Registering as self-employed

Introduction

Introduction

No need to go all Éponine on us! You’re most certainly NOT 'On Your Own'. We’re in this together - we even brought screenshots of each step to make it easy! The best way is to open the HMRC link (below) as a tab next to this website so you can compare the screenshots below to what you’re seeing.

Typically you want to be registered before you do your first self-employed job (but don't panic if you've already started working and haven't yet registered as you've got until 4th October of the next tax year to register). A tax year runs from 6th April to 5th April the following year. But let's all be keen beans and get on top of this early on!

So.... as soon as you start working for yourself, you’re classed as whats called a 'sole trader'. Foreign language right? This is just fancy/HMRC language for saying you’re self-employed. Being self-employed you have a few responsibilities like recording your income correctly, invoicing and tax returning. To make managing these easy, we give all new theatre graduates their first tax year for FREE on the SansDrama Web App (usually £2.50/month) to get you started on the right path!

Just so you're one step ahead, this is what is going to happen once you register online... You’ll...

- Get a letter with your 10-digit Unique Taxpayer Reference (UTR)- this is your self-employed I.D. so keep it safe!

- Be enrolled for the Self Assessment online service at the same time - this is where you will register (yup another registering process) to fill out your self-assessment tax returns each tax year.

- You’ll also get a letter within 10 working days with an activation code. You’ll need this to be able to login to your account on HMRC.

RIGHT! Have your tea and biscuits at the ready. We're going to get through this process together!

Registering for a UTR

Alright, here we go: take a sip of tea and click on this link to take you to the HMRC page for registering

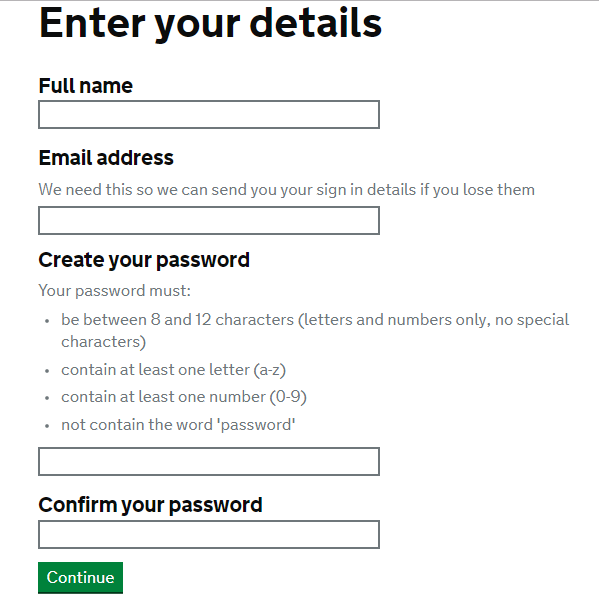

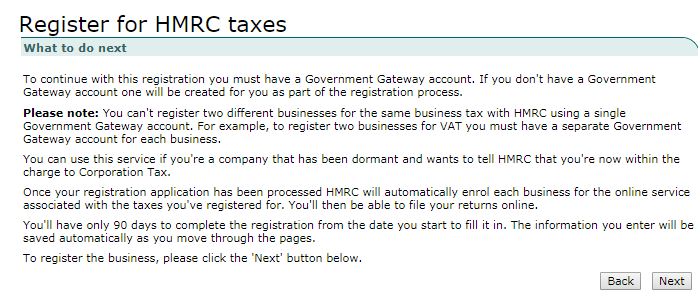

It will look like this...

Fill in the boxes and click continue! This will trigger you being emailed a 'Government Gateway User ID'. You'll also see this on the next screen to appear - no screenshot for this page. Don't worry about the weird wording, just know that you're going to need this later so make a note! Click on to the next page which should look like this...

