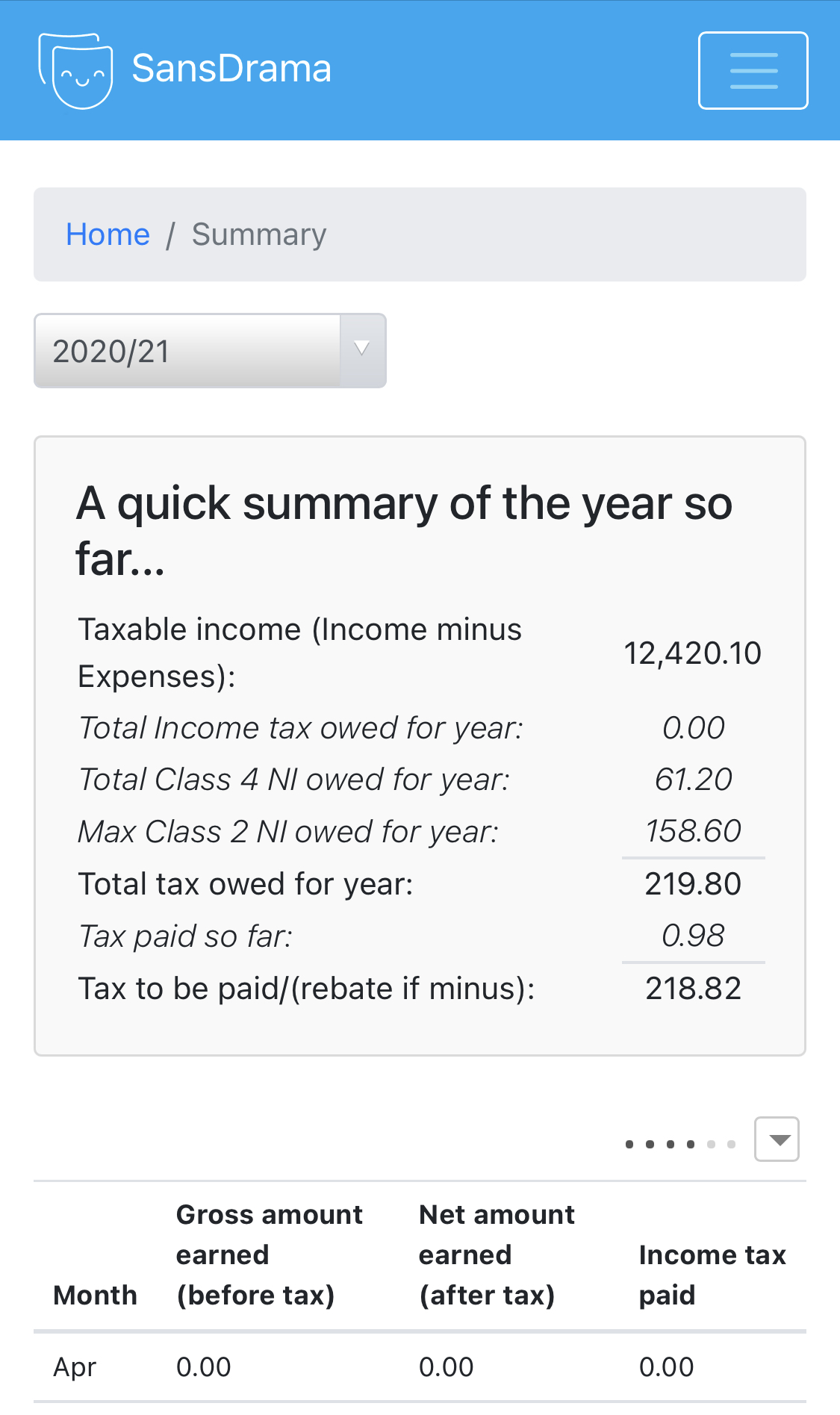

7. Save Your Return

Get yourself a copy of your return saved down. Always good to keep the records safe!