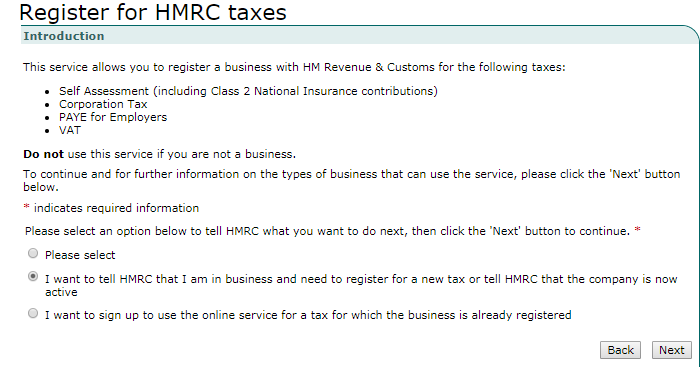

Here, you need to select the middle option as shown and then click next. You'll then see this screen...

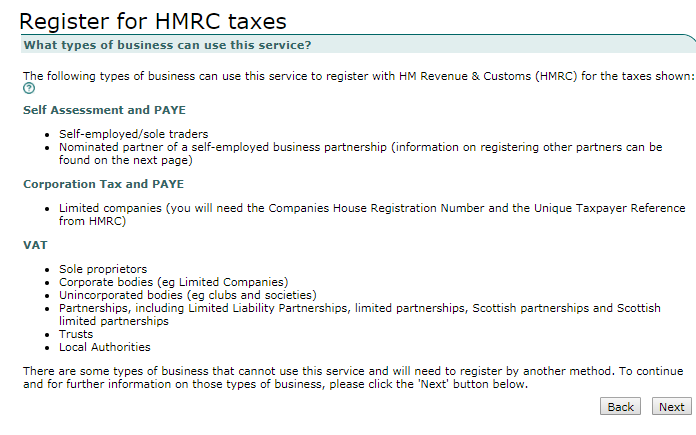

Click next! Then you should see this screen...

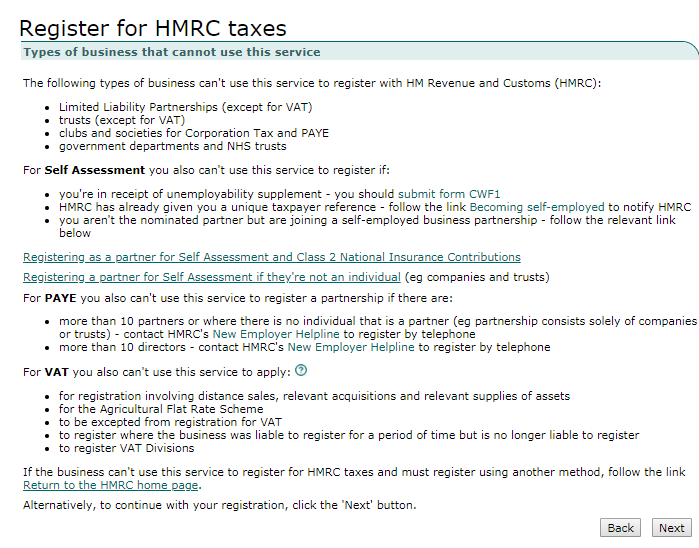

You guessed it...click next...

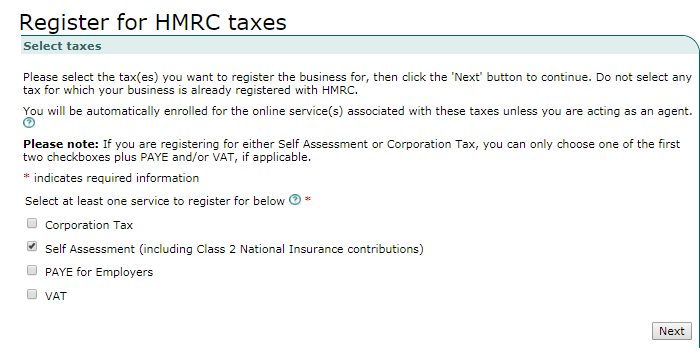

In the next screen, you tick 'Self Assessment (including Class 2 National Insurance)', as shown below. Then click next...

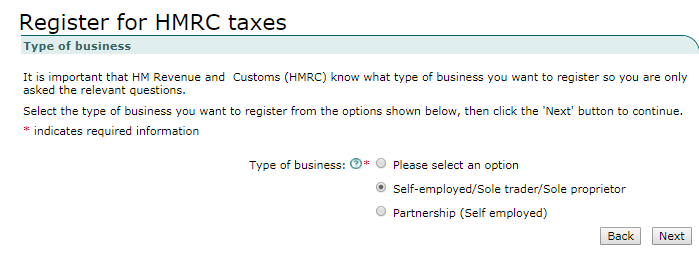

Tick 'Self-employed/Sole Trader/Sole Proprietor', then 'Next'. Maybe time for another sip of tea...

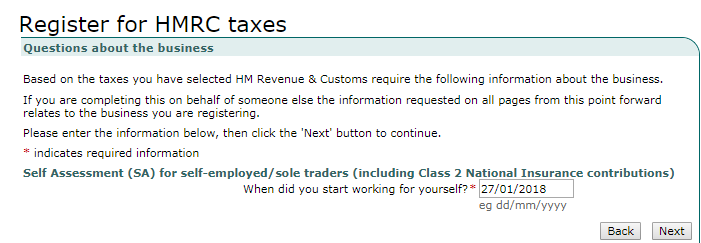

...and a biscuit, too. On the next page (see below screenshot), you need to enter the date from which you first started working as self-employed. For me (even though I hadn't started work yet), I used the date on which I was registering. So if you're doing it today - use today's date if you haven't already started working as self-employed. Next...

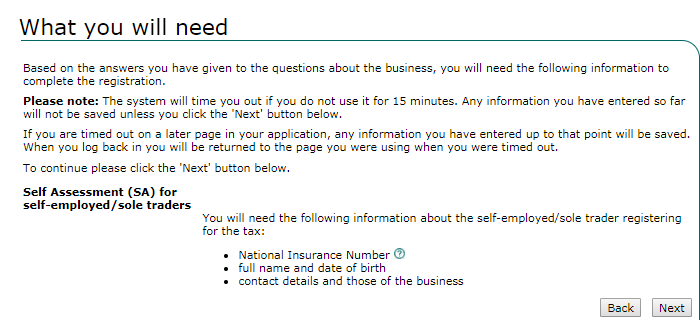

The following page tells you all the info you're going to need at hand to complete the registration process.

If you're wondering what 'contact details and those of the business' means then don't worry, the 'business information' is the same as your personal information. Next!

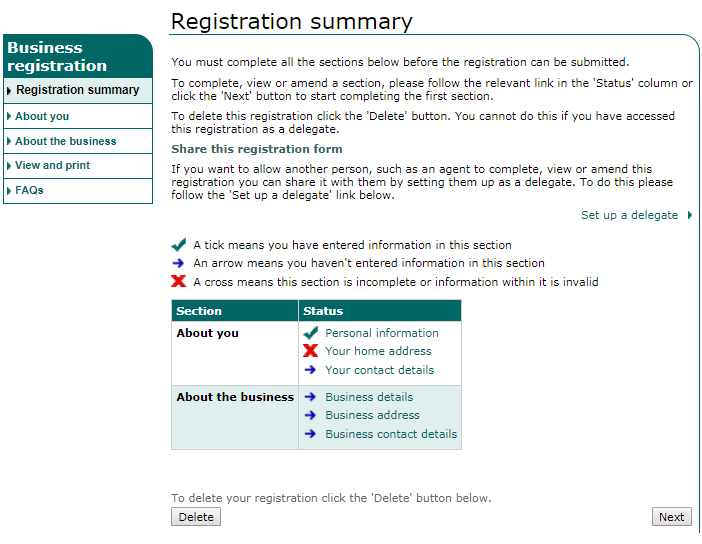

This takes you to a summary page showing the sections you need to fill in. You'll see in the below screenshot that I have completed the first section, the second section is incomplete and the other sections have not been started. Let's take them one at a time starting with 'Personal information'...