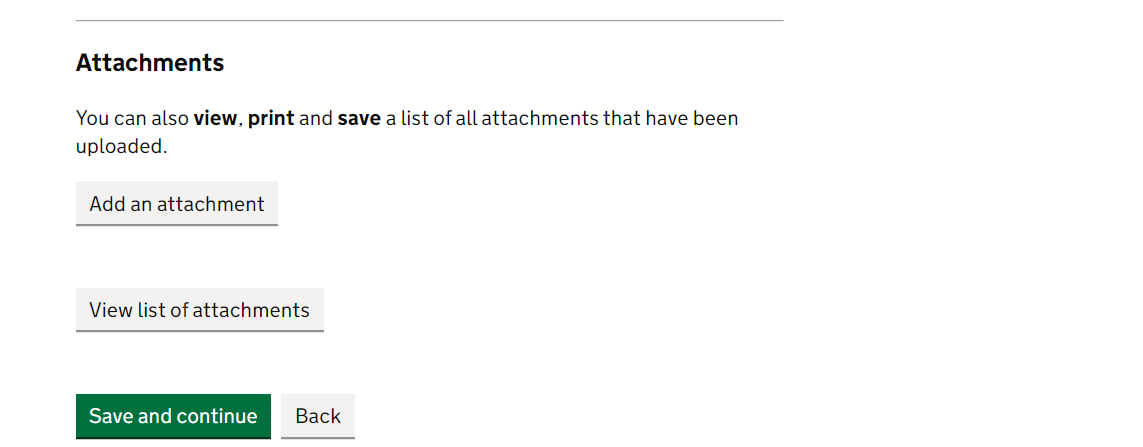

It's always easy to say this in hindsight, but if you are getting a nasty shock at this stage, have a think about how you are keeping track of your finances/tax and national insurance situation throughout the year. Use any method you want, if it works for you, great. We are shameless advocates of the SansDrama Web App - we've specifically added the function to see how your tax situation is going at any point in the year. Then you're ahead of the game and, if necessary, you can set aside any cash you might need to pay your tax and national insurance bills next time round. Little screenshot example below for you…