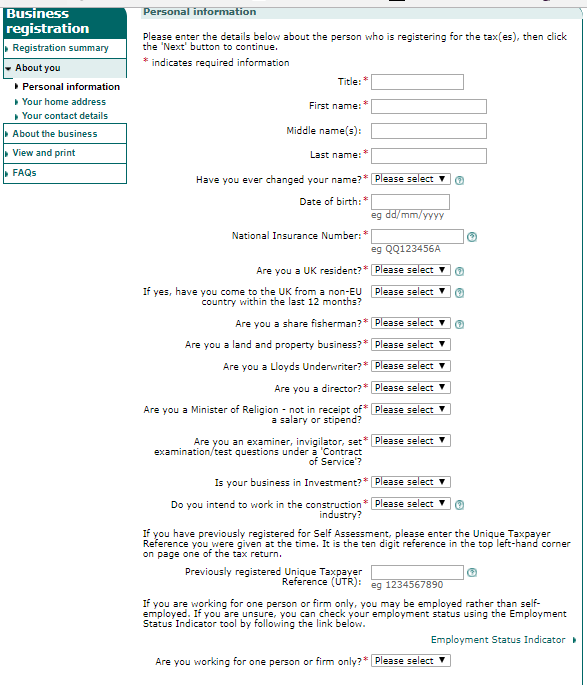

You should see (below) - Here just fill in your personal information up to and including 'Are you a UK resident?' (If you're unsure on your residency status, then check out or tax residency road trip HERE). The answers from 'Are you a share fisherman?' to 'Do you intend to work in the construction industry?' will most likely be 'no' but check this yourself too. Following that we are assuming that you have not registered before and so will leave the 'UTR' box empty. Equally, the next box asking 'Are you working for one person or firm only?' we expect to be a 'no.'

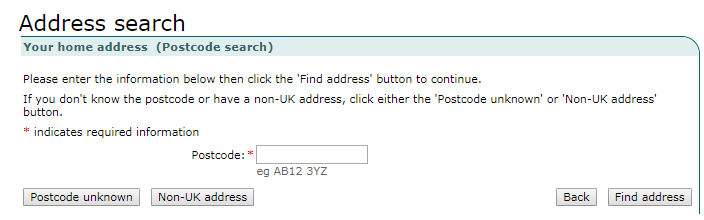

How are those biscuits going down? Grab another, you've earned it. Next... Just type in the postcode of where you would like all your 'business infomation' to be sent to and select the correct address from the drop down. Personally, I have this as my family home because I move around alot and have found this to be the easiest option.

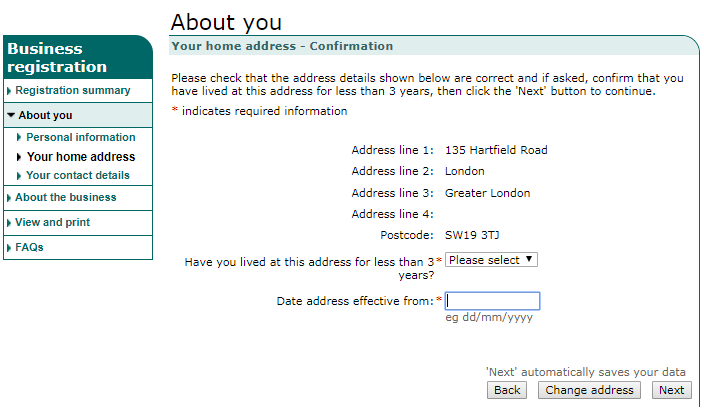

Next.... Here you confirm how long you have lived at the property. If it's less than 3 years, you'll need to tell them about your previous address to the one you have selected. Another reason why the 'family home' worked well for me.

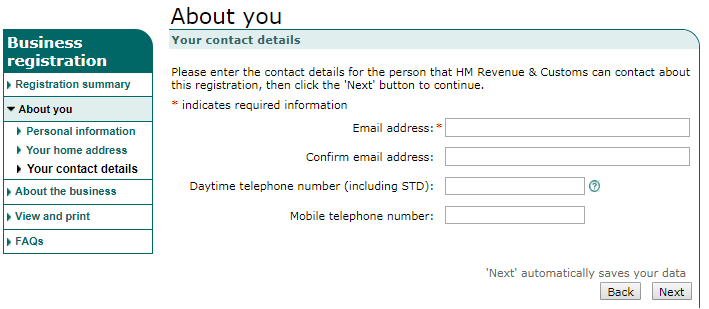

Next.... This next one is just your contact details - which you probably have covered!

We haven't added a screenshot of the next page as it is a summary of all the details so far. Check that you're happy with these and click next...

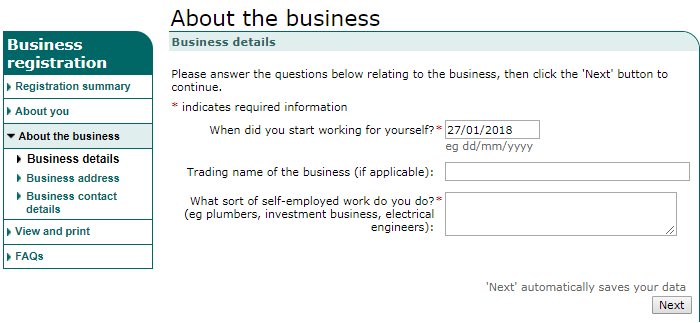

This page is 'about the business' (see below). Here pop in the date once more (as directed earlier). 'Trading name' you can leave blank (I used my stage name); 'What sort of self-employed work do you do?' is a summary description of your self-employed work. So use something similar to 'Musical Theatre Performer' or 'Musical Theatre Performer and Events Hostess' - I used the latter as my self-employed work involved hostessing at events also. Then click next!

This next page shows your address and asks you to confirm if your business operates from the same address - unless you actually have a 'business address', you will want to say yes here.

Next!

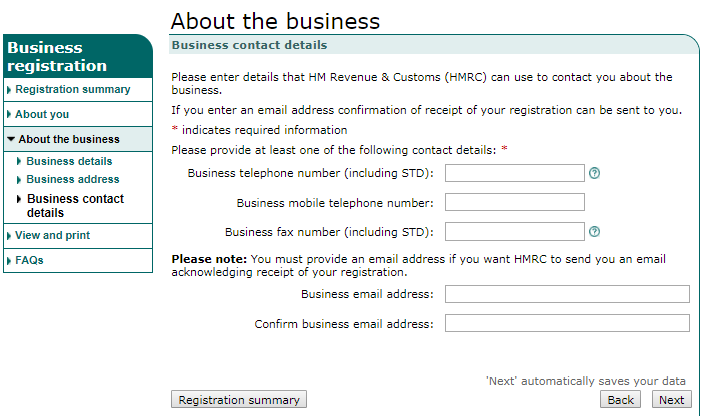

Business Contact details - presumably the same as your details you entered earlier.

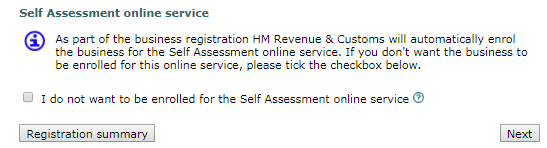

Next... This page is another summary of your business details. Make sure you're happy with what you've entered. At the bottom you will see the following question. If you want to do your self-assessment tax returns ONLINE (which is what most people opt for) DO NOT click this box.