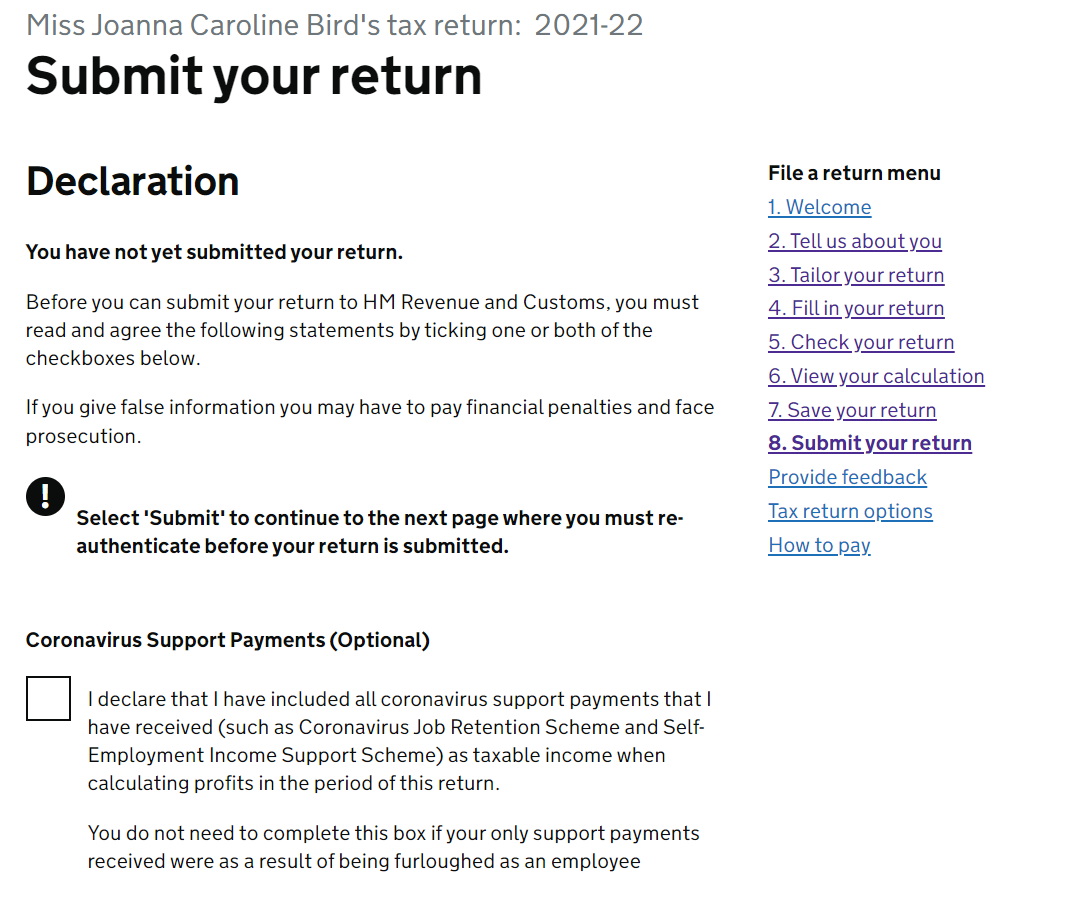

8. Submit your Return

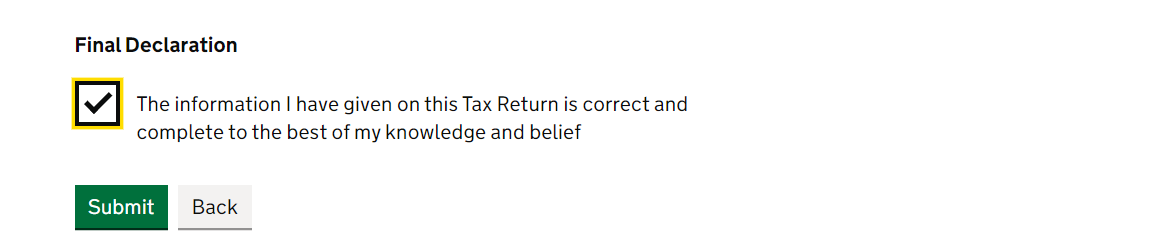

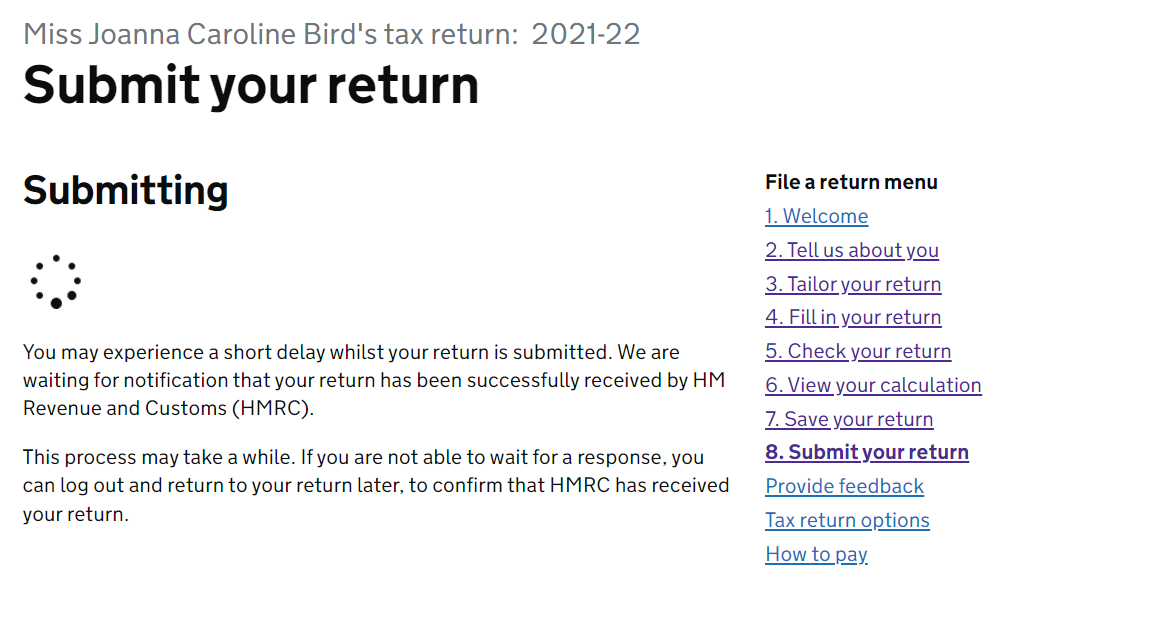

Finally!! You'll see this page (below) that has all the information you're submitting to HMRC and it asks you to confirm that everything you have supplied is 'correct and complete to the best of my knowledge and belief'. Tick the box and *Cue rousing chorus of gospel singers* OH HAPPY DAY!! Click SUBMIT.

Not done quite yet! HMRC ask you to re-log in to submit. You've done this before, so we know you've got this :).

Remember that January 31st is the deadline for paying your tax and national insurance bill as well as completing your self-assessment. To pay, go to your 'Business Tax Summary' page and you'll see the amount you owe under 'your balance' in the self-assessment section. Then click 'Make a self-assessment payment' and choose your preferred payment option.

NOW... GO, RUN, DANCE, BELT AND... give us a shout out on social media!!

SansDrama is here to help YOU and everyone else in our amazing creative community. If you've found the site helpful then you can help us to keep this site free to use forever by using the SD Web App.

Love Jo and James x