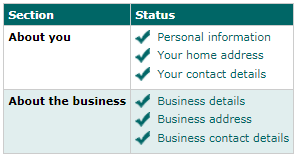

Once you've clicked next, it will take you to a summary page where you should see all green ticks (like below). Yay - time for a victory sip!

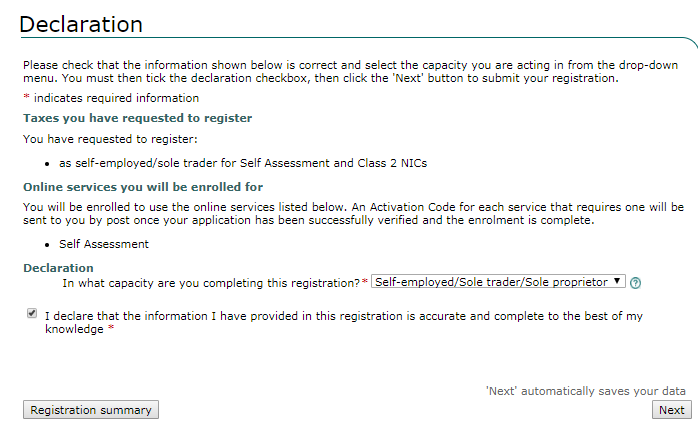

Click next... Declaration - here you select Self-employed/Sole Trader/Sole Proprietor and tick the box as shown below. This is confirming that all the details you have entered are correct to your knowledge.

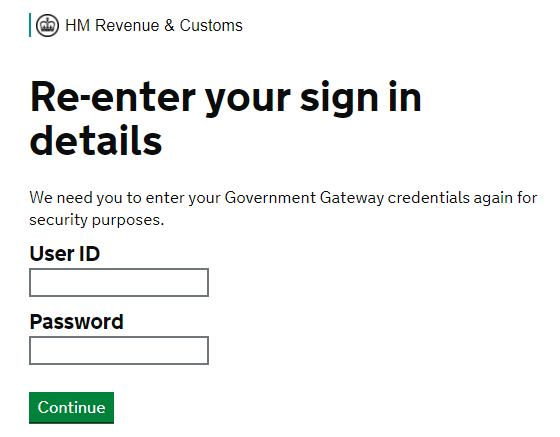

Nearly there...click next. Re-authentication page. In this, you need to enter the user ID you were given at the start, which is the same as the 'Government Gateway User ID'. Note - you should also have been emailed this, so don't worry if you didn't jot it down.

Finally.... Acknowledgment. You'll see here you have a tick at the top of your page confirming that your registration was submitted. We recommend clicking the 'view and print' button half way down. Definitely worth printing this off and putting it somewhere safe!

HMRC just became your penpal

Alright, alright, I maaaaaaay be exaggerating a little... HMRC are going to send you two letters:

- Government Gateway Self Assessment (SA) Activation Code - there are instructions on the right of the letter. You go to the Government Gateway website and log in using the User ID you were emailed during registration and the password you chose at the same time. The click on 'Self Assessment (SA)' and enter the Activation code at the bottom of the letter. Easy peasy!

- Unique Taxpayer Reference (UTR) - HMRC have sent you your UTR (this was the whole point, yay!). Read this letter and then KEEP IT SAFE! As it says in the letter, HMRC will send you a letter when it is time to complete your self assessment. We will cover this in a different article!

Congratulations! You are now officially self-employed (at least in the eyes of the government) - that wasn't too bad, was it?!!? Take a final victory gulp of your tea, maybe knock back another Chocolate Digestive (or whatever floats your biscuity boat) and go get the job of your dreams.

Have you found this guide relatively simple and stress-free? Great! Remember you get your first tax year for free on the SansDrama Web App if you're newly graduated. You're only a new-grad once so you may as well make the most of it!!

SansDrama is here to help YOU and everyone else in our amazing creative community. If you've found the site helpful then you can help us to keep this site free to use forever by using the SD Web App.

Love Jo and James x